1/31 Recap

The SPY remains ok for now over the 8 ema, but we have not made new highs yet so until we do this isn’t incredibly bullish. We’re very close though, but you’d hate to see it turn here and form a lower high. Who knows what is coming this weekend with China and their AI push along with Trump and his tariffs. We are in an uptrend for now and things have been ok, you might remember me mentioning the massive put sale I noted on TQQQ the other day and why the market wasn’t a concern if someone was selling 10,000 puts on a 3x of the Nasdaq. Next week we have AMZN and GOOG reporting and that finishes off 6 of the Mag 7 with NVDA reporting in a couple weeks. What we got from the megacaps this week was they are making alot of money and as long as they remain 30% of the S&P by weight, they will buoy this market.

We are in a ripe environment for stocks to work, the dollar broke that huge uptrend it was in 9 sessions ago and it has remained weak since, even now it just broke to the lows of the session. If it can take another leg lower into that 100 day just over 105, equities can run hard.

Recent Trades

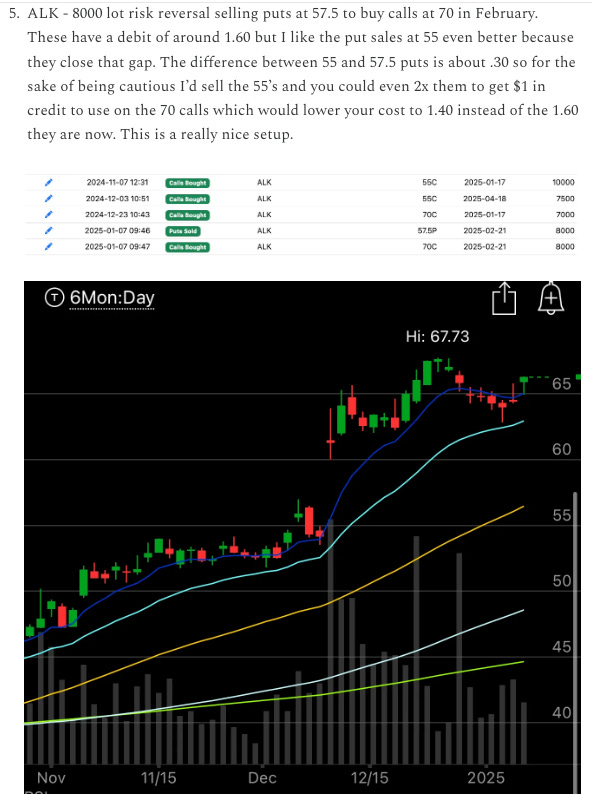

ALK - I flagged this Alaska Airlines risk reversal back on 1/7 in the recap here the name is up 12.6% since to $74.28. Those at the time had a debit of 1.60 and today with where it is you’ve nearly tripled your money. That’s the power of amplifying a trade with put sales to lower your basis, if you’re going to be directionally right, then the put sales shouldn’t be a scary thing to add assuming you don’t mind taking on shares at a lower price.

My Open Book

No changes today, I did sell some weekly META puts at 690 expiring this afternoon, if I’m put shares there, great, I think this week they wanted to pin it below 700 because of all the calls there. Otherwise as you can see you in a week I completely pivoted. Before I saw that massive META OTM call buy last week I was happy with 30+ positions on, selling puts and cleaning up, but I knew what I saw in those META calls and pressed my chips in the right direction with that risk reversal, that trade alone is up almost $400k in a week. At this point I’m in about as good a spot as I could ask for, I have a long term capital gain on my AMZN trade from last year, another $10 higher in 18 months and that position rises almost another 60%. I figure my META trade is my new AMZN trade and now I pretty much don’t have to do anything but wait for my AMZN trade to slowly trickle towards its max value and then cash that in for a long term gain, wait for my META trade to hopefully trend in the same direction, and then I will have capital to trade again when I dump my AMZN stake. A big move over 250 next week and it could be then, but realistically even a move down next week on AMZN wouldn’t hurt me as I simply need just a few bucks in 18 months.

So from here on, it is unlikely you’ll see anything like you saw this whole past month, my margin is really tied up with the META short puts I have. Overall, I’ve had a lot of amazing months in my life in the market, but I’ve never done it on a book this size for myself, I’m up around 21% for the month right now. I know a few of you in the discussion thread in the discord beat me and well done I can’t imagine how you pressed more leverage than I did but congratulations. For me, if the market trends up, I will do great, if its flat and AMZN just holds firm, I will really outperform, so really, I am positioned very well at this moment and just can’t do much until I cash in one of these big positions.

One of the big things traders mistake is they think they have to dabble in junk to get those large returns everybody seeks. What you’ll notice with me is my AMZN trade below, I utilized a call spread where I risked $18.xx to make $80. That’s a 4x on your money if you’re right, and I was, but the point is you don’t have to go play in junk small caps to get these huge returns. Think about the META trade I placed last week, that risk reversal cost me $22 out of pocket, its tripled in a week, but the trade maxes out at $500. I could make 10-20x on my META outlay in the next 24 months, I don’t have to play with some $4 stock to get those returns. You can stick to quality names and still get those small cap returns you seek by utilizing options. That’s why you always see me mention various ways to use risk reversals in the trades I highlight because if you’re directionally right, the returns are materially higher than just buying calls. Of course you better be right on direction or you can really get hurt.

Today’s Unusual Options Activity

Here is today’s link to the database, the rest of today’s trades will be added throughout the afternoon. The link will be open until monday morning and the opening bell. For those of you in the live tier, I will post a new link for all of February under the pinned notes section under live discussion in the discord