12/7 Recap

We seem to be bouncing back and forth between small caps leading one day and then megacaps leading the next. Today the large caps were rallying off the back of the Gemini video from Google yesterday. If you remember monday’s recap I noted all that odd options action in Google

and then yesterday buried in the table was a large buy of the January 145.5 calls 4000x.

Those calls bought on monday with GOOGL sub 130 4600x for the 132 calls are up over 1000% this week with GOOGL up 6% today. I know alot of you message me that you’re not allowed to trade options where you’re at but, you don’t have to always trade options, being directionally right on something is just as important. So remember that when you’re looking at these options trades, sure hitting a big trade like that one above is nice, but even just buying common in the right direction before a nice move is a big win.

The SPY is just forming an inside candle today, nothing of note yet, this is still a bull flag albeit some bearish divergences are forming, but until we lose some of these moving averages it isn’t bearish.

Oil bulls need to be careful because as of this moment a gravestone candle is forming. There is still alot of time left today but oil tried to trade up over 70 and reversed all the way to the lows of the day now. This is not bullish price action and while oil names may be good values here, it may be a little bit before these work. If I was bullish oil I’d want to see a few closes over the 8 ema, the blue line. I do think we’re nearing a bottom in oil because I have a couple huge risk reversals I noted below today and those tend to come in when names are near bottoms.

Trade Of The Week Update

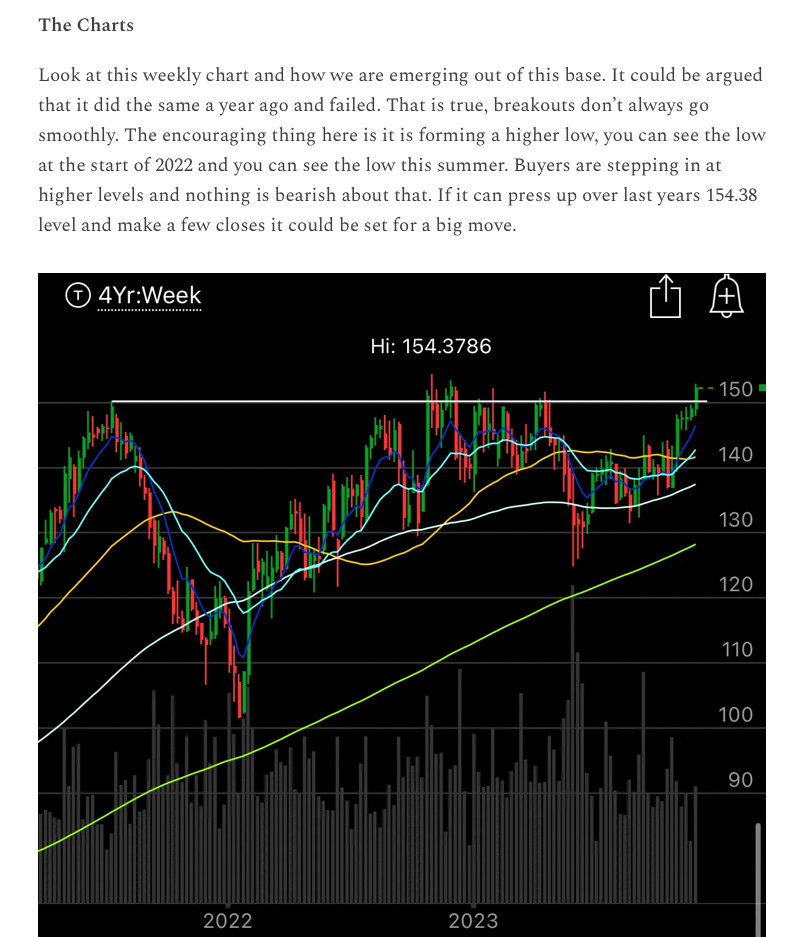

When I wrote TMUS up this weekend, although it had a few bullish flows, it was more the chart that caught my eye, when a quality name comes out of a huge base like that, the move is usually prolonged. Amazon for instance is very close to the same sort of move out of an equally long base, hence my affinity for it at this moment.

TMUS has followed up this week by going up every single session and getting over the highs at 154.37 from that near 2 year timeframe. It’s breaking out, the end.

When you see stuff like this, you have to step back and think about all those people writing deep dives, studying the fundamentals, etc and understand that while all that matters to a degree, until some players with alot of capital buy into it, none of it matters, and when they do actually finally buy into it, you’re going to see it on the chart which is why my focus is more on the charts and options flows and less on the fundamentals because in my opinion it is better to focus on what is being bought and not really ask questions on why is it being bought if its just a trade.

Trends

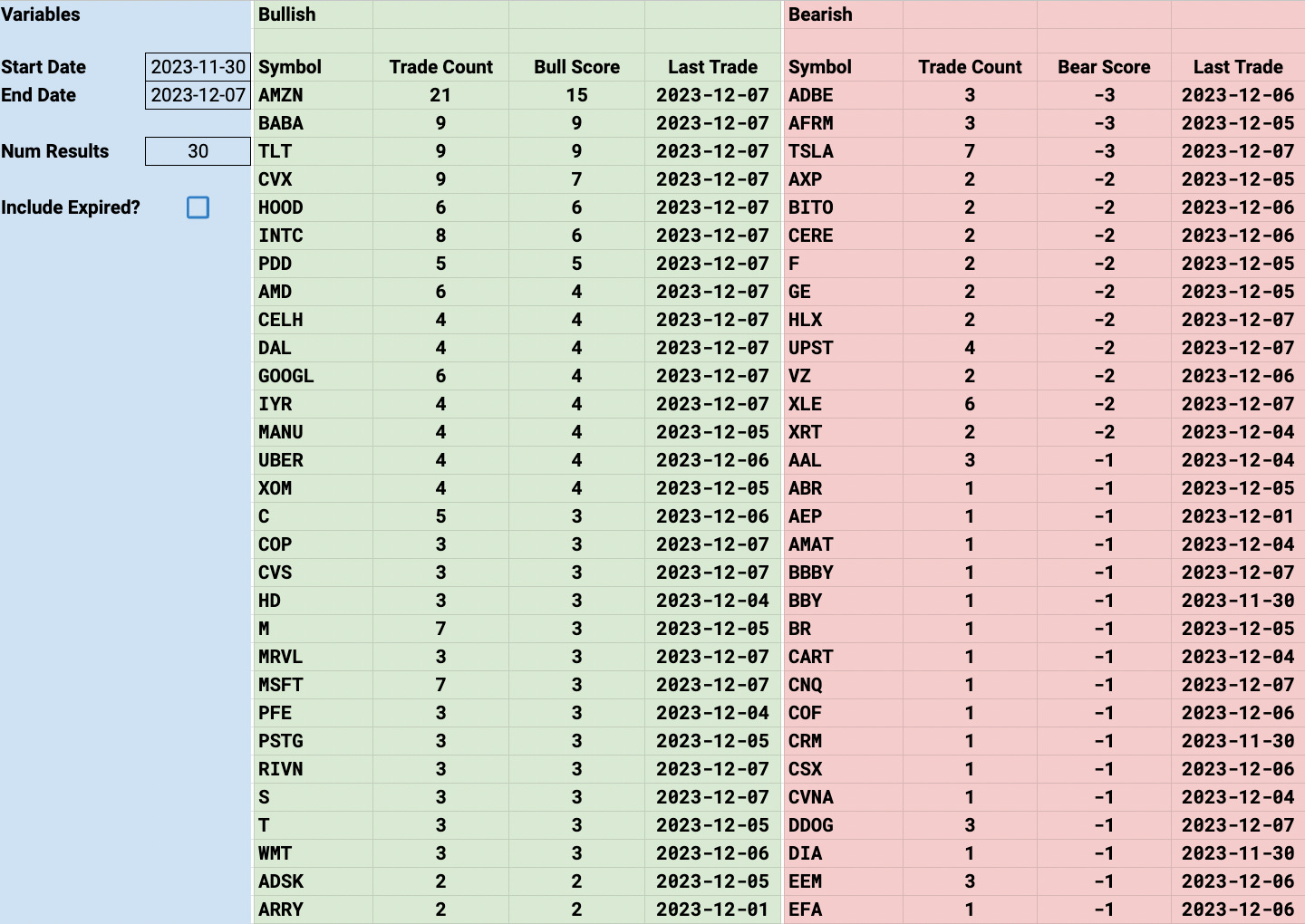

1 Week

2 Week