12/3 Earnings Preview

Before I jump into the earnings preview, I wanted to discuss year end with a lot of you. This has been a very good year in the market, all of you should have done well, I would say it was more of a mean reversion than a great year, but nonetheless equities went up substantially this year. A lot of you always ask me questions about why I don’t hedge more or why I don’t outright short things more and I’ve told you all, in my view it’s a big waste of time, truly. The only time to short things is when a trend breaks, if you remember a couple months back I highlighted that trend break on the SPY for weeks, it broke, and we had a period of a few weeks of weakness and then we rallied. There’s things like tax considerations where I’m not going to close up some longs with a huge gain to short things for a 6 week period of weakness. That is just reality. Being short is something you have to do and be super tactical with, it’s fine for those who do, but for me, considering equities are up far more often than they’re not, it is not something I want to dedicate time to.

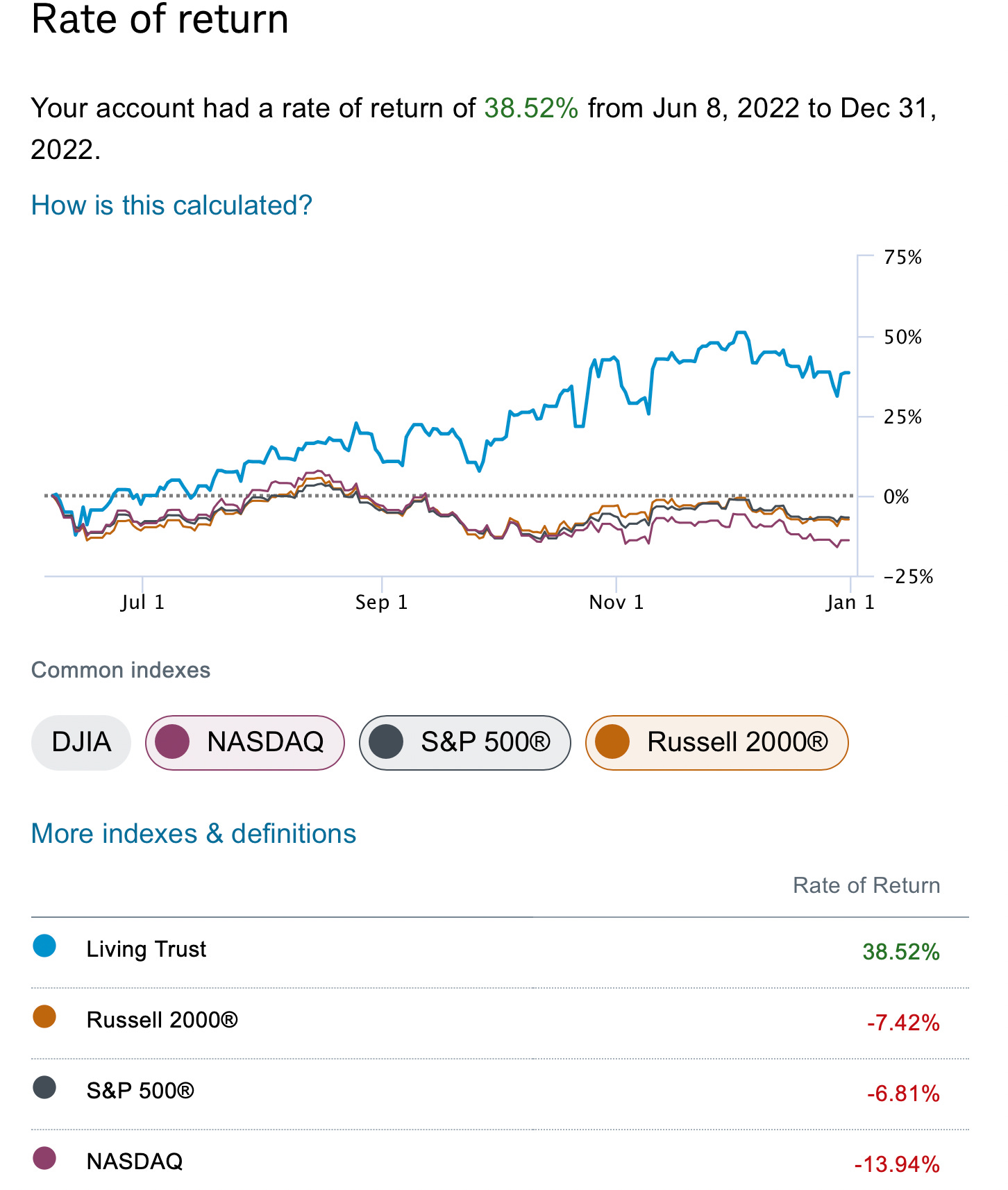

These past few weeks we’ve seen an insane rally in these small caps, a bit like 2020-21. As people sniffed out the possibilities of rate cuts, everyone piled back into these smaller names. That’s fine, but do you know how long these have lagged for? I began writing this substack June 8th, 2022 and the IWM is still RED over that timeframe, that’s nuts.

So while everyone is feeling good about this year, please just remember, things were normalizing moreso than anything else. Unless you really outperformed last year don’t start to feel like superman because everything went up in 2023. Even for myself, I don’t really feel impressed by my returns this year because the Nasdaq is up 36%, while I’m happy I returned 2x it, to me, it’s not my best work, but again I haven’t really done much in months, so I’m happy with the overall outcome.

I would say last year from when I began writing this through the end of 2022 was much more impressive to me because I was up almost 39% while the Nasdaq was down 14%. Of course I was for more active every day but my point is, this past year has been a year where everyone did well and everyone loves to share their YTD screenshots which show Tesla and Meta up ALOT when they’re flat on a 2 year stack, don’t judge your success off of 2023, judge yourself off how you do in the worst of times. Many do not survive those.

If you’ve taken one thing from me in all this time here, it’s that there is always a bull market somewhere and we will find it within all this options data and the charts. As long as you stick to what is working, you will be ok, where people really get beat up in the market is when they insist on sticking around in names that are clearly not in uptrends anymore. There is a very big difference between a pullback within an uptrend and a broken uptrend.

Earnings Preview

One of the final earnings weeks of the year is here. There are only 19 sessions left in this year. I’ve decided that the final week of the year, December 25-31, I’m going to write up a very long preview of 2024, highlight a lot of the names seeing the most option flow and some charts in a very in-depth preview of the coming year instead of writing the daily recaps just because that final week is usually so slow anyhow.

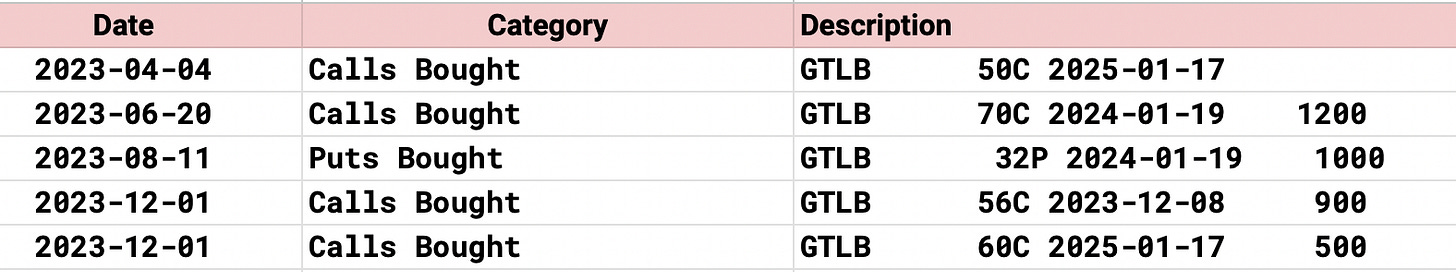

Here is the earnings calendar for the week ahead and as always I will post all the options data sorted by when they report. If you are interested in a name, please double check the open interest and make sure a trade is still there, I do not keep up with closing trades, just opening trades.

Monday Afterhours

Tuesday Premarket