1/8 Best Ideas For The Week Ahead

Friday was quite the session, we initially gapped up and dumped within a few minutes of opening. Then around 10 am, we got the ISM print which showed these are worse times than covid and the market rallied because the fed can talk about all the hikes it wants but sooner than later it is going to be forced to stop and cut rates which would expand multiples. Our whole economy is a house of cards today and without low rates, it simply cannot function. So that’s your recap of friday, stocks went up because the economy is so awful and stocks are based on fed policy, not fundamentals anymore.

On a shorter timeframe the SPY did break out, but if you look at /ES technically we’re still in the same range, the MACD looks like it flips positive tomorrow, we’ve reclaimed a ton of moving averages and it looks like we can have a small run.

On a zoomed out weekly look you can see our old friend. The red line at the top is the same downtrend we were looking at 2-3 weeks back as stiff resistance and it is not far off now. So that looks like the short term target at most but there isn’t much bearish to say. That is a nice weekly candle, we rotated up but the RSI is still mid and not really confirming much.

The dollar(below) had a big reversal on friday closing below all the key moving averages which fueled the rally. Equities are just the inverse dollar at this point and friday’s session just pointed to future easing that the dollar did not like. When people cheer on equities up, you have to look at it in real terms, the dollar is down nearly 10% in a few months while equities up around the same, that isn’t really a win in real terms.

My Best Idea For This Week

Last year went really well with these I was successful on 26 of 28 of them but this year I’m not going to focus on 1 week trades, the market is a minefield of datapoints these days and you’re just gambling if you’re playing trades 1 week out. I’m going to just point out charts that interest me with option flows to back them as my best idea. You can see on my recap monday how I play them if I do but it just isn’t prudent to play week to week anymore when you seemingly have fed speakers, datapoints,etc on a near daily basis and the market has become a bigger casino than it was during the covid lockdowns.

SHOPIFY

On a daily basis, the MACD just flipped positive for the first time in a month. It has reclaimed a ton of moving averages but it could potentially be forming a bearish head and shoulders so caution is warranted. I am short January 2024 $20 puts and that is how I am playing it. The equity is still pricey, but is in firm second place behind Amazon in e commerce and has a fantastic runway over the next decade. It is down almost 80% off highs and there were definitely worse times to get involved. Christmas data already came out and consumer spending was fine and last week they announced better ad targeting for sellers which should help conversions.

On a weekly basis, SHOP is trying to base. That is what has to occur after a big drop, it just takes time for all the moving averages to come down, flatten out and slowly it is beginning to reclaim them. It could be argued that a nice bull flag is forming on the weekly right now. As you can see the lows were $23 and that’s why I targeted the short $20 puts because that is 10% below that and back at levels from 5 years ago.

Unusual Options

1055 Jan 2025 $25 calls were bought for $18.85 on 1/5/23

2900 Jan 2025 $35 calls were bought for $14.50 on 1/5/23

5000 Jan 13,2023 $37 calls were bought for $1.13 on 1/5/23

2900 Jan 13,2023 $38 calls were bought for $1.66 on 1/4/23

3300 Jan 13,2023 $36.50 calls were bought for $1.66 on 1/3/23

Those calls were all bought last week, now they were before the run we had friday so keep that in mind, those trades are all up right now becuase of when they were put on. The longer term story here is still intact and in the world of growth names there are many worse stories than Shopify. With that said it closed last week below $37 and if you wanted to be aggressive on a weekly basis you could sell put. Below you will see something like the $33.5 puts could be sold for a near 1% return next week but of course SHOP is the type of name that dies when the market goes red hence why I prefer to sell my puts so far out and let the theta decay occur over time.

Scans For The Week Ahead

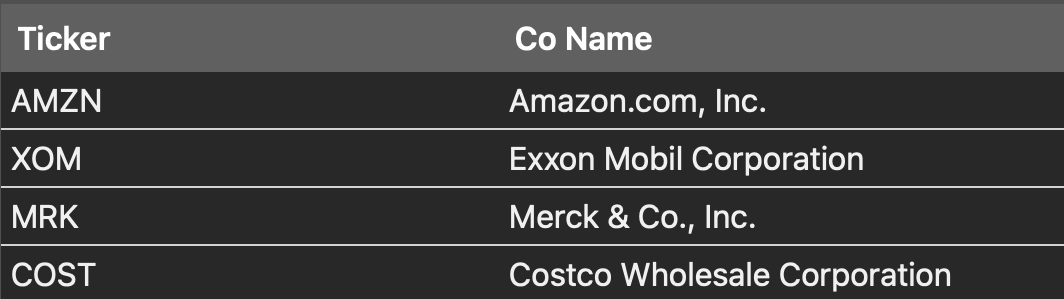

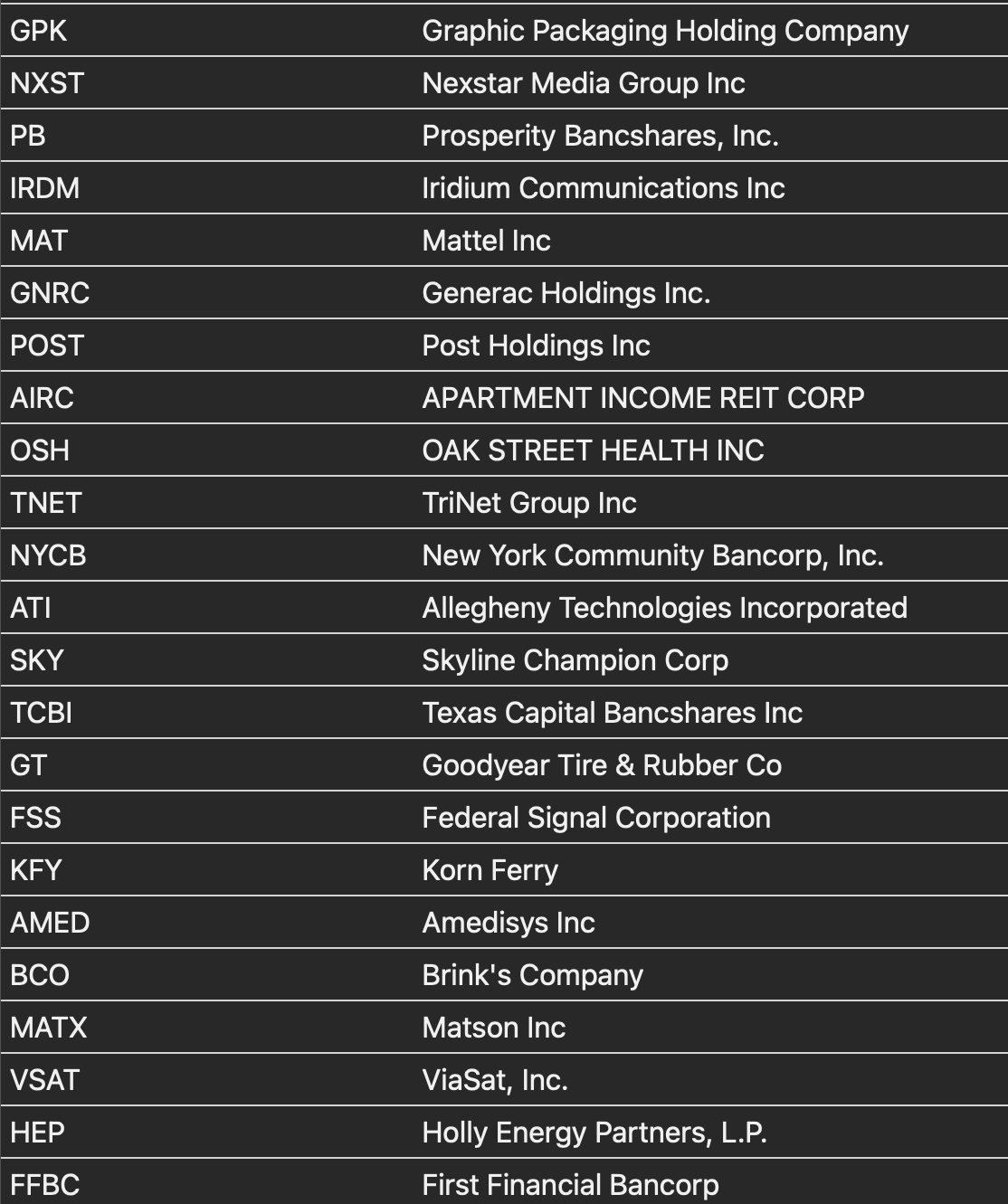

Weekly Bullish Engulfing Candles

Weekly MACD Bullish Cross

Surprisingly there were not too many names that put in a bullish engulfing on the weekly, one you will notice there is Amazon. Amazon actually had a bullish engulfing candle on the daily friday and it closed just slightly over the trendline it has been battling for weeks. We need to see a follow through if something real is there but this isn’t a bad spot to put on your Amazon trades.

Another name that was very strong last week and just had a MACD cross was Disney. As you now I put on a fairly large trade there at the end of last year just on fundamental undervaluation, the return of Bob Iger, and the activists in the name but it opened the year with a very strong week as you can see below.

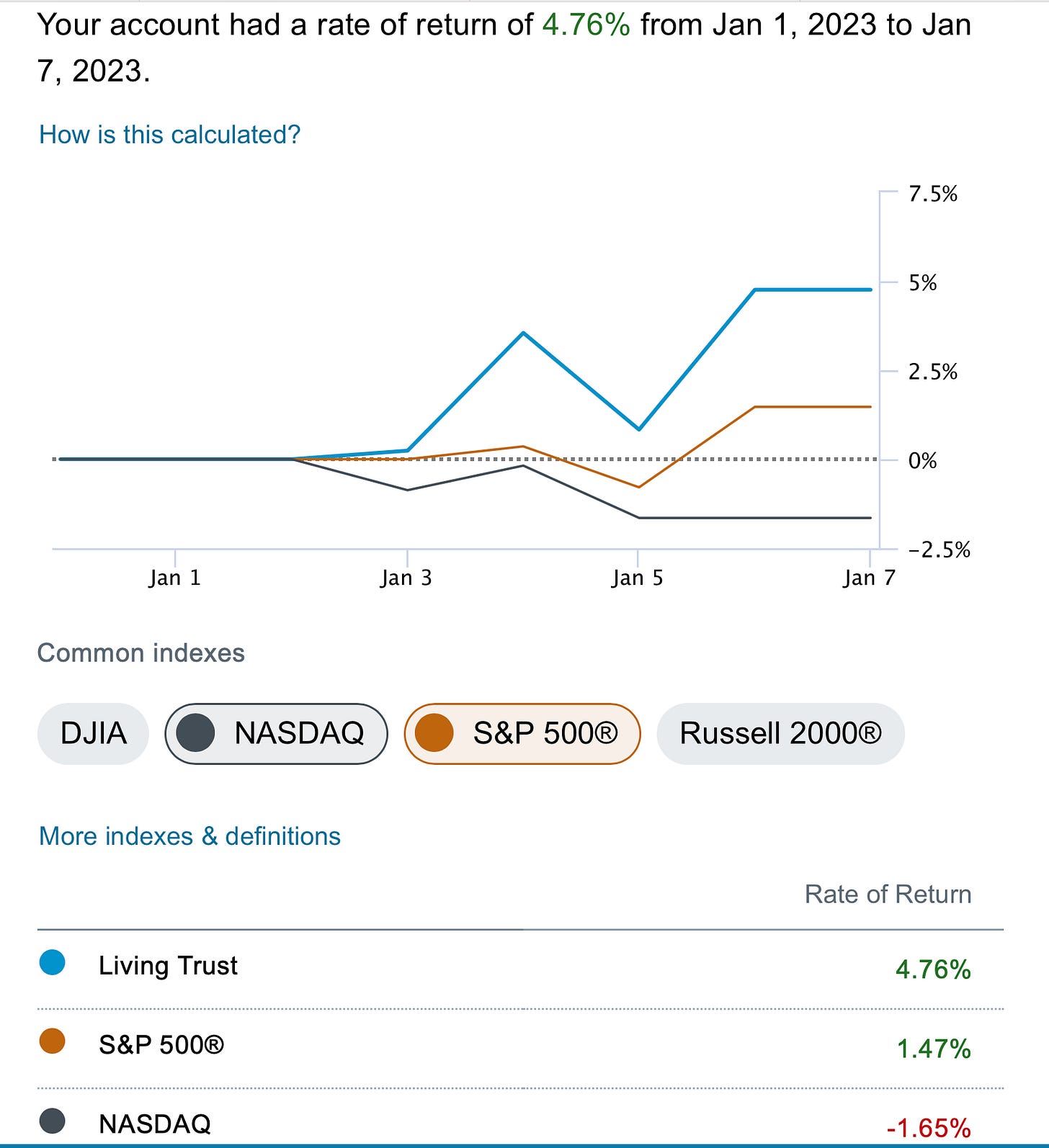

Performance

I opened the week just like I finished 2022 with a bit of outperformance closing the week up almost 5%. As I’ve stated, short term I’m going to outperform or underperform simply because of all the leverage I have in the puts I sold. Typically the second half of the year is where these all begin to decay for me as they get closer to expiration but my focus is the same, positioning myself for far lower prices, whether they do or don’t come, I plan to profit it off that.

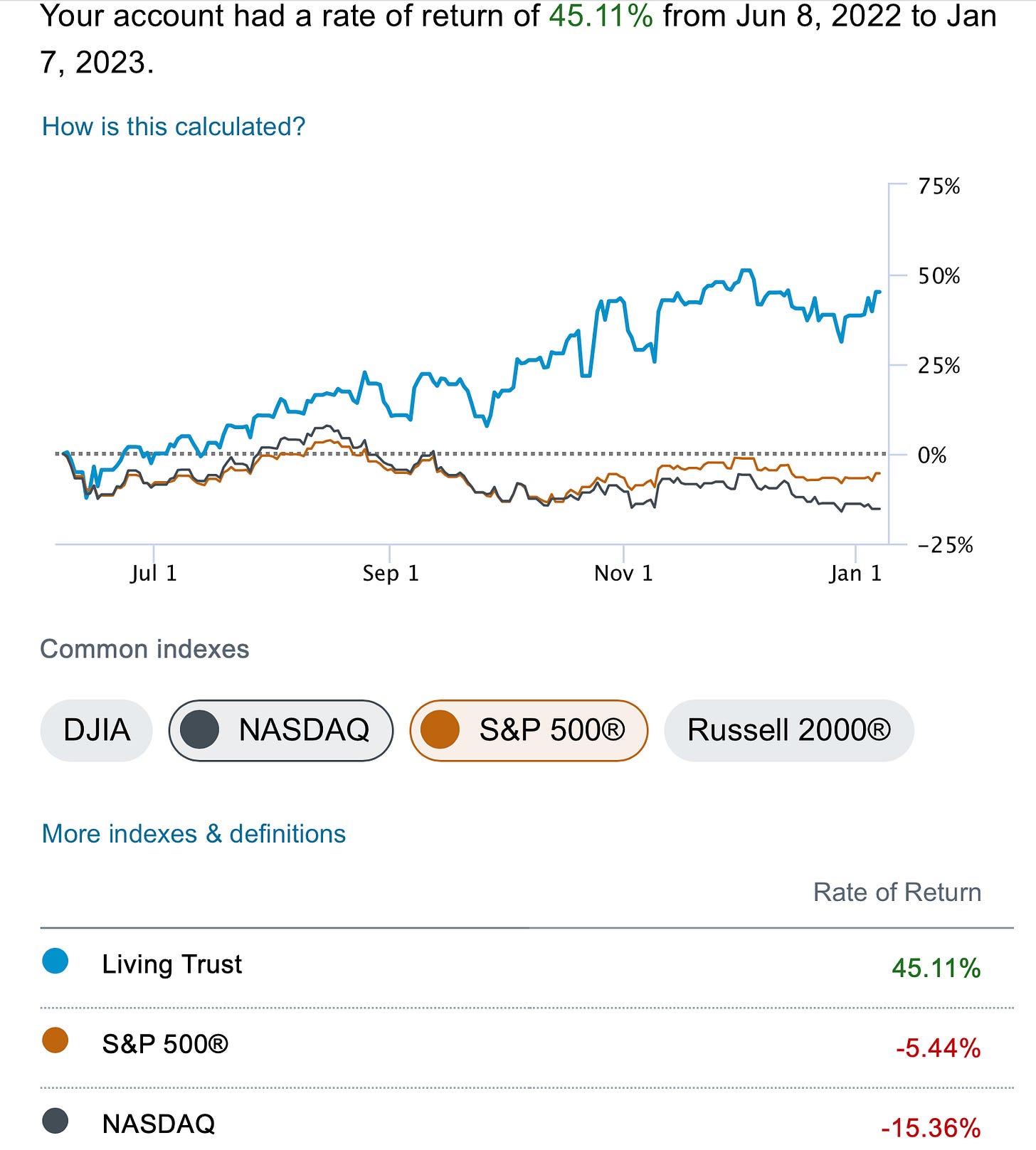

I finally hit 60% outperformance from the time I began writing this substack on June 8th, 2022. It’s hard to believe the Nasdaq is still down 15% from last summer, but believe it or not it is down about 20% since President Biden took over in January 2021.

It has been an ugly 2 years for tech stocks and I really don’t think 2023 will be any better. I still do not see much upside and maintain this will be the year premium sellers, like myself outperform, as equities do mostly nothing other than gyrate up and down in a range. As I said last week I think names with high yields, things like VZ,SU,EPD,MO will be great this year and tomorrow when I post my book as I do every monday you will see I’ve positioned myself in a lot of short puts in those types of names. I do have plenty of growth and tech names, but I’m long nothing at the moment, just short puts at levels much lower and waiting for the market to make its move. I’m playing time decay, not trying to pontificate whether stocks go up or down because as friday showed you, it’s all a guessing game at this point. Bad data is good and good data is bad, this game is damn hard and the people trying to guess directions from day to day are just gambling. I try to make calculated bets utilizing my margin in the best way possible for the most profit, that is all.