12/21 Recap.

Today went in line with what I said in yesterday’s recap.

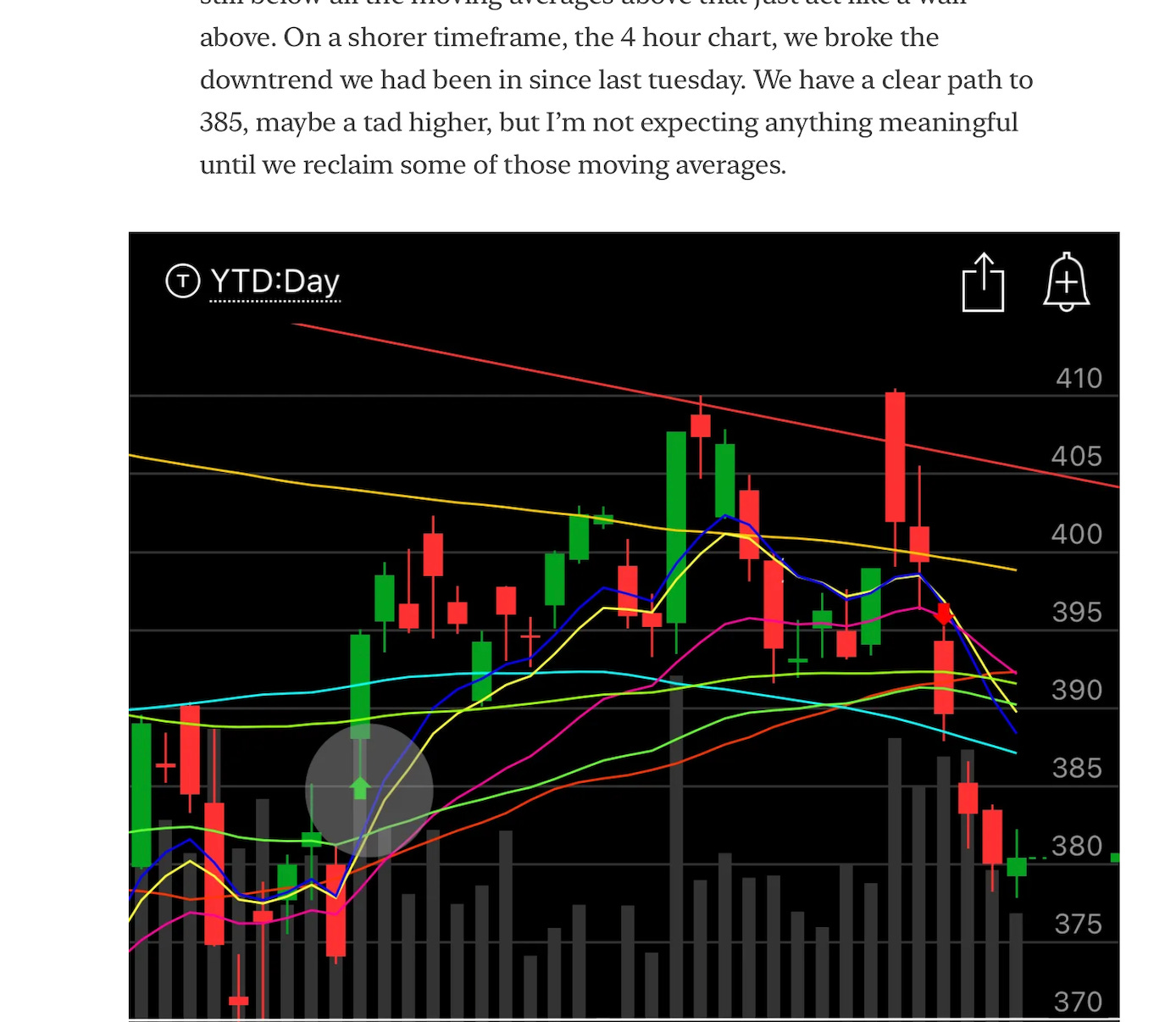

We ran into the big 385 level, went a tad higher and reversed ower. There is massive resistance overhead, a myriad of moving averages are just sitting there blocking every move up. It’s going to take some time if we’re going to break through there. Likely if/when it comes, it will be an overnight gap up. While today was nice, it was pretty insignificant for bulls as we still closed below everything meaningful as you can see below and on pretty moderate volume. A small rally with nobody around for the holidays isn’t really anything to write home about.

The bigger one is we’re 7 sessions away from closing out the year and we’re potentially looking at putting in a bearish engulfing candle on the yearly timeframe, something we’ve never done. For the sake of everyone, let’s just hope we close next week over 375.31, I don’t think we want to find out what comes with a bearish candle on that large of a timeframe.

The VIX(below) continues to be annihilated, it was down another 7% today to 20. The Fact there is no volatility anywhere to be found is amusing with all the potential landmines lying in wait seemingly every week across the market.

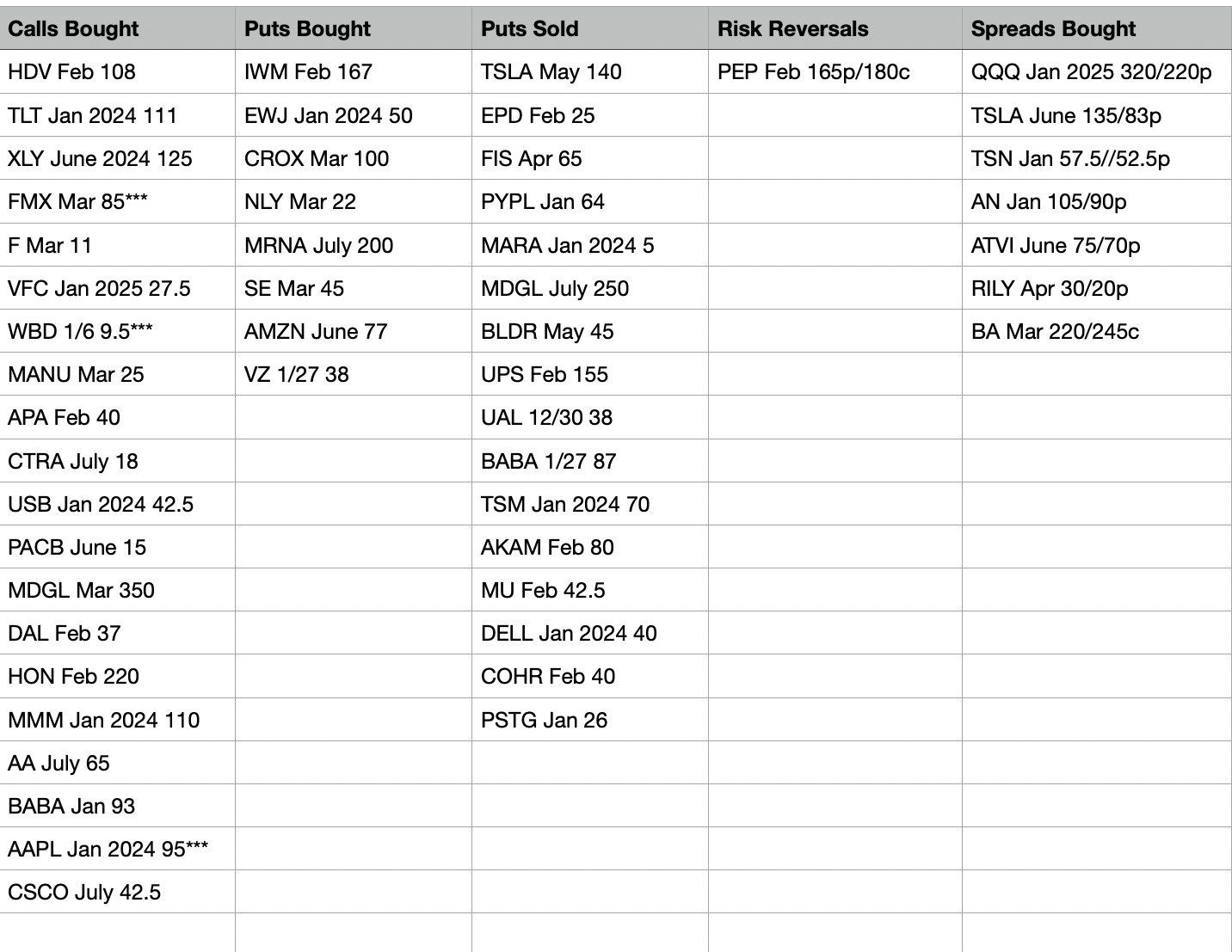

Today’s Unusual Options Activity & What Stood Out

FMX is a name that doesn’t see much action ever and 5,000 March $85 calls were bought today. Interesting setup.

WBD saw 50,000 January 6th 9.50 calls bought today in 1 sweep. This is a horribly broken chart, but it is very cheap.

AAPL saw a huge deep in the money call buy at $95 for 2024. It was only 2400 contracts but the dollar amount was enormous as these were near $50/each.

Pepsi was the only risk reversal i saw today of interest. They sold 165 February puts to buy 180 calls. This has been a really strong name this year.

PSTG continues to see bullish flows nearly daily, I really don’t know this ticker but I’ve noticed it seeing flows often recently. January 26 puts sold in size today.

MMM also continues to see these huge blocks going off daily, today January 2024 110 calls for $5m+. This is a super cheap name that is beaten down and this very well could be a situation like PINS back in May where I kept noting the calls daily and an activist got involved.

What Did I Do Today?

The market was green so naturally all my short puts exploded higher. I outperformed the market by almost 2x today and that’s fine but more importantly I sold a ton of puts which added another $143,000 to my coffers today. I’m almost tapped out in terms of margin short term, so I’m fairly limited in what I can do until my large PINS short puts at $23 next week hopefully expire. That’s fine I wasn’t planning on doing much the next few days anyways. I put on alot of trades today, let me go over them

MMM I sold Jan 2024 90 and 100 puts for 4.04 and 6.24, small size

GOOG I sold 100 Jan 2024 60 puts for $2.33

AMZN I sold 75 puts at 60 in Jan 2024 for $3.81 to round to 100 lot

BA I sold 10 Feb 150 puts, I tried for more but it ripped so fast they didn’t fill

EPD I sold 100 Feb 22 puts for .38

XOM I sold 100 Jan 2024 75 puts for $2.86

META I sold 50 Jan 2024 70 puts for 4.75

TSLA I sold 100 Jan 2024 50 puts for 3.34

UBER I sold 100 Jan 2024 17.50 puts for 1.80

So here is my thinking on why I’m going so far out. I have a ton of short puts that expire on PINS next friday which should clear up my margin short term. I will have some money for shorter term trades and then 75% of my margin will clear up after Feb expiry. So I’m set up for the next quarter in terms of what I want to do into what I think will be a rocky at best Q.

I’ve taken names I think are deeply undervalued as is and sold puts far lower a year out across the board. These are levels I don’t see hitting unless something catastrophic hits and if that’s the case I will decide then what shares to take and what to roll down and out. My thought process is at those particular levels the valuations would be laughable.

MMM I was a tad aggressive with but I didn’t do many 30 contracts overall. GOOG and AMZN at $60 would be silly valuations. EPD I followed the puts in my table above someone sold. I like EPD it’s a very good name with a high yield in the energy space, the pipeline leader. XOM I sold puts at $75 which is 15% lower than the director just poured in $85m at. I think Exxon will be a great name next year with energy coming back. META at $70 is 25% lower than where it was before they cut jobs recently, another silly valuation. TSLA at $50 is another 10% lower than even my $65(pre covid highs) call. As much as I dislike Tesla, at $50 I am interested. UBER at $17.50 is 30% lower than where the CEO recently made his large purchase at $25.

So there is a method to my madness. I’m not suggesting you follow me at all, as I’ve said we all work with different balances and risk tolerance levels. I’m just explaining why I did what I did. I’m mostly neutral, I don’t care if markets go up or down, I just try to sell premium on good names at good levels and let whatever happens happen. I try to structure my book around various dates so the expiries aren’t all simultaneous and it gives me time to work around things if they go against me.

In Conclusion

I hope you all have a great Christmas with your families for those who celebrate and for those who don’t I hope you enjoy the end of the year. For me, this is my last post till after New Years. I’m traveling tomorrow and I’m really not going to be able to do anything till after new year’s. I made my final trades of the year today and I am done for 2022, but I will post a large recap next week going over names and themes I like into 2023, I’m slowly working on it and have been for some time. I think you will really enjoy it. It will be a very large recap with a lot to say.

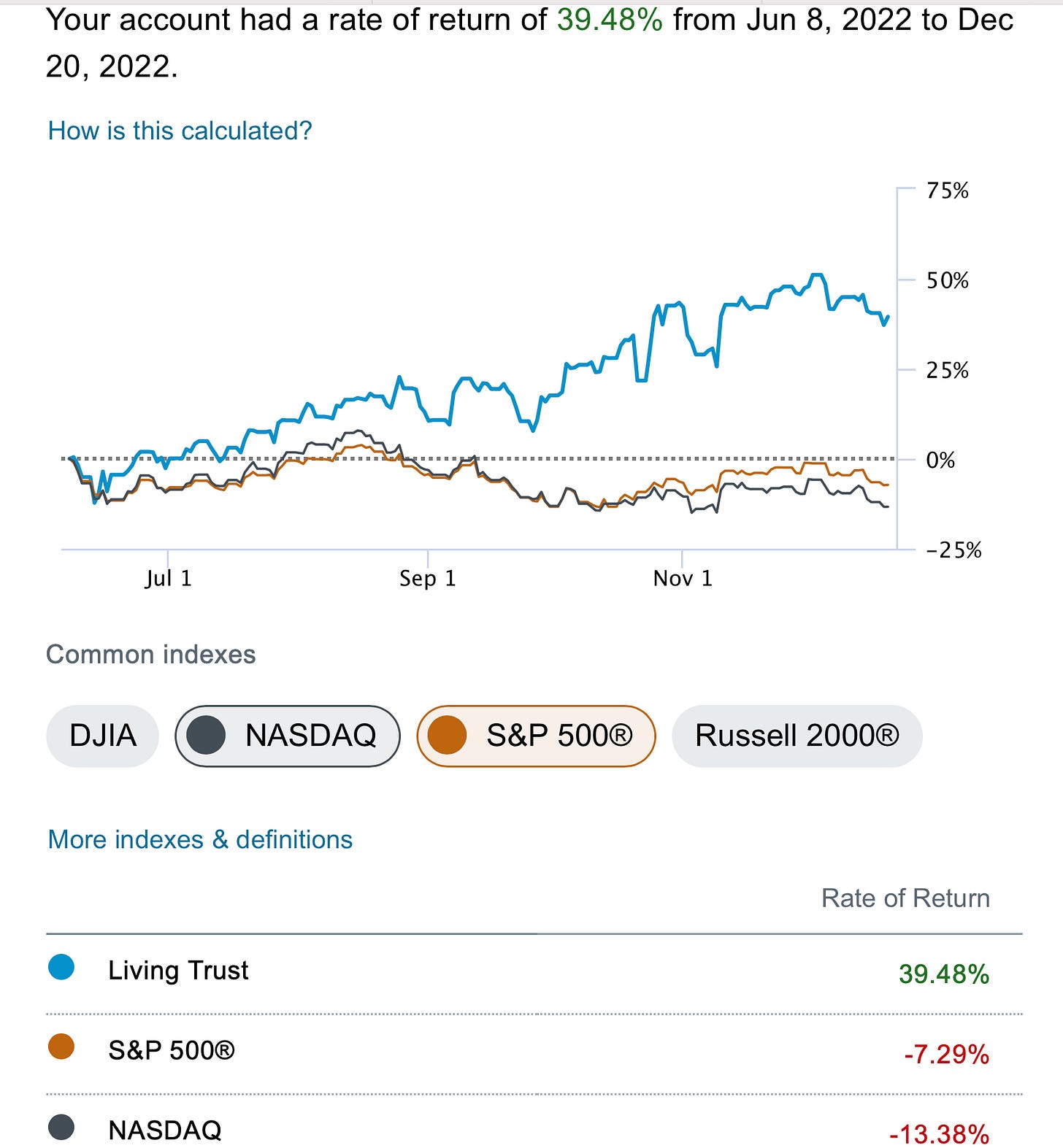

As for this substack I’m very happy with what I was able to accomplish in here to this point. This whole substack began on June 8th the day of the very odd Sierra Wireless trade I noted and I’ve posted every trade I’ve made along the way since. It has resulted in a 39.5% total gain since June vs -7.8% for the S&P and -13.38% for the Nasdaq without today factored in. I really don’t think the last 6 months could have gone better in here, outperforming the Nasdaq by 52% is quite a feat for me. We will see where it all closes next week, but I can only hope 2023 goes as well for me as 2022 did.

How did you all end the year? There’s over 100 of you here and I here from the same handful of people every time, I want to hear from more of you this time. Have you learned anything? Changed your ways? Anything of note? I know it was a bad year for a lot of people, but I don’t think anyone in here should be down at all with all that’s happened in here. I hope if nothing else you all have seen the importance of directionality in the markets and using big levels to guide your decisions along with options flows. I know I get emails from people constantly about how their thought process has changed and it’s allowing them to see things more clearly in the market. I love getting feedback from you all that all this is worth it.

Happy holidays james!!

All my long term buy and holds have suffered this year, while my short term trading premium learning from you have done well. Long way till retirement so not worried, but glad I could capitalize on some of this market instead of getting punch in the face every other day.