1/9 Recap

Ok so I’m going to give the app its first live test with users, if you’re in the LIVE part, just go in the live discussion section and there will be a link there. Give it a try and give us some feedback, if it works smoothly, tomorrow I can share it with the rest of you.

We opened up deeply red in tech and have reversed to green a big 200 point swing in the NQ led by Amazon and Nvidia. Nvidia had some big announcements at CES and Amazon announced some generative AI features coming to Alexa. The market loved both. Oil got a big rebound today as it continues to bounce from headline to headline, today it was this production cuts headline

EIA EXPECTS OPEC+ PRODUCTION CUTS TO LEAD TO GLOBAL OIL INVENTORY WITHDRAWALS OF 800,000 BPD ON AVERAGE IN Q1 2024

The SPY continues to trend over the 8 ema for the second straight session, for the time being the weakness is over. What happens as more datapoints come out soon, I couldn’t say but until we go back below the 8 ema, there isn’t much to say we aren’t in a position of weakness overall.

Yesterday after I cut off a huge trade came in on FCX with a player buying 40,000 of the June 45 calls. I always tell you that even though I cut off early, and 90% of big trades happen in the first few hours anyhow, if anything big comes in the afternoon, I will be sure to note it, here is one for those that are interested and here is what I have from the past month on it.

Recent Trades

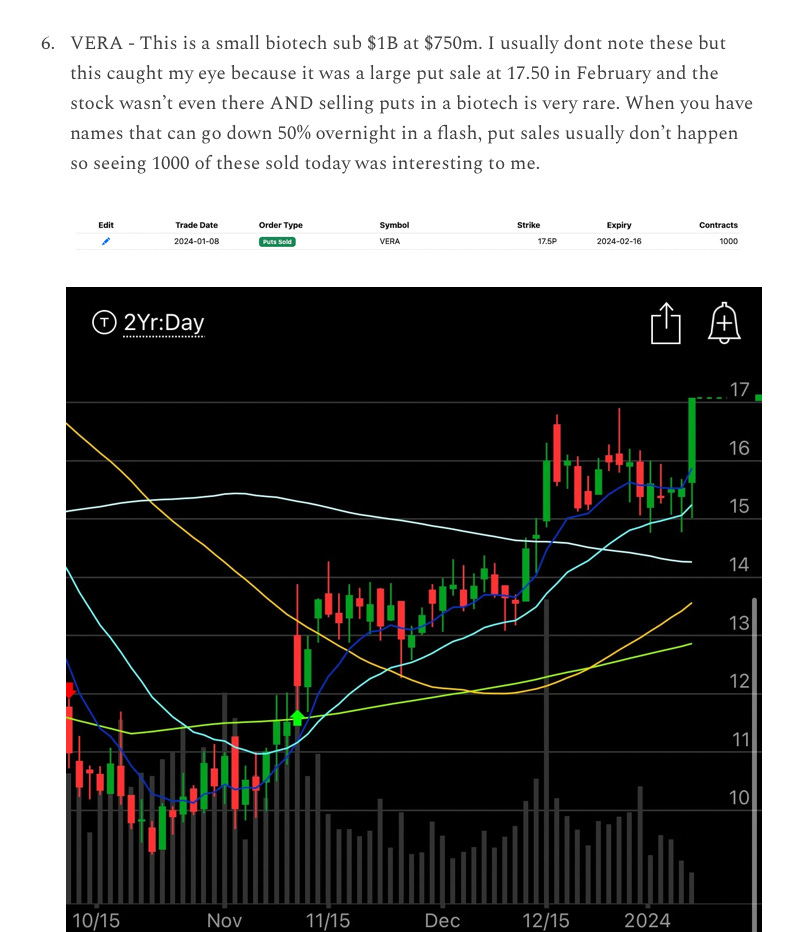

Yesterday I had an inkling to add a 6th name to the 5 I post daily because that VERA trade really seemed off to me, what kind of masochist sells puts in a biotech that small especially in the money ones, it was barely 17.xx yesterday, of course it kept running all yesterday afternoon and today popped up to 19.20 as of now. This didn’t even take 24 hours to work out.

NVDA too continued its run up another $15 after it was highlighted yesterday with a followup 2.7% today. Those AMD $138 calls for this week I noted last Friday have been insane as the stock is closing in on 150. Unreal move in semis this week.

Also a name I had highlighted previously on 12/15 the last day before I took off for Christmas, MTCH, exploded higher today to 42.45 at the highs after Elliott Management took a stake. You’ll notice there was a big block of 11,000 puts sold at $30 on 12/15 and another player that day bought $40 calls for February then 1500x. The stock was $34 that day. Impressive plays.

Trends