1/26 Best Idea For The Week Ahead

The SPY wrapped up another strong week after the massive headfake last week. When we broke the 21 week a week ago, had we closed below it, we would have broken a 15+ month uptrend we’ve been in. Fortunately for bulls, it was a dip below and we recovered, so for we remain in a strong uptrend. These next 2 weeks a lot can change with FOMC and earnings from the majority of the most important companies to the market. Just stay calm and let the price action tell you the true story.

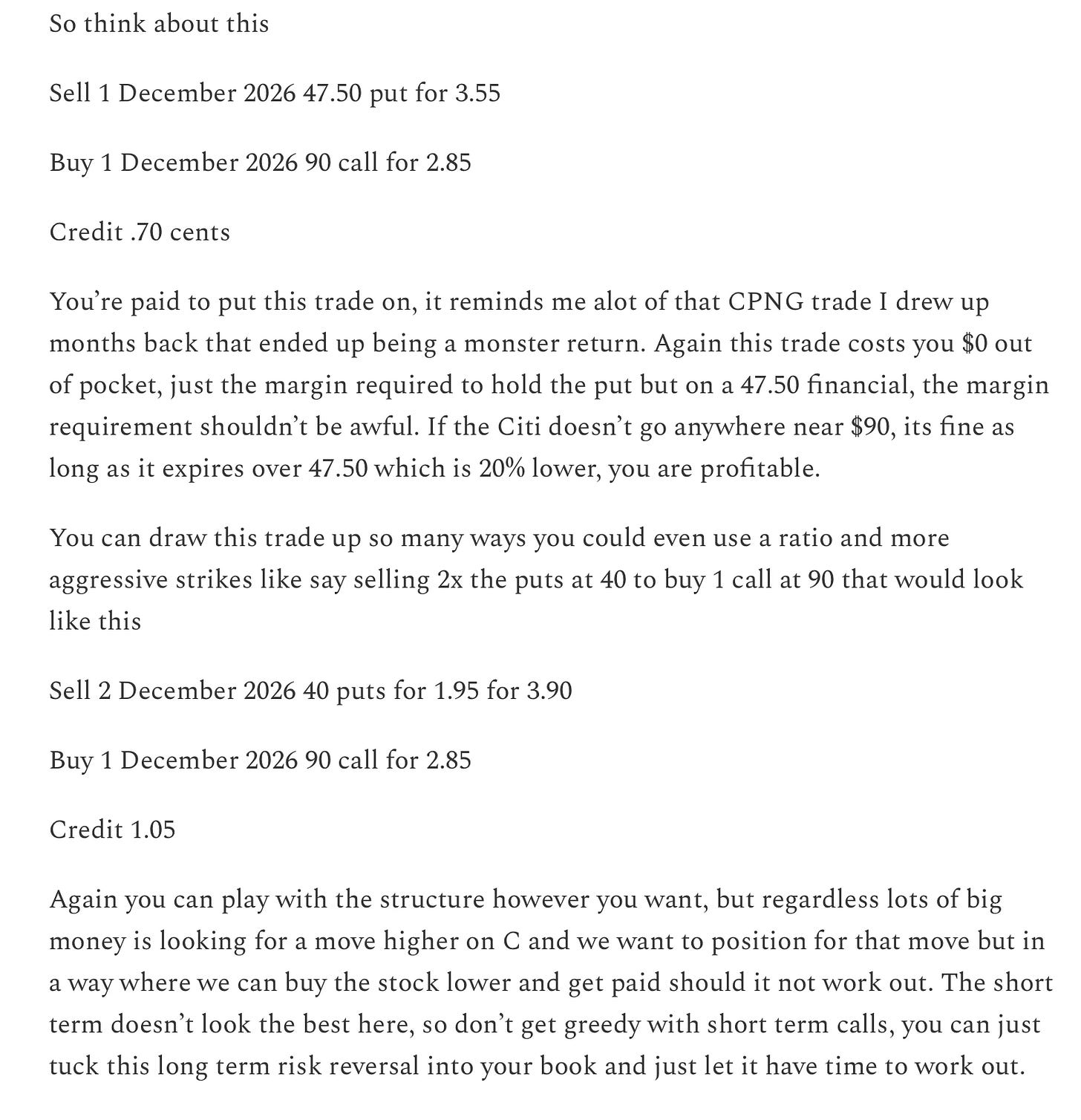

Remember with these weekend best ideas, they’re long term plays, they’re not short term trades to take and worry about what happens this week or next, they’re more names I’m looking at where you can add them to your book long term and be happy holding them via calls or long term leaps. Look at this Citi trade I posted 6 months ago as a weekend best idea here. Citi just had its highest weekly close since 2009 this week up over 33% in 7 months since I wrote it up below. They were all over the option flow if you remember then and the risk reversal I drew up below, the short puts are up over 60% and the long calls are up to just over a 3x in that timeframe and now you have another 23 months to ride that trade. The option flow is just a guide on direction, you don’t have to play calls or short puts, simply buying commons on the right name at the right time is all you have to do but should you choose to play options the returns can amplify your returns dramatically.

This week’s best idea saw a a lot of action this past week, 4 trades, for a name that didn’t have 4 trades I logged in the past 4 months it was very notable. Unsurprisingly, the chart looks great and for being a $150B market cap, it is a name you won’t see many on fintwit discussing so let’s take a deeper look.