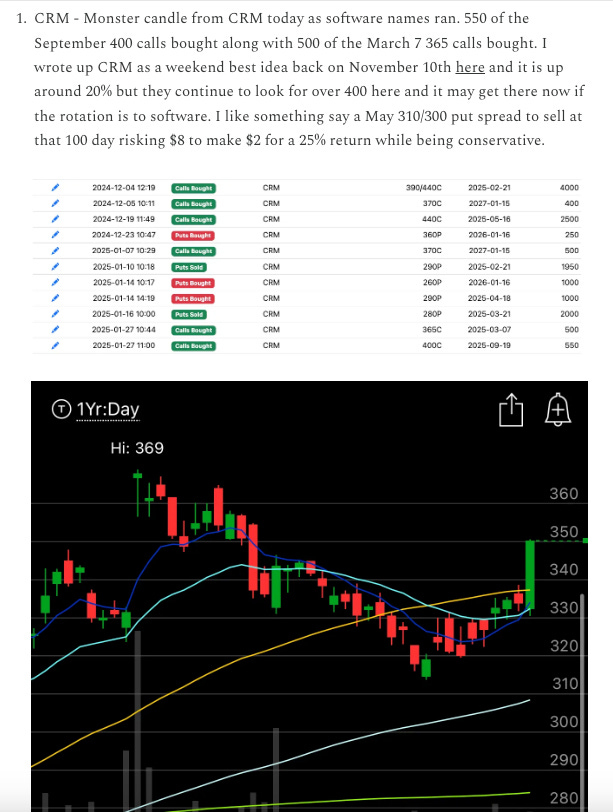

1/28 Recap

The SPY came back to life today snapping right back like nothing happened over the weekend. We’re back over all the moving averages and now we await FOMC tomorrow followed by a plethora of big earnings releases from MSFT,META, and TSLA,IBM,NOW along with SBUX and ASML between now and then. So lots of landmines to watch for beginning now, you never know when a name your in will catch friendly fire from someone else guiding so be careful. Overall I’d say markets look good now, the trade that makes me not concerned is one you’ll see in the table below where someone sold basically 10,000 at the money puts on TQQQ which is a major leveraged QQQ play. If someone is putting that sort of size on, in that instrument, they better be right or their fund is blowing up, so look at those and make of it what you will.

Recent Trades

CRM - Up 5% today I noted Salesforce in yesterday’s recap. That big candle closing near the highs was the tell buyers were stepping in. I mentioned a rotation to software yesterday and the IGV, so many names ripped higher today, for the moment that space is where you want to be selling puts/buying calls.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be open until tomorrow morning and the opening bell. Too many calls so far today to post a table here so please utilize the link below to see it all