1/26 Recap

Intel had a good print last night but their guide was weak and the stock was down over 11% at one point hitting all the semis. That sector has run really hot and I alluded to a possible pullback yesterday. Every one of those names is fine long term, short term they’ve just gone too far too fast and today was a pullback there. The Nasdaq is deeply red as I write this with only 1 name, Amazon being green, but that has more to do with 2 massive bullish trades I logged below today. Overall pretty boring day.

Oil, dollar, yields were all marginally down, nothing of note. The SPY remains over the 8 ema and it looks like we will be closing our 12th green weekly candle in 13 weeks by the end of today. The amazing run continues. Next week we have earnings on 5 of the largest companies: Apple, Microsoft, Google, Amazon, Meta along with Powell speaking. So this is probably the last week of calm.

Lastly, I realized the other day that I don’t do a good job of making my content more relatable to newer options traders. I guess my mistake was thinking most people looking for options data were more seasoned traders. So what I’ve done is I added a section in the discord called “Questions”. If you have any, post them in there, whether I answer it or someone else does, I want to make sure everyone who has a question about something gets it answered on anything regarding anything regarding options,strategy,etc. Sorry again for not thinking about this sooner I misjudged things.

Trends

1 Week

2 Week

Year To Date

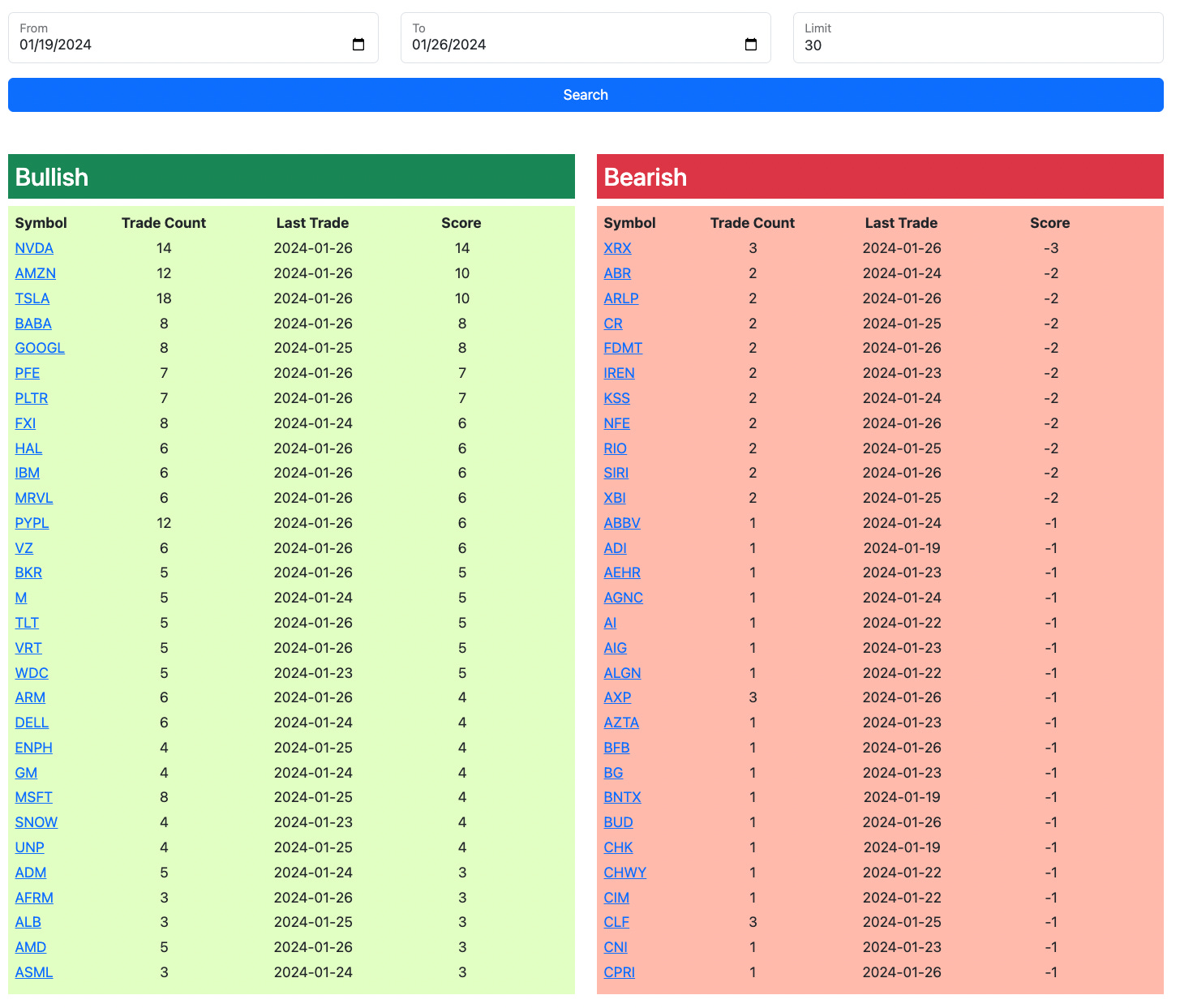

Today’s Database Link

Here is today’s link to the database, it will be up all weekend till monday morning at the open for all those who want to get work done this weekend. As always I will have the rest of today’s action from when I send this to the close added back in by tonight so you can check back then and see the updated list and trends.