12/4, Best Ideas For The Week Ahead

We wrapped up another strong week, the market is up 14% off the monster reversal candle we had back on October 13. So the question is, is the bull market back?

For now, the answer is “NO”.

Here is the huge reversal candle for you to see, the bullish engulfing we put in at the time was a sign of a reversal, but nobody could have guessed how hard and fast this rally would be. What concerns me is looking at the chart you see the RSI flattening out along with the MACD being quite weak, these are not things you see before a breakout. On the plus side for bulls, the SPY is over every moving average that matters, for the moment it is strong, but until we get over that red downtrend line, it is all meaningless to discuss.

Zooming out to look at the weekly below, you can get a better picture of the situation. It looks like a textbook double bottom which is a bullish setup, but again, until that downtrend is broken, we can’t just assume anything. When traders say price is all that matters, they mean that none of your biases matter. Even myself, I think the economy is pitiful, but the stock market is not the economy and if we get a weekly close on the other side of that downtrend, it’s time to get long and hold your nose. With that said, we rejected off the downtrend again this week, that makes 4 attempts that have failed since the year began. Will this be the week we breakthrough? Possibly, until then, we have to be cautious and open to the possibility this is just another lower high short term top.

The dollar is dead and dying. This is another bullish datapoint as you can see below, it is now well below the 200 DMA and EMA. A weak dollar is a boost to earnings for everyone. When the dollar goes up, stocks go down and this puts into perspective the recent move we had. It wasn’t so much stocks went up as the dollar went down. Is this a chart you’d buy? No way, so for now stocks have wind at their sails as long as this disaster of a chart continues to unfold. This is trading below every moving average that matters, there isn’t a soul in the world going long the dollar here.

Best Idea For The Week Ahead

Microsoft.

I know I know, James you’re so boring, I want some uncovered gem. Well, I’m a boring guy. I go for safe and steady returns. Again as I’ve said all along, my focus in my trading account is steady income, not grand slams. If you’re going to do that, you’re going to be in names that are safe and have a floor, hence why I like to pick at activist names mostly. So why Microsoft?

I drew this downtrend back in early 2022 when Microsoft was coming off its highs. I made the DT white this time because there were too many lines it was going through for you to see.If you look, all year we bounced off that downtrend and rejected lower minus that small breakout in July which eventually failed. Look at the low of the year, a perfect bounce off the 200 weekly, that is as textbook as it gets. For the moment MSFT has once again crossed that downtrend and looks very bullish as the MACD finally flipped green on the weekly BUT a bearish counterpoint would be look at how weak the RSI is, that is very valid and lines up with the rest of my thinking on this “rally” in the overall market.

As you look at the daily below there is a large gap just below 230, I would expect that to fill before I go long. So as I always do, I never go long, I just sell puts lower and if the stock comes to me, great, if it doesn’t there is always another trade.

So what do I suggest?

I think selling a 225/215 put spread for 12/30 is a prudent trade. Is it the biggest return? No but it’s conservative and calculated. At the moment you would receive .35 in premium while risking $9.65. Is that alot? Not really, its 3.7% but, it’s also a 4 week trade on an overheated market and anytime you can make such a solid return in 4 weeks on one of the 2-3 best companies in the world, in an uptrend, you should.

Now if you’re ballsier and don’t care about margins and just want the shares. Go ahead, sell the 225 puts with no protection. There are worse things in life than going long Microsoft at 224.31. That isn’t overvalued and it’s almost 40% off highs. That requires alot of margin, hence why I suggested selling the put spreads.

Some Charts That Stood Out To Me

TLT is breaking this year long downtrend it has been in, that is a bullish setup.

MO is a high dividend name I’ve mentioned before in my best ideas, the dividend is still almost 8% here today. The chart is nice, stuck in a confluence of MA’s for now, but that was a very nice candle last week.

JNJ was my best idea recently and it’s continued a very nice run along with the rest of the XLV. This is a very nice setup over all the key averages.

The last one is SPLK which has been a favorite of mine for sometime with Starboard taking their stake and last week they posted a great ER. The stock has continued its bottoming process and you know my beliefs on Post Earnings Drift, so this is one I expect to be a solid put selling name for weeks to come.

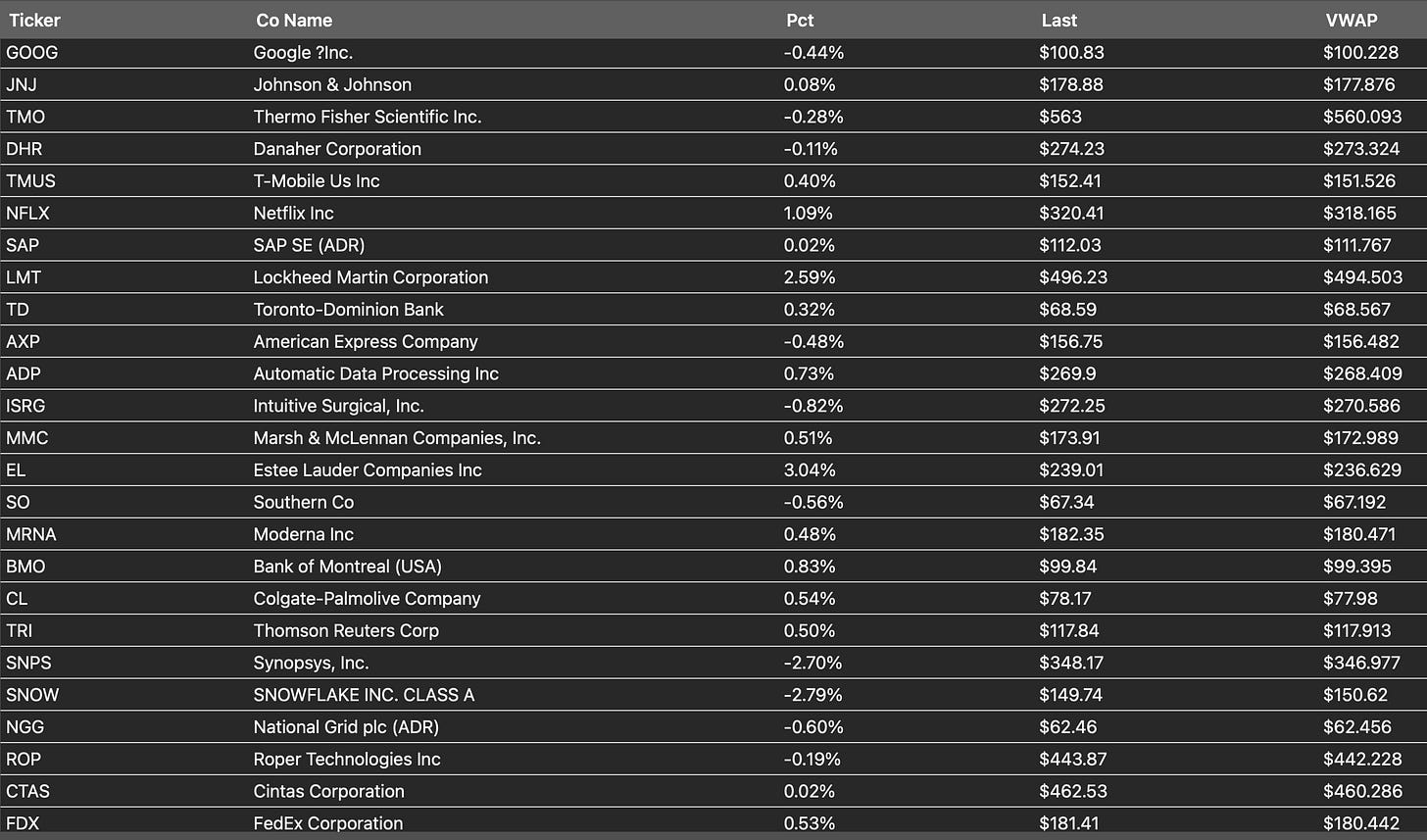

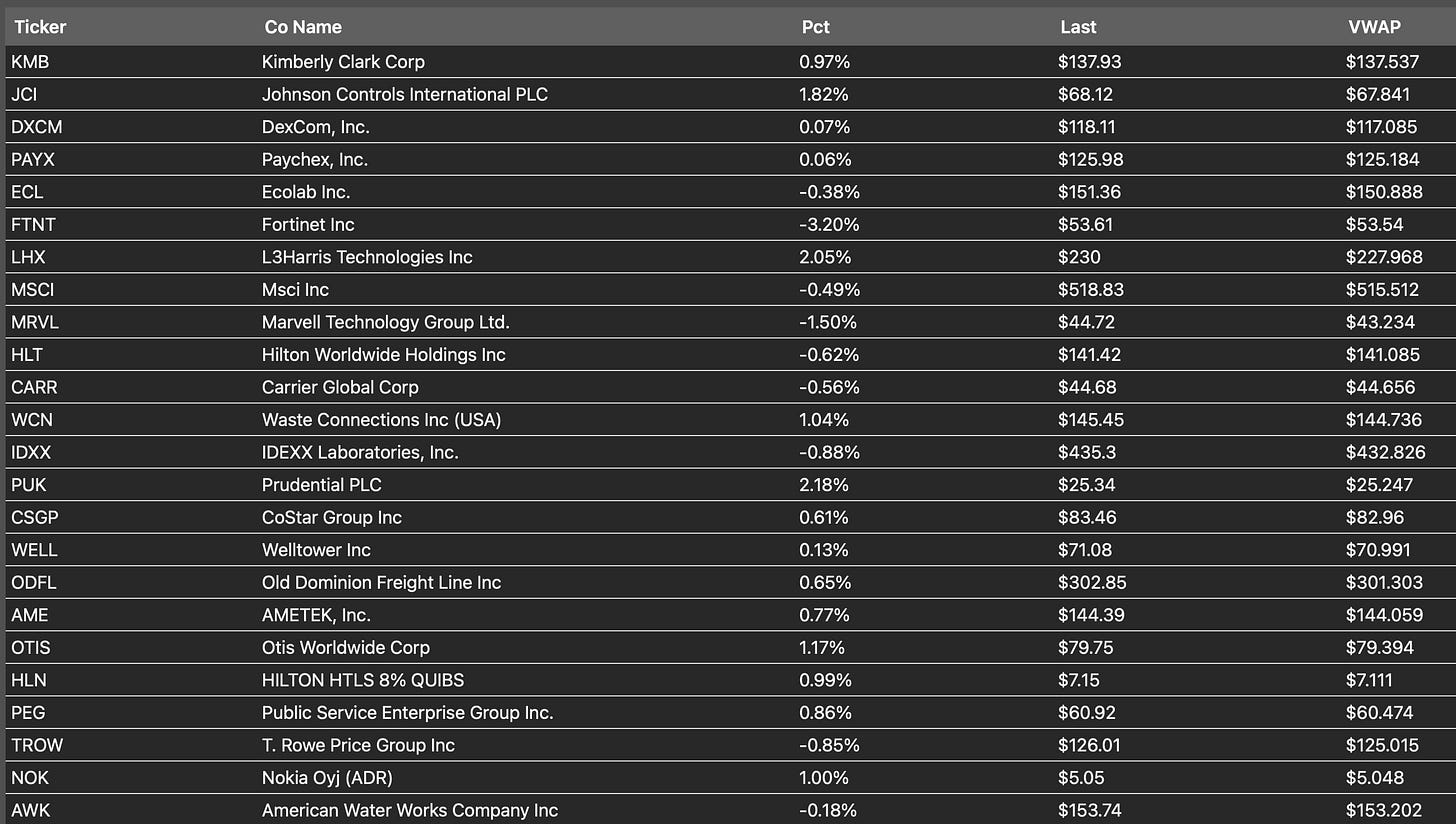

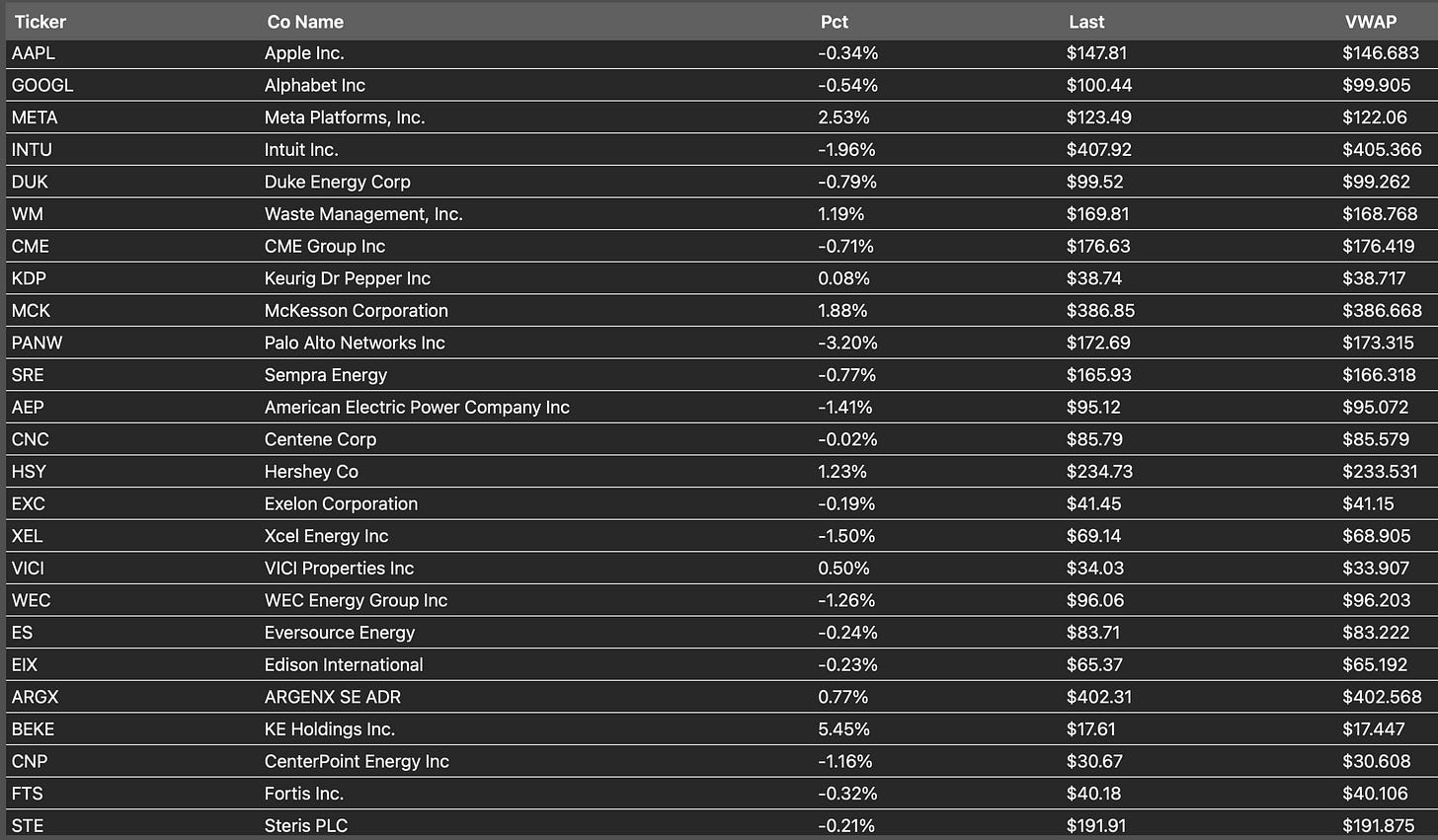

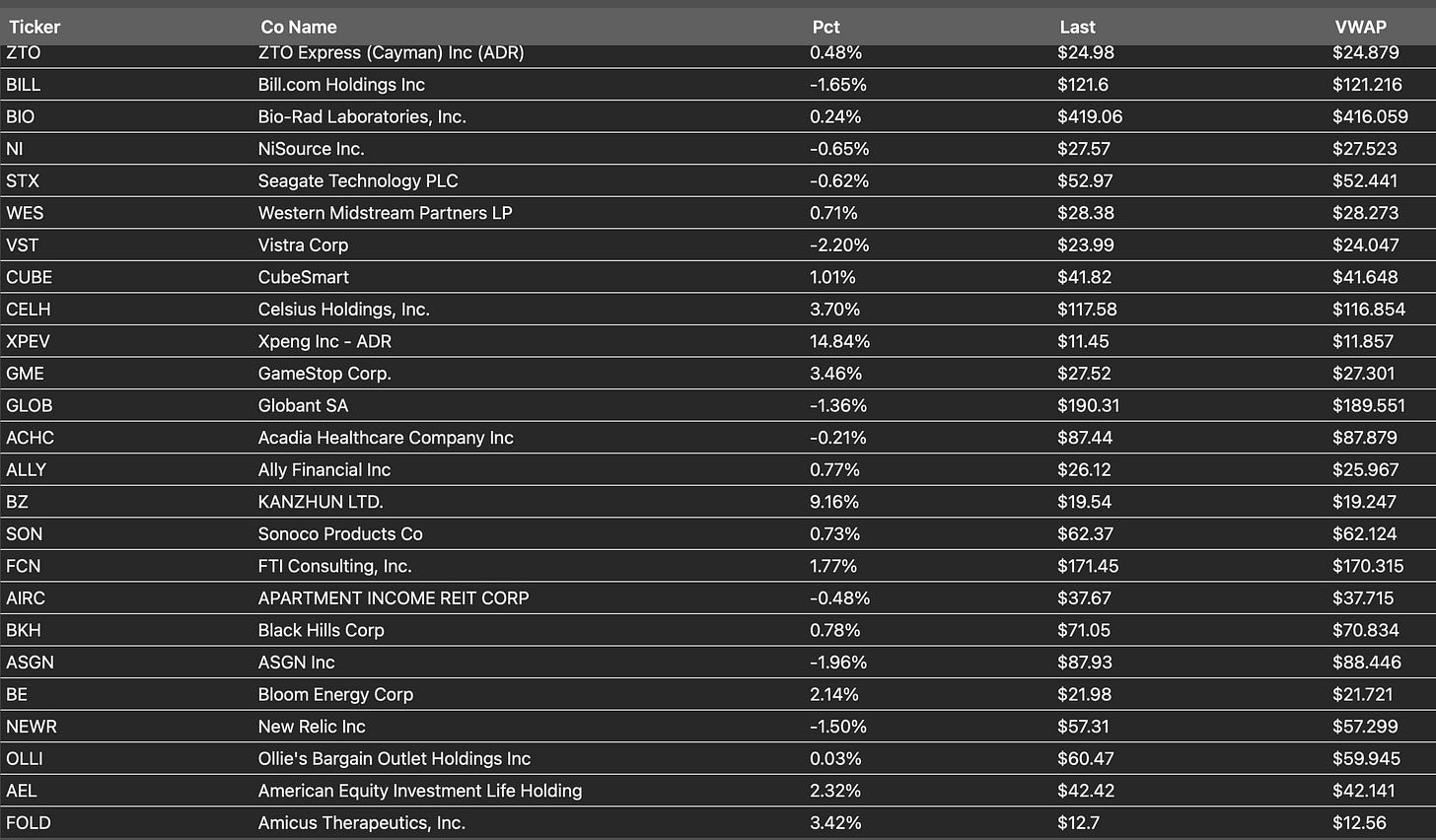

Some Names For You All To Consider

Weekly Bullish Engulfing Candles

Weekly MACD Bullish Crossovers

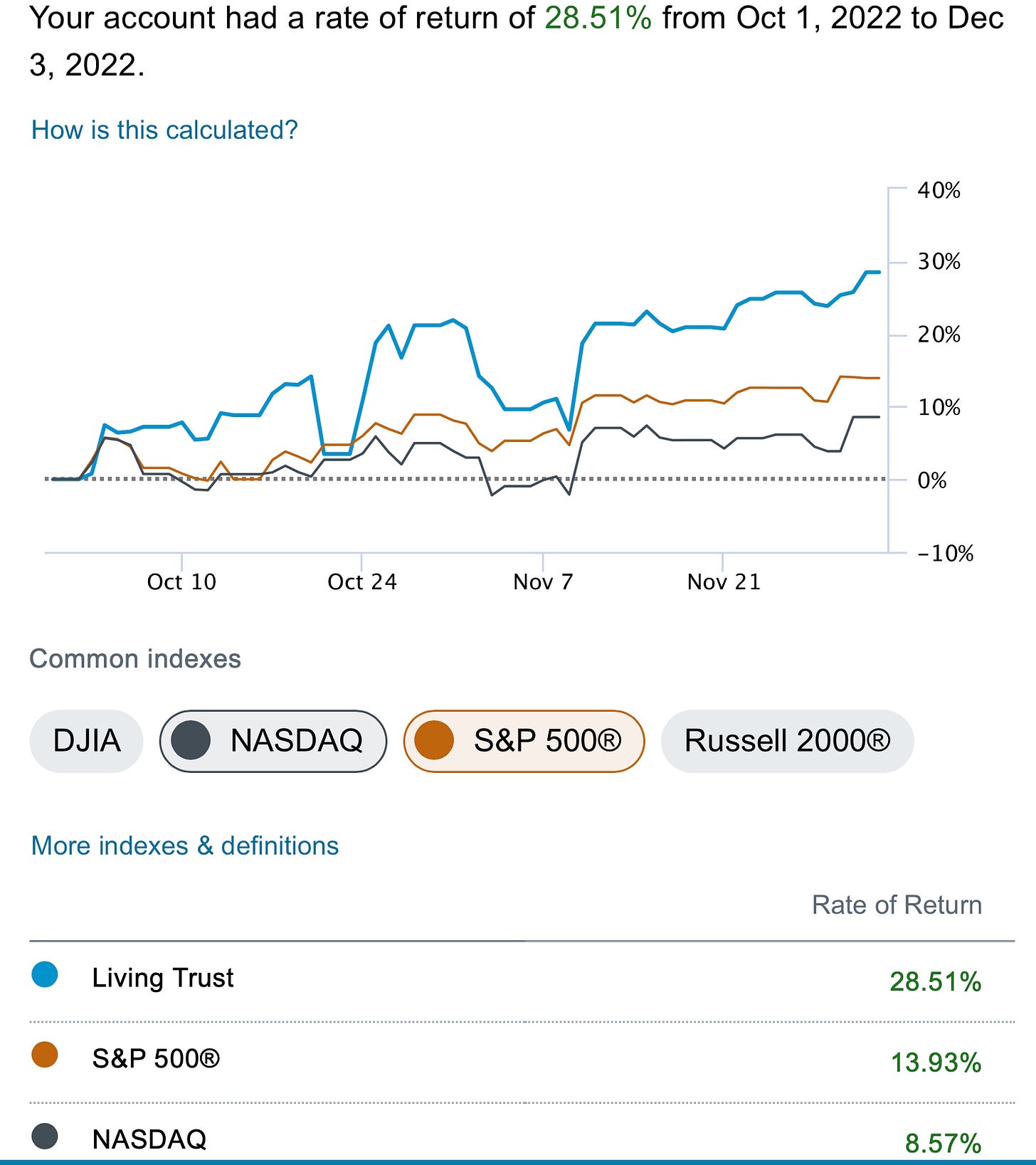

Returns To Date

This has been another great quarter for me so far up 28.5% since October began outpacing the SPY by 100% and the NASDAQ by alot as its only up 8.5%

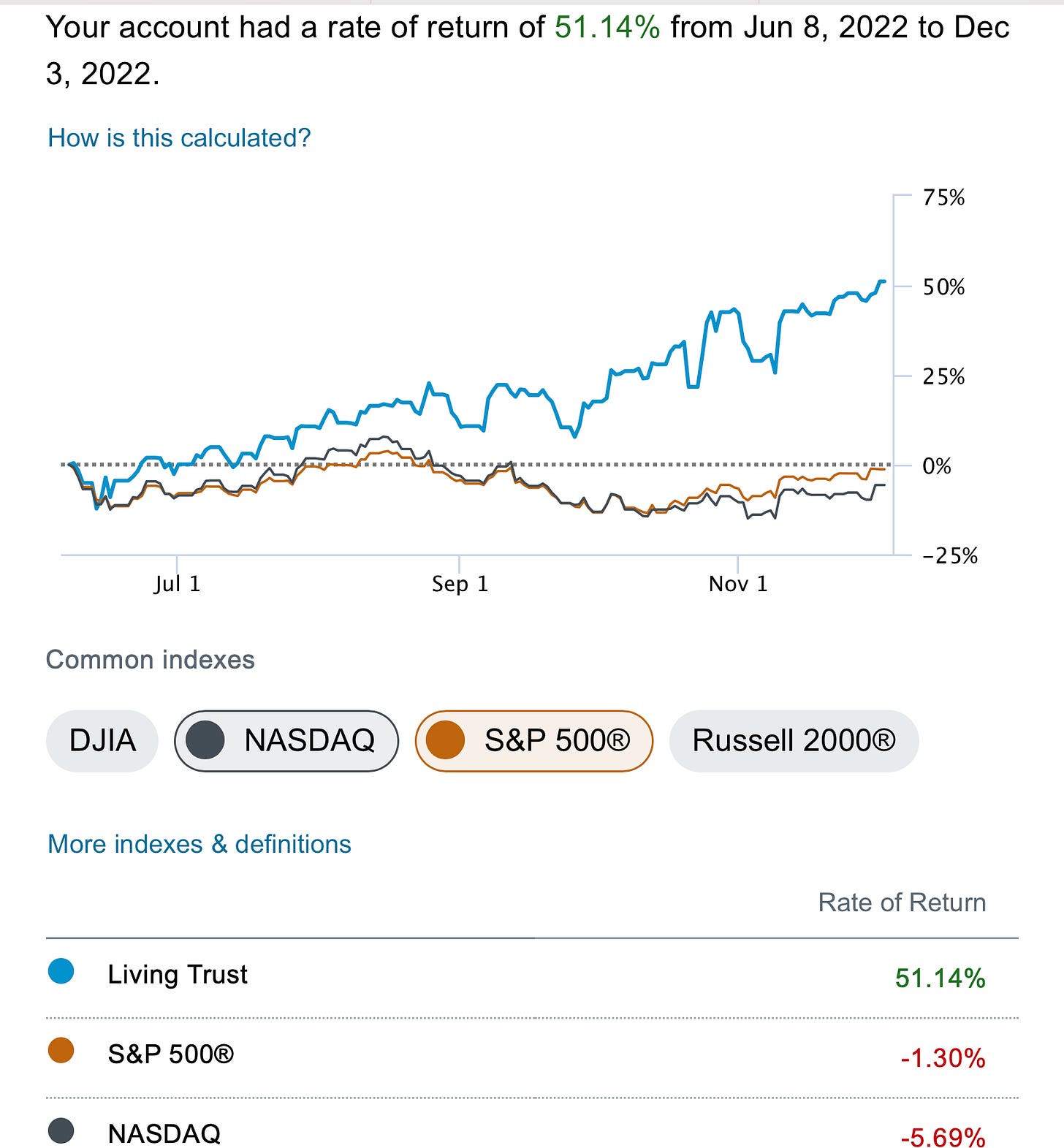

Since 6/8 Substack Inception I am up 51% and the market is RED. I’m beating the NASDAQ by almost 60%!

I know alot of you in here have been around from day 1, how are you all doing in that timeframe?

To say I have crushed this year would be an understatement. I hope those of you who’ve been here long enough are finally realizing that the market is alot easier when you focus on good charts and stop putting yourself through the pain of holding a bad one. If you do that, your experience with the market will be significantly easier.

Anyways, I hope you all had a great weekend and I will see you tomorrow.

I started trading mid-year around when you started the substack and have been doing well. I have been more aggressive with buying premium using some of your ideas along with my own. I am up around 160% on my trading account, but more importantly I have been learning what works for me and my trading style. It is one thing to see you or anyone else do a trade, but doing it yourself is another challenge. I need to focus on waiting for the charts to line up with macro and/or what the company has for tailwinds/headwinds instead of hoping the charts will flip because of those factors.

Seeing how the unusual options and charts work together has been an eye opener for me that I have seen on here.

Also wondering if you have seen the massive out of the money call buying on RLX. Chart looks fairly decent as well. I grabbed some calls.

Keep killing it the rest of year!

FWIW + IMHO, I don’t think it’s boring to trade or go long Microsoft esp given the current macro. Actually I find it safer to only trade 3 names (Amazon, Google, and Apple) bc even if the markets were to crash I’d be (bag)holding great companies!