1/23 Recap.

Another rally that ended with us fading off the downtrend we’ve been battling. To me this feels like I giant pump before Microsoft tomorrow which could just as easily reverse everything. I’m trying to keep an open mind but it’s getting hard to see the rally extend much more. The Nasdaq is up 11% in 12 sessions. It’s only natural in a market where everyone came into the year looking for 3300 that they’d squeeze them first. That’s why I always joke about the market being up and to the right 93% of the time and why I sell puts and don’t waste time shorting equities. We’ve seen how the last few days have gone since I placed my hedge on last Wednesday.

The chart below shows another rejection of the downtrend, we tested over it, rejected and closed below it. For me, I’m eyeing that candle that touched over 410 in December as the spot where I’d look to close out my hedge and move on with a rotation up. Will we get there? I don’t know, but for a max pain trade that’s a point where many bears would throw in the towel before we go lower. The psychology of the market fascinates me, at lows nobody wants stocks because we’re going lower and at highs people can’t buy enough because “it’s a new bull market.

What made today especially odd to me was the dollar was up! That typically happen when equities are lower and then the VIX barely went lower when a 2% up day should be met with the VIX being crushed, so for now those 2 are calling the markets bluff

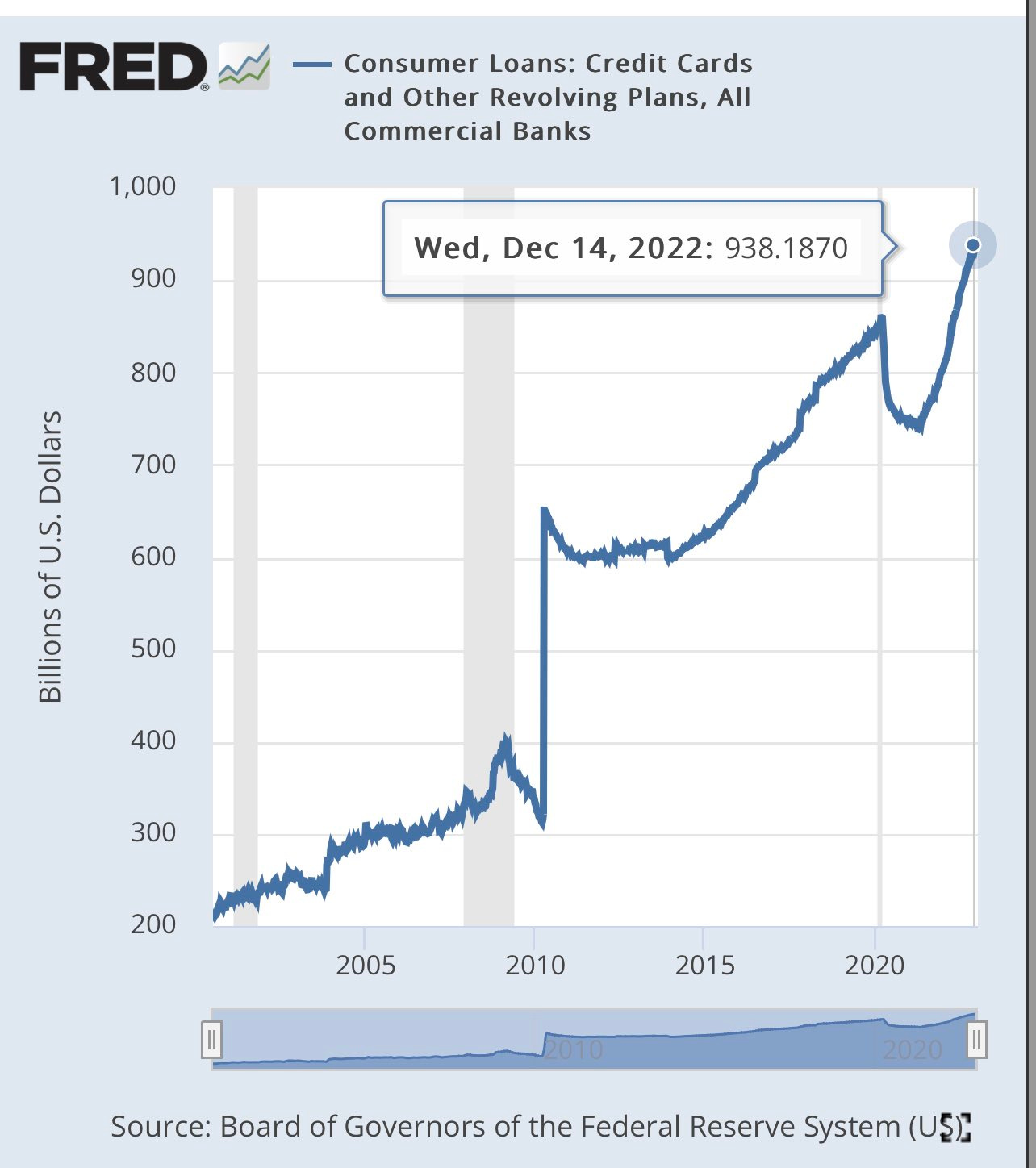

They are definitely doing their best to suck the bulls in with all this soft landing talk, my base case is a recession, which the data shows we are in as we speak and my 10-15% case is a probability of something worse than anyone can imagine. We already know the consumer is tapped out, we see the savings rate at historical lows and we see consumer credit card debt at all time highs. Look at this chart below. People are employed right now and the FED is unhappy with how many have jobs. They want more unemployment, yet the consumer is maxing out credit cards just to live. How do you think this ends? Does that sound like a soft landing with people on maxed out 30% interest rate credit cards who can’t pay them back?

Here is the personal savings data going back a few decades, this is basically the worst time in modern history in terms of people being able to save money.

This whole narrative of a soft landing is absurd to me. Unless you’re well off and hold no debt, the next couple years are going to be tough, wages are stagnant, the cost of everything is rising, and the cost to borrow for any large purchase has exploded. Gasoline, home energy, you name it, it’s all up far in excess of the 6% CPI figure and nobody has anything saved up for this. Remember Bezos warning people recently to hold off on that big purchase? People will spend more on interest than actually buying things with that chart above, and this is somehow bullish for the economy? There are X dollars to go around and if more are going to interest, gasoline, grocery bills where is the money going to come from to boost everyone’s earnings? Give me a break. I don’t care what stocks do in the short term, there is zero percent chance of the soft landing they keep telling us is likely to occur. This stuff takes time to play out but earnings will decline, it just takes time. Morgan Stanley is at $195 of earnings and the consensus is $225. I’m of the belief the consensus will miss by a mile. The hopium of a fed pivot with SPX at 4000 is hilarious. The fed is stuck, sure, but a pivot and they lose all credibility, on the otherhand they keep rates high, something horrible is going to break. Either way do you see them getting out of this unscathed? I don’t.

Today’s Unusual Options Activity & What Stood Out

There were alot of unusual trades today, typically only 5-6 things stand out but for whatever reason today had a plethora of unusual options before you are surprised by how many I post below.