1/29 Recap

Our first big day of 2025 is here. Jay Powell will speak in 2 hours and we follow it up with our first big ER day with Microsoft,Meta, and Tesla earnings today. Just remember earnings are always a crapshoot, you look back at Amazon in August and it crashed hard to $155 on nothing really material and here we are 5 months later and it is nearly $240. People who try to time earnings with trades are simply gambling that is reality, if you’re trading stuff short term, avoiding earnings should be a rule you follow. If you’re in these names longer term, whatever happens today, assuming the thesis hasn’t really changed is not too meaningful so don’t panic and sell any weakness blindly.

The SPY is holding on today, we are right ontop of the 8 ema with a small gap to fill above with a likely big move coming in the next few hours. The levels of interest to me would be that 100 day below just over 585 on any breakdown today. To the upside if we can get over 610.78 and make new highs it is blue skies above.

I get alot of questions about NVDA almost daily since the sell off monday, here is the chart below, what do you see? I see a name that broke the 200 day the last 2 days and is testing it a third time today. I see the moving averages starting to slope down and those start to become resistance. Today if we get any news of reduced capex from Microsoft or Meta, it will sell off hard, conversely if they reaffirm heavy spend it will bounce hard. All you can do with names like this is go alot lower than it sits and sell further out puts and hope it falls to you at a level you’d like, for me I’d say the level that interests me is around $100, that is where the 21 month is right now and NVDA hasn’t touched that moving average since 2023.

Recent Trades

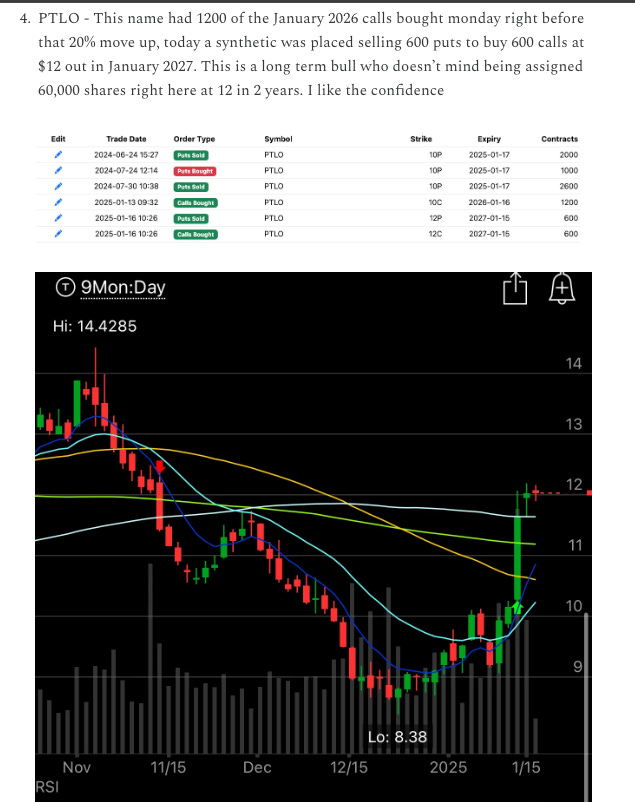

PTLO - 2 weeks back in the 1/16 recap I flagged this Portillos trade here and the name has rocketed almost 17% since. This synthetic is up tremendously now and you have 2 years left on it. I would remain a holder, its a beautiful breakout and on leaps you can’t ask for anymore than a quick move up like this.

Today’s Unusual Options Activity

Here is today’s link to the database as always it will be up until tomorrow morning