1/30 Recap

The SPY is holding up over the 8 ema, breadth is surprisingly strong. We have tremendous weakness from 2 of the 3 largest component of the market today in MSFT and NVDA, both are losing the 200 day averages at the moment. Microsoft is on its 7th break of the 200 day since August, it was perpetually weak going into earnings and dragged NVDA down with it by guiding down on capex. That was one of the reasons I noted yesterday for telling you to be cautious. META and TSLA are green on their earnings reactions and the Chairman Powell did say equities were expensive yesterday. Rate cuts appear to be off the table now, 1 maybe 2, but I really don’t even see how any get done. Alot happened but mostly a nonevent as the NQ is barely red today. We’re seeing a rotation out of 2023/2024 leaders in MSFT/NVDA and if you’re in them you probably need to aggressively start selling covered calls because they look like they will have a rough period for a a little bit.

Recent Trades

BABA - I only highlighted 1 name in yesterday’s recap because it had immense bullish flow and today that name is up 4.7% to nearly 102. Alibaba really looks like it wants to go and as usual the influx of call buying heats up right before that move.

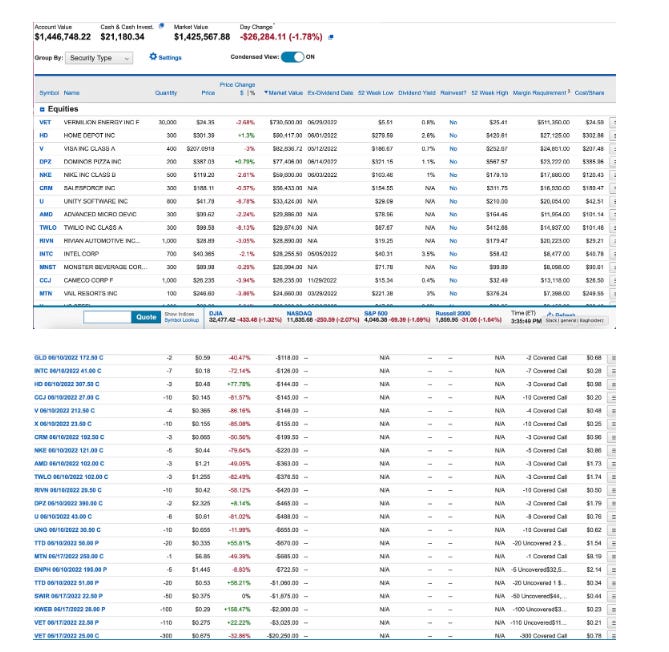

My Open Book

So here is my open book, I said I wasn’t going to be posting it daily because I wasn’t going to be adding much, my margin is really tied up in those META short puts I utilized friday in my risk reversal. Overall, I can’t complain those short puts worked, I could close them up now for a gain of 20% or so but the problem is they reduce my basis on the calls, so I can’t do it yet. I’m going to wait and hopefully my margin requirements dip over the next few months. Until then I will be in this and not actively trading. META had a fantastic ER, it also filled the gap today on the massive tech sell off because of MSFT/NVDA and now it is set to roll after doing so. I also sold some January puts on it at 600 to raise more capital and try to go long there. I don’t really see the need to mess with much else on my end now, I’m up over 17% in January and honestly this META trade still has alot of meat on the bone, you certainly don’t close it up after a report like yesterday where the name should drift for at least the coming quarter. ARVN was a small trade I highlighted a few times recently, it just caught my eye as a biotech risk reversal and how dangerous those are, add in Martin Shkreli said he liked it and I followed it. Nothing major, just a little gamble I put on for a small debit.

I hit a pretty big milestone for me today. You go back to the June 9, 2022 post I made here that was the first time I shared my book in my 2nd ever post, I had just under $1.5M and today I crossed over $7m. Alot of you are probably sitting around with similar book sizes as I had at that time and think growing it is difficult, and it is, but it isn’t impossible. The whole point of this substack for me at the time was I wanted to document my journey from what I had to $10m and see how long it took me while explaining how I traded. I told my wife at the time that there were so many bad traders on twitter during the 2022 downturn who just didn’t get how markets worked. I felt I could share my real book not a google sheet, show exactly what I was doing and I would turn that money in my trading account into $10m while explaining every step along the way. Like most wives would, she rolled her eyes, but, 31 months later and I’m getting pretty close now. I think I may even hit it this year if META and AMZN cooperate, I’m not far off so less is more for me at this time.

My return in that timeframe is over 7x the S&P at 373% vs 51%

Today’s Unusual Options Activity

Here is today’s link to the database, it will be open until the opening bell tomorrow.