1/4 Recap

I’m going to keep this part short today because I have a longer writeup at the bottom regarding Amazon after today’s news.

The SPY remains very weak and stuck between the 8 and 21 ema. Those 2 look set to cross in say 3-5 sessions depending on what happens, that is a classic 8/21 bear crossover, one of the most basic bearish setups. It doesn’t mean a crash coming, it doesn’t mean sell everything, there are tax ramifications for that. It just means some more weakening in the short term. Again markets don’t go up in a straight line, well, sometimes they do as the last 9 weeks of 2023 showed you. This is all very normal price action, you can take advantage by selling calls vs your positions and just waiting for things to normalize likely in a couple weeks.

Yields are perking up again and you can see the weakness in the TLT today. If the chart below was a stock, you would likely want to buy it, that’s the TNX, and yields look like they want higher. Yes I know we’re pricing in 7 rate cuts this year, and it is very possible we do get that many, but markets zig and zag and for now yields look like they want to go up. A rejection and lower would be nice to see.

Oil fell dramatically intraday again, this time it was on news that the terror attack in Iran yesterday was not Israel escalating the conflict in the region but rather ISIS being the culprit behind the attack. Oil had spiked yesterday on fears the war in the Middle East would be expanding potentially and now that isn’t the case at all.

Recent Trades

A couple names I highlighted in yesterday’s recaps like ETRN after that big risk reversal and C with all the call buying were both very strong today outperforming the market up 1.5% each. Another UBS had a large risk reversal yesterday 10,000x and was up 1.5% today as well. Others like TCOM which saw a huge call buy yesterday in the table and was up 7% today.

The moves are often quick after these options flows and simply buying common in the right direction can pay off very quickly.

Trends

We’re going to hold off on using the new app I debuted yesterday, some changes need to be made after feedback I got, so for now I will be using the older platform I’ve been using. Late next week I will be able to post the 2 week trends again.

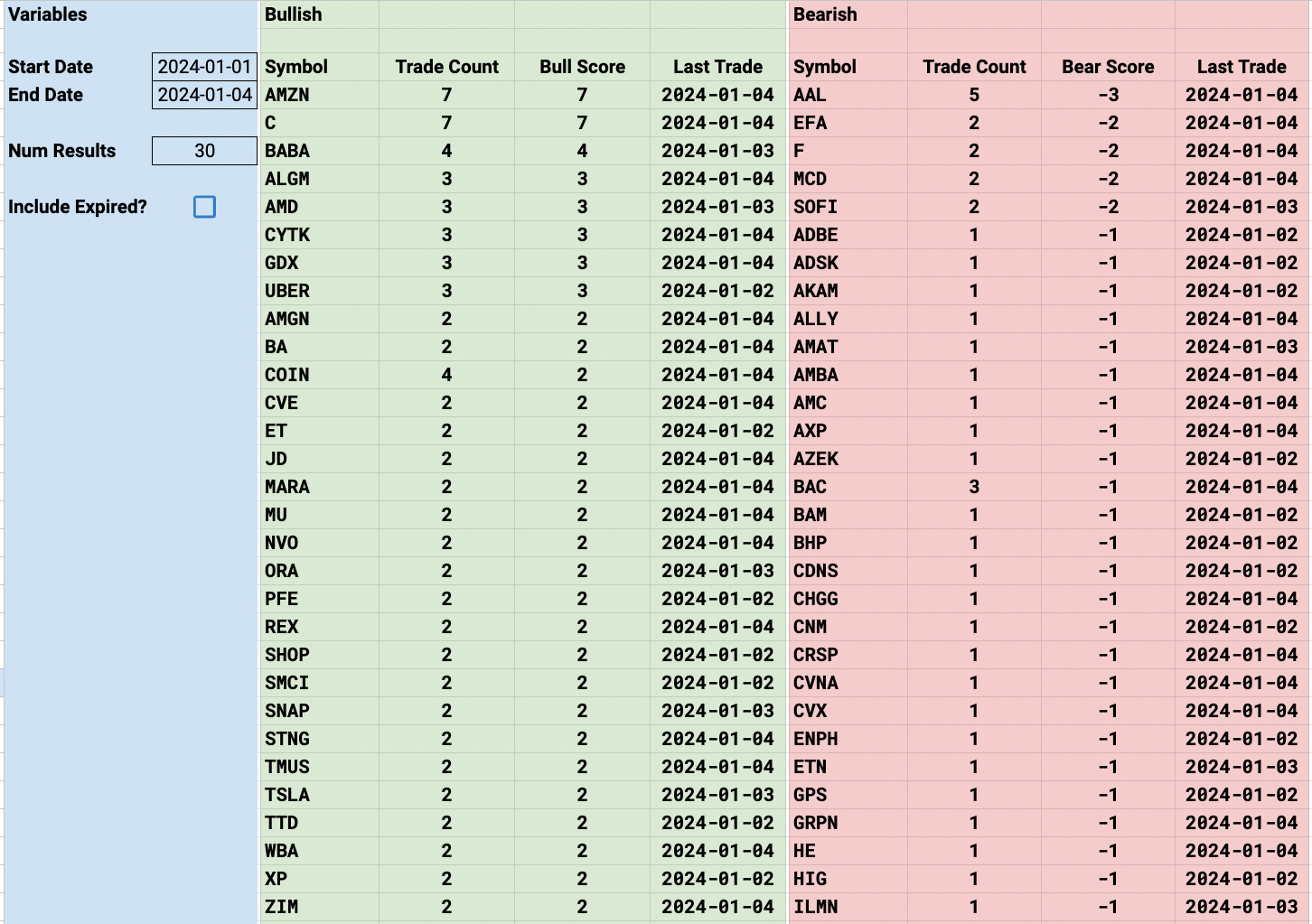

Week To Date

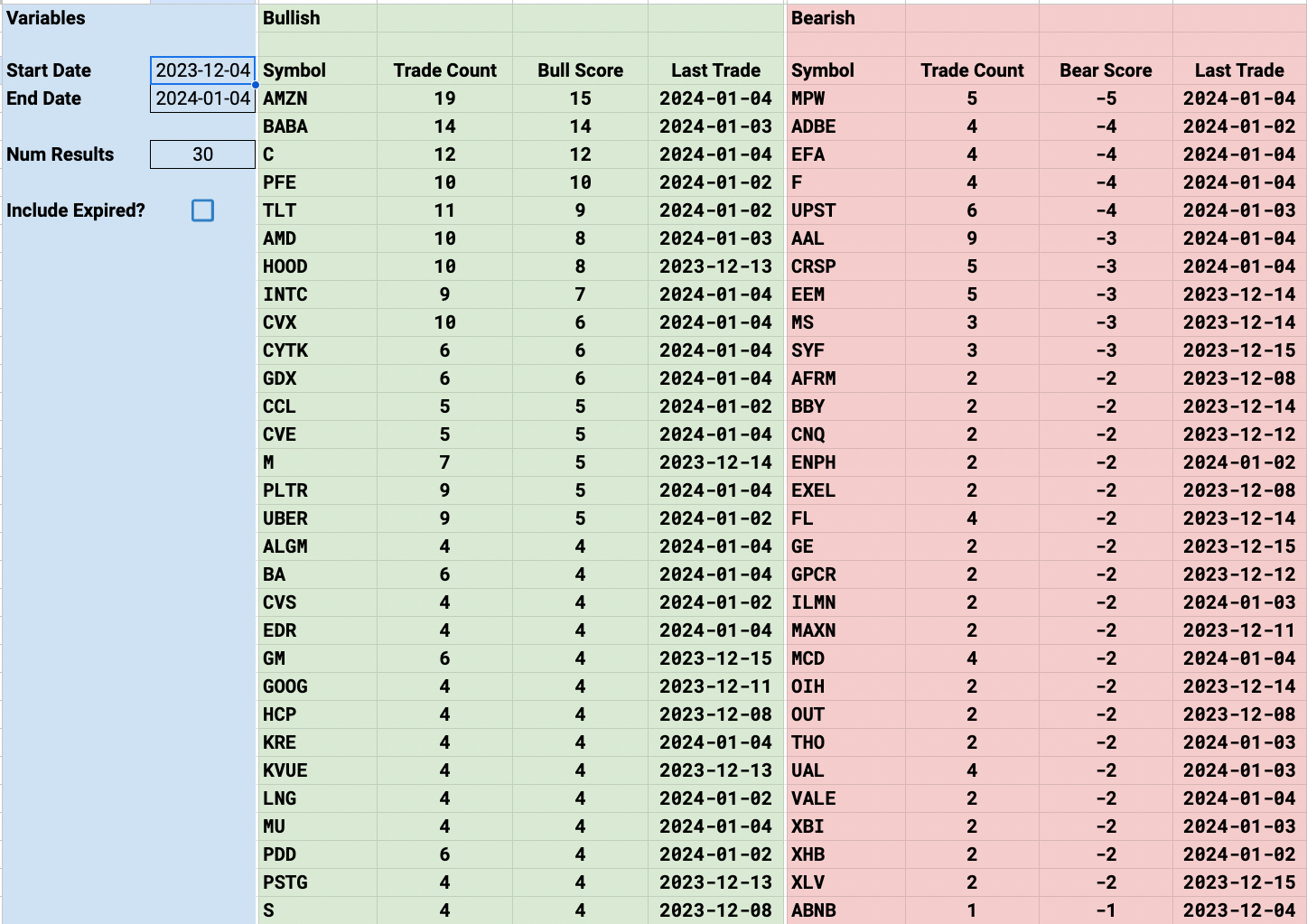

1 Month

Today’s Unusual Options Activity