1/3 Recap. New Year, Same Choppy Market.

I’m gonna make my first post of the year public just because I have 6,000 people on this substack and a fraction of that are actual members, so I wanted to give them a taste of what it is that I post in my daily recaps. I also wanted to say welcome to all the new people who joined, there were a lot of you over the Christmas break, thanks for signing up and I hope I can pique your interest into the side of the market that is mostly ignored, the flow of money through charts and options.

I also returned to posting YouTube videos, mostly chart sessions and those can be found here, I’m going to try to post at least 1 per day for a while and see how it goes.

Market Recap

We finally returned from what seemed like a never ending holiday to a pretty decent market. Outside of Apple and Tesla, which are both still quite expensive for the growth they display, most of the names I was involved in were green today. Tesla and Apple do combine for almost 10% of the S&P weighting so naturally their weakness will weigh on things. Some names are starting to look nice again, but overall I still am not too optimistic for 2023 in terms of buy and hold working out. With that said, I do plan on making at least 40-50% this year myself. Wait what? How? Those of you who have been here long enough know I really don’t care much about what the overall market does, I’m focused on my positions, selling puts at key levels and letting the market do whatever it is going to do. The macro, the earnings, most of that is just noise to me and I just follow the options flows and charts.

Let’s take a look at some charts to kick off the year

The SPY continues to trade inside that range I noted on my video this morning, until we make a decisive break in either direction, it’s just going to be choppy and you’re doing yourself a disservice trying to trade it in here. Look at the range on today’s candle, it tested nearly both ends of the range, it will be maddening and we have a lot of data coming out this week.

The dollar put in a very bullish candle today which is not ideal for equities. All last year a stronger dollar was bad news for equities, look at this thing now, it reclaimed the 8/10 EMA and the RSI is pointing up, this isn’t a good setup for stocks. Combine that with the bear flag we are forming on the SPY and you have the pieces in place for a move lower.

Lastly oil was decimated today, it continues to be weak, a very ugly engulfing candle today and closing below all those big averages, oil will remain weak in the short term

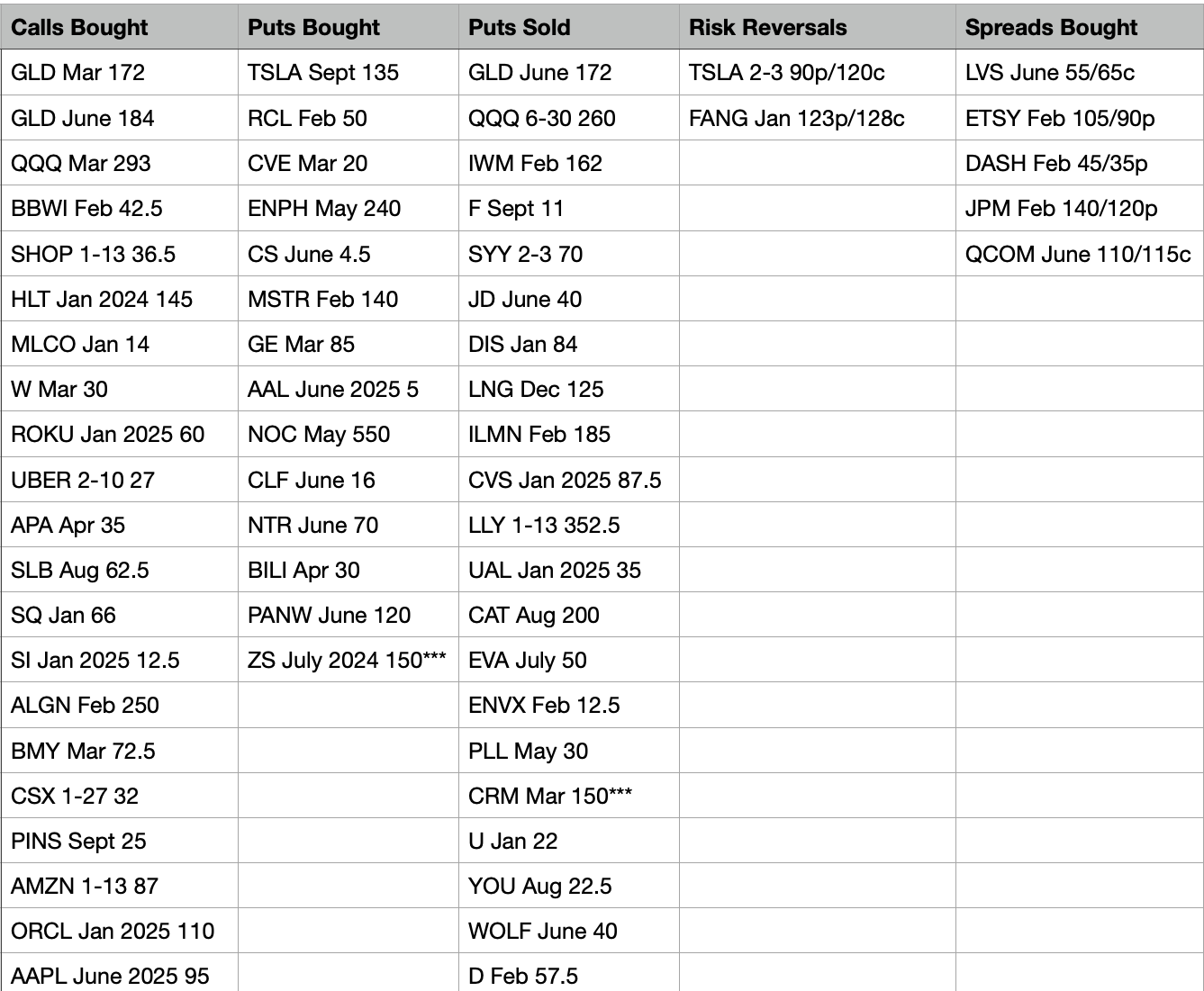

Today’s Unusual Options Flow & What Stood Out

GLD - lots of bullish action on Gold today, big call buys at $172 in March and $184 in June along with a large put sale at $172 in June. Gold has a nice chart as well, could be a runner if we head into a stagflationary environment.

CRM - Salesforce had a monster put sale today at $150 in March, 15,000 of these were sold. Someone looking for some decent upside here selling them ITM, we know about the activist involvement here the last few months.

LLY - Eli Lilly saw a large put sale for next week at $352.50. This was one of the leaders in 2022 with their new weight loss injection begin called revolutionary.

AMZN - large buy of next week $87 calls. Amazon had unusual strength all day today with markets red. It’s teetering on a major trend line, but nice to see it have relative strength for the first time in nearly 2 years.

ILMN with a large put sale at $185 in February, this was a name I highlighted in my video yesterday as having a nice chart of strength at the moment while being well off its highs.

Some Charts Of Interest

OXY - we all know the story here, Buffett owns 30%, it was one of the darlings of 2022, but today it finally broke down. The first chart is a zoomed in look, the second chart is a zoomed out look for you to see the breakdown clearly. I closed out my OXY trade today, not interested in playing with it now after a firm breakdown. Could Buffett still take it private? Sure, and he may, but I am a trader and I’m not going to baghold meanwhile.

Pinterest - The first chart is the longer term uptrend which is still intact the second chart is the hideous bearish engulfing it put in today. I expect more short term weakness here but as long as that uptrend doesn’t break it is fine, if that breaks then I would consider closing the rest regardless of my beliefs on the activist situation.

Twilio - I made a video on this one last week and said it was one of my favorite setups into 2023 as a potential activist situation. I still do see that happening by June, but for now look at the strength with 6 straight green candles in this weak tape, reclaiming some big averages and just looking to fill that gap from earnings.

Amazon - look at the close below, what a tease this stock has been. It continues to bounce around that huge level. It did close over the 8/10 EMA but not quite over the white line. Until it does, it will be weak, but a couple strong closes over that line and it is back in business. The outperformance today was quite telling here.

What Did I Do Today

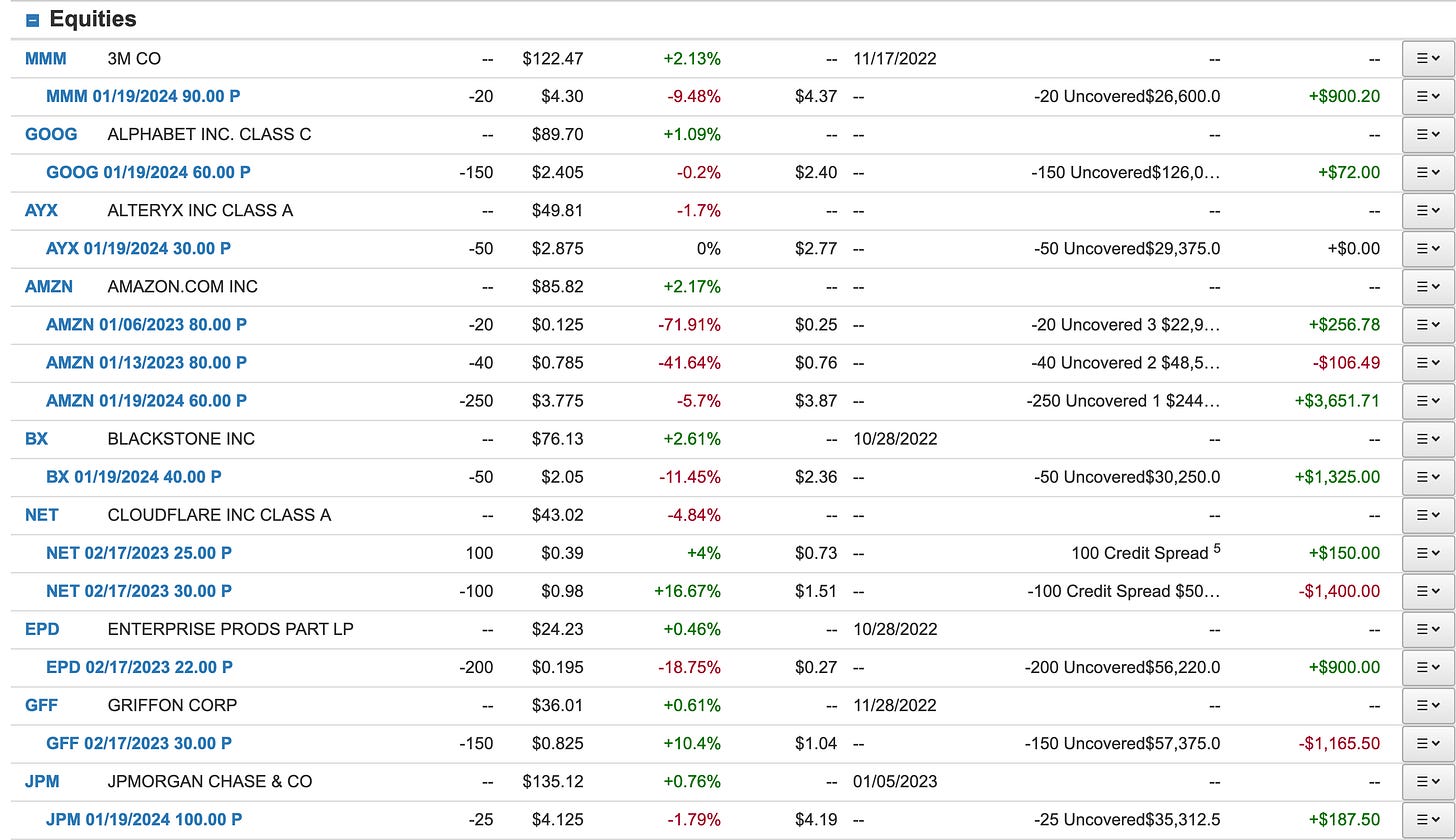

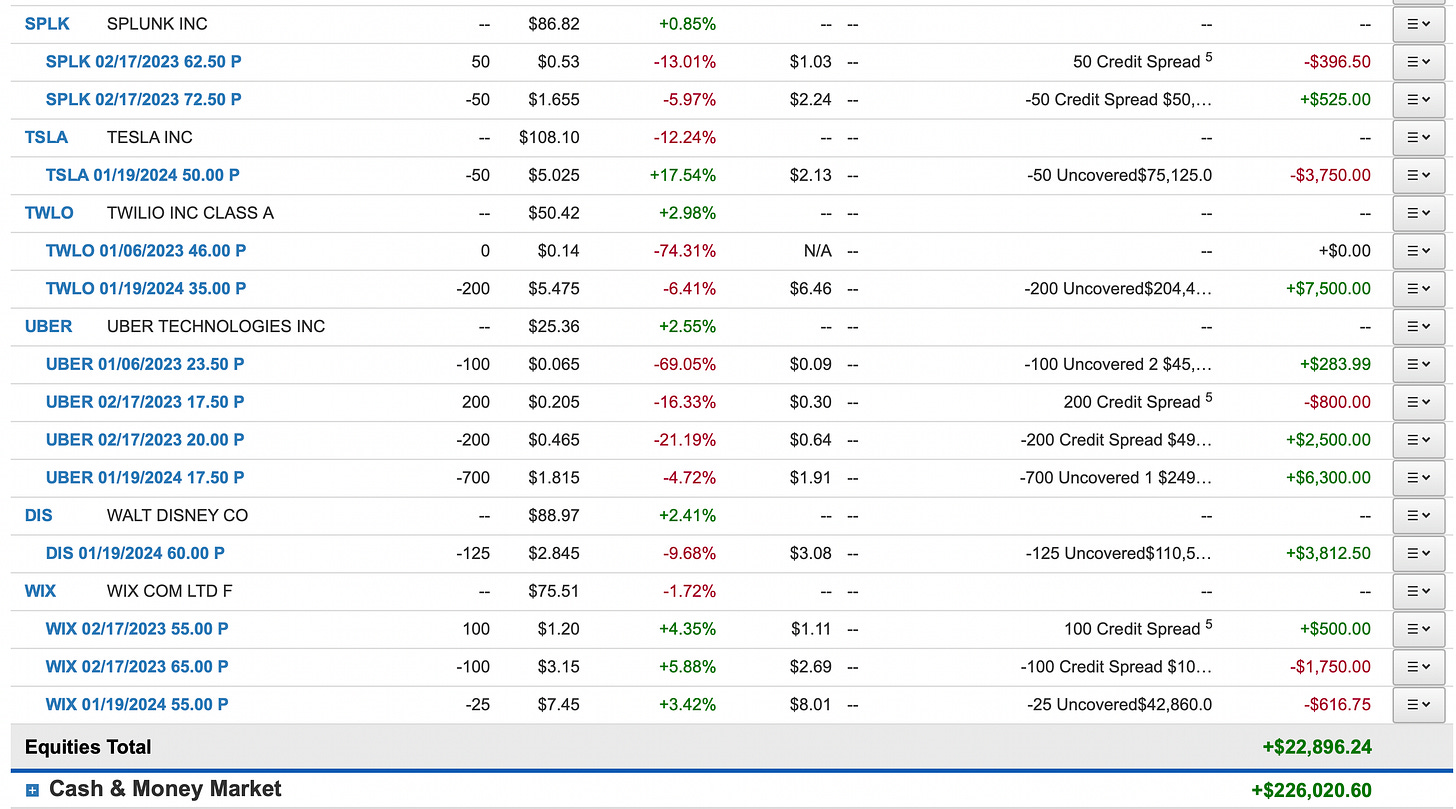

I actually had a small gain today in this red tape. Most of my names were green actually, but Pinterest was down heavily, almost 6%, so that weighed on me today. Overall as most of my short puts are so far out, I’m not expecting much in the day to day department for this first month until after all the positions I have expiring in February finish up and free up some cash for me. I sold a ton more puts today which added another $225k to my cash pile above. For those that are new, the account value is not the important metric I look to, I try to focus more on the actual cash in the account because when I’m selling puts, I’m selling them so far down on beaten up names that I’m not actually expecting to get the shares so I sell the puts and patiently wait. If the market goes up, great I make money. If the market is flat for an extended period, great theta decay ends up being a win for me, and if the market goes down, but not far enough to push me below the levels I sold puts at, I win again. The ability to win a trade without being long or short is what attracts me to put selling. That combined with the fact my trading account is simply for income generation.

Puts I Sold today

AMZN 1/13 $80 puts for .76

AMZN 1/6 $80 puts for .26

AMZN 1/2024 $60 for $3.60

SIX 1/2024 $17.50 for $2.20

NEE 1/2024 $70 for $3.82

UBER 1/6 $23.50 for .10

META 1/2024 $80 for $6.50

SHOP 1/2024 $20 for $2.04

Let’s discuss why I did what I did. Amazon I think is grossly undervalued, of course it is in the consumer discretionary with Tesla and will suffer as consumers struggle. With that said, it had relative strength today, it had call buying next week so I sold a few short term puts and added a few to my longer term short puts at $60 which would be an absolute steal if somehow it got there. SIX FLAGS is a name I highlighted a lot late last year with multiple private equity insiders buying millions of dollars of stock north of $20 and a few buys over $30. This has a strong set up and if I was able to buy shares at $15 in a year, it would be incredible. NEXT ERA ENERGY this is FPL in florida, the dominant utility, it’s also the leader of the ESG brigade in terms of utilities. It has a huge market cap but saw a flurry of insider buys in the $75 range last year, I’m happy to get long at $66.xx but I also do not see it going there as it is defensive. UBER was another name I had recently gone very long at via short puts, but added some shorter term ones as it also displayed strength today, this name has been seeing so many put sales north of $30 into February, it intrigues me a lot. META was up over 4% today, it’s very inexpensive here at $125 and even cheaper at $73.xx, another name where I am selling puts without really thinking about the silly valuation if the stock somehow got there. SHOPIFY, a name down over 80% and I sold puts another 40% lower. Highly unlikely this sees $18, but if it does great, I will take the shares for a long trade back up.

New Things This Year

I’m going to answer chart requests from subscribers daily so post what you want in the comment section and I will include it in the next video I post.

Those of you who are signed up, if you haven’t joined us in the discord, you should, there’s 100+ people in there, and lots of people to bounce ideas off of but more than that I recently added optionsfambot to the chat where you can go through all sorts of analytics and charts on any name you desire. It’s actually pretty cool, and very useful for things like technical analysis.

I’m not going to post my trades intraday on the discord anymore. The discord wasn’t even something I originally planned on doing but at everyone’s request, I did, then I was asked to post my trades intraday, and I obliged, but the problem is, I can’t keep up with who is on my sub stack and who is on my discord because they’re completely separate, and so many have quit this thinking I’m just going to post what I do anyways on discord. With that said, I’m a put seller, my trades are over an extended period, what I do intraday isn’t important as you will see it after-hours.

If you have anything you want me to change or add to these recaps or the YouTube videos, by all means, let me know, I’m always open to whatever it is you all want to see.

Current Trading Portfolio

As I do every Monday I post my entire open book but as I always tell everyone, my book isn’t meant to guide you, it’s just simply what I’m doing, you and I have different objectives, different risk tolerance, and more importantly different balances so it’s unlikely you can put on the same trades I do. It’s just more of a me being transparent thing.

I’m still all cash, I’m still short a myriad of puts way lower on a bunch of beat up names. I did close out my PINS Feb puts today, I didn’t like the bearish engulfing candle it put in on volume, it is still holding the uptrend, but I kept my January 2024 Pinterest short puts. I also closed my OXY put spread because the stock broke down for the first time in a while today. Warren Buffett or not, a broken chart is a broken chart. I also sold some TWLO puts intraday, but they went up a lot so I closed them.

I hope you all had a great day, and I will see you tomorrow. In the meantime I will post a video to my YouTube likely later tonight or tomorrow morning so be sure to subscribe there. Have a good one.

For your next video could you go over the chart for MSFT? I'm trying to see if there's a level much much lower to sell puts at but nothing is really jumping out at me. Thx!

Hi James, Nice to have your recaps back. I have a couple of questions if you don't' mind. (I think I already posted them, but now I can't find them. Apologies for the repeat.)

1. I'm thinking of changing brokers. I'm now at Tastyworks. It has a great options platform but other features are no so hot. Are you at Schwab? How do you like it? I once opened an account with TD Ameritrade because of its Think-or-Swim platform but was very disappointed in it. Do you use the standard Schwab options platform? How is it for what you do?

2. Would you consider posting your long-term book? You've mentioned i once or twice, and I'd be very interested to see what you have as longer term investments if you are willing to share.

Thanks.

-- Russ