1/31 Recap

We opened down big. Microsoft, Google, and AMD all had horrible reactions to earnings. Where do I begin? Microsoft growth was ok, but the name has run way too far in the last 18 months to justify the numbers it posted. It’s a great company, and yes there’s too much capital with nowhere to put it in this world so quality assets like MSFT get overdone. Google had a terrible quarter, I know investors will look at eps and say Google had a great quarter, eps is meaningless. The real metric to look at with all companies is FCF, you can’t fake that. Google missed FCF by a mile, the estimate was $15B and they came in at $7B. Capex was alot higher than analysts were looking for and Google was hit. Google needs new management, the team in place is not good. Lastly AMD, for being the pick and shovel play in the AI revolution, posting 10% revenue growth and not even $700m in income is a bit shocking. Doesn’t really sound like much of an AI boom going on at AMD.

The SPY is hanging onto the 8 ema before Powell speaks today. It isn’t bearish yet, below 480 is when I would start to be concerned.

The RSP below, the equal weight, is down much less at -.25% vs -.8%. That shows you how weighted the SPY is to tech and tech is where all the weakness is today. The RSP looks really good here.

Overall, I’d be patient with the market, as long as you’re over the 21 ema, simple rule of thumb is the trend is still up, we’re close to losing it, but haven’t in months, it could happen here shortly, but until then it’s still an uptrend.

I’m not going to post the trends table and today’s option flows in here today because I wanted to post a deeper answer to a question I’m getting alot below. The trends and today’s option flows are there inside the database if you click the link down below.

My Thinking Into Tomorrow

So I’ve gotten I don’t know how many emails/dm’s in the last 48 hours asking me my thoughts now.As many of you know, I have an enormous Amazon position in my trading book. I took that position back on May 18, 2023 when I wrote the post below.

Why Amazon Is A Generational Buy

And I haven’t been involved with anything else since. At the time I had on 20-30 positions consistently and was trading daily and posting my whole book everyday. The setup was appealing to me for a max long because Amazon had seemingly turned it around completely in the April quarter and the stock was still trading at pre-covid levels. There wasn’t much else for me to think about other than sitting around and going with my strategy of trading week to week wasn’t going to give me the return this trade was going to…..if it worked.

So I did what crazy people do and I went all in, but not on shares, leaps. I gave myself plenty of time for the Amazon turnaround to take place. Since then Amazon has gone from 116 to 156 today and I have since rolled from the very conservative calls I was in to more aggressive ones. All in all as you can see below, I’m up 64% vs 20% for the SPX and 25% for the NQ, so the madness worked.

Now I’ve got people asking me what I’m thinking or doing tomorrow and the answer is absolutely nothing. I’m sitting in June 2026 leaps, unless something material happens on the call tomorrow, there is no need for me to adjust anything. The whole market has run hot, we all know that, the market is up in a straight line from last October when it was Amazon earnings that set that rally up. Alot of people asked me why I always suggest selling puts and the answer is because we are so overbought, the only way to play this market is to try and get in names lower. That’s just reality and call buyers in AMD, MSFT, and GOOG got punished today. The put sellers are still ok assuming they went out a few months and lower.

So now Microsoft and Google are hit, why wouldn’t Amazon struggle? It very well could, but, Microsoft and Google are severely overheated stocks. Take a look at the fcf MSFT generated in 2023 and look at what they did in 2022. It’s barely grown FCF but the stock was up 90% off the lows. That’s what happens with the AI mania going on. Google missed their FCF by 50% yesterday AND their capex was a bad surprise up, not a recipe for success. Amazon meanwhile is set to post their best quarter in their entire history tomorrow with estimates below having free cash flow just under $27B. Do you know how massive that is for 1 quarter, Microsoft did $59B in FCF all of last year. Amazon had NEGATIVE $16b in FCF in 2022, that’s how enormous this turnaround has been.

I still maintain by 2026 Amazon will do more FCF than Microsoft and the stock, if they execute, is incredibly undervalued at 1/2 the market cap of Microsoft. Could things change along the way? Sure and I will be first to tell you when they do and if I close my position but what happens tomorrow likely won’t change my thesis as this is a multi quarter story that is barely unfolding. Amazon is up 30% this quarter, that’s a little ummm nuts? In an ideal world we have a small gap down on earnings and then go up, when a name gaps higher on earnings, you just spend a week or two waiting for it to fill the gap most of the time. Rarely do you get a breakaway gap like NVDA had a couple quarters back where you never look back and fill it.

So for me, just on math alone, Amazon does $100B of FCF by 2026, the stock is materially higher than the $35B or so of fcf it will post in 2023. Again MSFT did just $59b in fcf last year and it is at a 3 trillion dollar valuation. It isn’t insane to say that by 2026, if Amazon posts even $80b of fcf by then it should be $2.5t or higher. That would be north of $250/share.

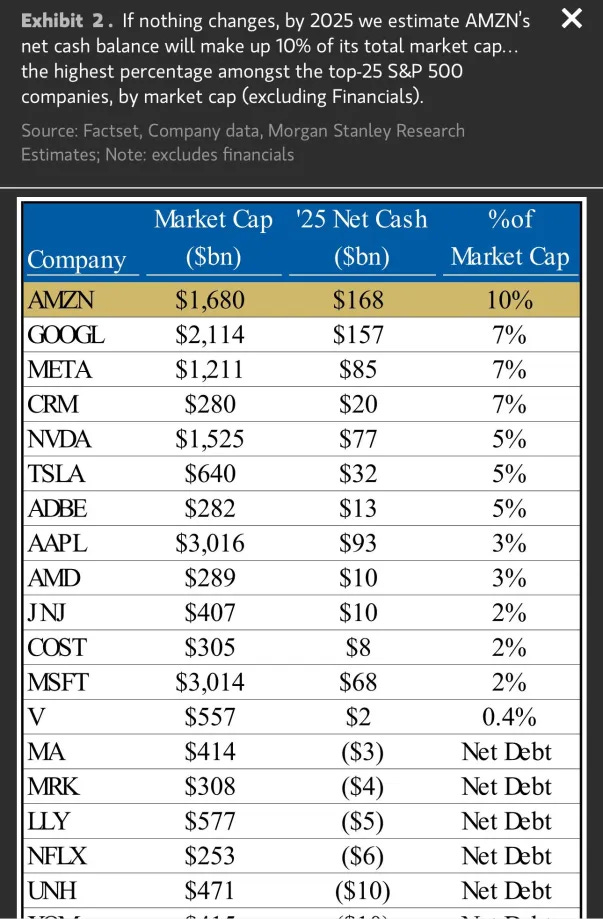

Just remember stocks by design are made to go up, unless they’re junk. Cash accumulates on the balance sheet and the names get cheaper over time, assuming they’re generating cash. In the case of Amazon, nobody will generate more cash now over the next 24 months and probably beyond, they’re the only megacap without a material buyback, yet, so the cash should mount quickly. See the chart below

So overall my stance is, I don’t really care what happens tomorrow or what other companies post. I’m not using short term calls, and I always tell you that you shouldn’t either, those are just gambling. As for Amazon, I know AWS has its question marks, but I know it will be fine in time. UPS had a horrible print yesterday because of Amazon. We have this correlation always that if one company struggles, the whole space is struggling, what if 1 company is killing everyone else, slowly? Why is that never an option because that seems to be what is happening. UPS didn’t have volumes drop 7% YOY because of a recession, it happened because more are using Amazon and less are using UPS. Google too, they missed on ads, and they too recently warned Amazon was hurting their ad business…….

In the end, I’ve always thought Amazon was the world’s best business, the one that could dominate the most. I’ve stated my case why in multiple posts. I think the rest of these companies make alot of money and Amazon simply did not for 2+ years, yet the market maintained a market cap of $1 trillion out of respect. Meta for instance crashed to $250b. Now that Amazon is back to making money, you’re all going to see that when 1 company spends hundreds of billions on capex, more than any company in history, and focuses on organic growth while all its peers just buyback stock to appease short term oriented investors, the results will be epic.

The talk in the next 4 quarters will go from Amazon doesn’t make any money to look how Amazon is immensely profitable, where did this come from. No company in history has gone from -$16B in FCF in 2022 to $60b of FCF in 2024. That is the unthinkable. It’s going to be an exciting 24-36 month period for Amazon and it’s investors, tomorrow doesn’t change that in any way even. It remains the top name in my database over the last year in terms of bullish option positioning. Our markets are overbought, sentiment in tech is now bad, and short term who knows what happens, as Amazon becomes this cash printer, there is no denying that sooner than later, a re-rating that will occur in the months ahead.

There’s a reason nearly every single bank made this their top pick into 2024, anyone can see what’s coming, it won’t be easy when everyone is bulled up like this now, there will be many headfakes along the way, but in the end, it should be materially higher a few months out.

Recent Trades

How about EW? Up 7% today to $79.

I wrote EW up as a best idea on 11/25 Link

The stock was 67.xx and is now up 20% since. On 1/19 I noted some way OTM calls at $87.50 for February expiry and those now have a chance of working out very nicely

Today’s Database Link

As always this expires tomorrow morning at the opening bell and I will have the rest of today’s trades after I send this posted by the afternoon.