2 Years On Substack

I’m going to post a best idea tomorrow on sunday, today is the 2 year anniversary of my writing this substack so I thought I’d go over the experience in depth. This is long but I think will help you understand how to get the most out of what I do. I get that question so many times a week and this is the answer.

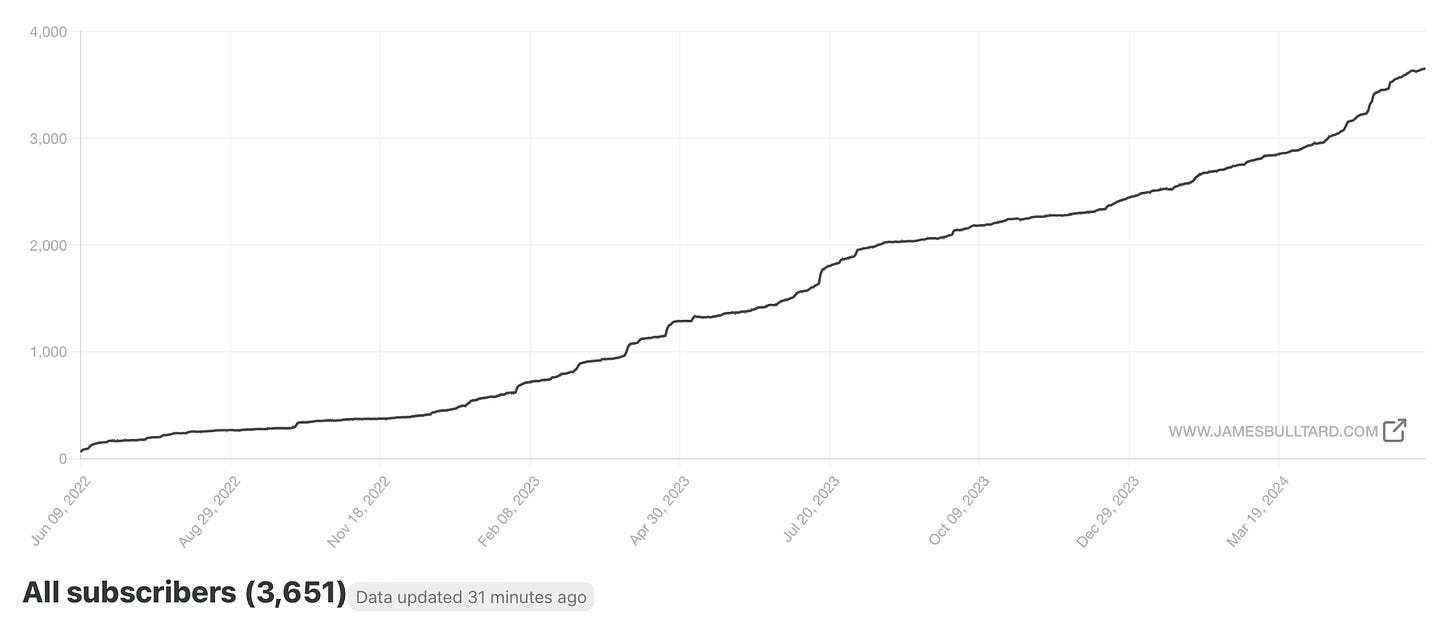

Where do I even begin, 2 years into this project, this has turned into far more than I could have ever imagined. What started out as a place where I’d jot my musings down on markets has turned into a full blown community with over 3,600 members that doesn’t appear to be slowing down anytime soon. No really, look at this 2 year chart, if this were a stock, I would buy it.

I can’t even believe it sometimes, 3,651 people care to read what I have to say? I can barely convince my wife to think what I have to say is important most days. It’s a honor to think that many people find what you have to say valuable enough that they’re willing to have their inbox spammed with your daily musings. For that I cannot thank you all enough.

So why did this even come together? Simply I saw alot of people who had no idea what they were talking about guiding people in 2021 and 2022 after I joined Twitter. Alot was going on in 2022, markets were crashing, lots of the furus who everyone trusted after the up everyday era in 2021, where everyone long only growth names at 50x sales looked smart, were now getting obliterated. It was chaos and people were just lost at what was happening. I knew exactly what was going on and my following kept growing because I was honest with everyone in my tweets. I just believe that options flow and charts tell a story and I listen and share. For instance look at the market crash in 2022 below, when that uptrend broke in late 2021, why would anyone have remained bullish? You know my stance on following trends, there is a time to be aggressive and time to pull back. If you listen to the trends, you know when to “get out”.

So someone mentioned to me that I should write a substack because tweets weren’t really long enough. I had never heard of this place. After taking some time and looking around at various platforms that existed at the time, I wanted to build out something that improved on things I didn’t like. Things like sending recaps at the end of a session don’t do people any good when they want to trade intraday before a gap up, which is why I send mine mid day. I wanted to post deeper looks at individual trades placed daily, not just simply post what option flow I saw. That’s where you get the 5 highlighted trades a day, no you aren’t supposed to take every single one, I’m just throwing out potential ideas for you to brainstorm. Then most of the options platforms that you see show you every single trade that is placed in a day, why would anyone care about someone at home buying $45k of calls on a name? That’s irrelevant. I have my parameters in place that I’ve tweaked over time and I try to show you only the most relevant trades in a session based on things like size, historical context within a name, location relative to certain moving averages, etc.

My top priority is giving you the most important data without wasting your time. I could easily add all sorts of fluff to the recaps or app, but why? What you see is all that I think is important. There’s millions of trades every day, these are just my parameters of “odd”. Then I wanted to organize that data into a simple to read format where you could quickly sort by what sort of trade you seek. As I’ve said many times we all have different objectives, for me, the puts sold daily are the most important because that is where institutions are showing their hand on what levels they want to go long a name. All the calls/puts we don’t know the intention of those trades. Are they hedges? Possibly, but with short puts I know those are simply levels someone is looking to establish a long in size and I find that invaluable because those trades are right at the highest clip. For others here they’re only interested in call buys or put buys. That’s what makes a market, people who like different things. Sections like the trends, that was just my concept on how to get to where you all could see the names I’m logging ranked.Look how this week PYPL was the top trend and sure enough it had an incredible week as the big money loaded it right before the move up.

I think my style is unique because most options platforms just highlight option flow and then most of the gurus follow it, but they don’t really have commentary on the how or why that should simply be one datapoint in your brainstorming process. If someone buys calls higher in size, maybe you buy lower strikes, maybe you sell puts, but you don’t have to follow it directly. That is silly, my career led me to developing my own system. That system is repeatable and exactly what I discuss with you everyday. I take all the relevant option flow, I look over charts and add in the option flow. If something then interests me I utilize my own method to attack the trade in a different fashion. Why is that? Because these big players aren’t right all the time, if they were, they’d all be outperforming the market by a mile but they’re not.

So I have to take their knowledge and put on a trade around that while lowering my potential risk of loss. How do I do that? Every name that is somewhat decent is a buy at certain levels, those levels are dictated by the charts. The charts show you where support is and my top priority is selling puts into a level of support. My focus is taking the calls that they’re buying in size and then selling puts far lower to get money to pay for those calls higher. That way even if they’re wrong, you simply end up buying a quality name lower. I would say that is my speciality and what makes me unique in a sea of people writing discussing options. I actually have a strategy that isn’t simply go long. People always say things like why would you share your process. I say why not?It’s a system, it applies to any name, it’s not like me sharing my system ruins some monopoly I have on options. It just helps people understand how to approach trading with a sophisticated approach to capital outlay. If I explain how to use risk reversals, ratios, another complex trades to maximize returns while reducing risk it has no negative correlation to my ability to profit in the market. This whole substack is simply my notes and process on how to navigate what we’re seeing.

What about balance sheets? I’ve been told by many I don’t do enough deep dives. I’ve joked before that I don’t care about fundamentals and it’s true. I’m trading directionally, I’m not Warren Buffett holding for the next 30 years. You can do that with 90% of names and it works because stocks mostly do go up. My first boss used to say “Just buy what they’re buying”. I try to do that. Too many think the market cares about their opinions, it doesn’t. People write these 10,000 word deep dives and think they’re really going to make an impact. How many deep dives have you seen on TSLA,BABA,SNOW, etc over the last few years and those stocks have gone nowhere. The story doesn’t matter, the IRR doesn’t matter, the balance sheet doesn’t matter, all that matters is the question of “ Is somebody with more money than me buying it”. If they are you’ll see the buying in the chart. If you don’t, then sorry, nobody cares about your stock.

What people don’t understand at home is very rarely will you see a name go up without serious accumulation in the calls beforehand. That’s only visible through option flow and charts showing accumulation. By the time that 13-f comes out and fintwit talks about super investors moves, that is months behind. Big money is scaling into names long before they move. Look at NVDA that’s been one of if not the top trend all year in the database starting below $500 in January months before it was a $1200 stock. The move up is nuts, but it’s not like it really came out of nowhere. They were loading calls over and over. If you look at my post from last May where I went all in Amazon leaps, I saw something special, look below. The option flow was all lining up and you see how the MACD on the monthly was inflecting positive, that’s the exact month I entered. I see so many say the MACD is irrelevant, don’t listen to them. On a longer term trade it is very relevant and my entry coincided with a big bullish turn there and it ended up leading to a 60% move in 12 months.

I’ve actually managed money for a living and I understand how computers do most of the trading and why you have to think like one if you’re going to succeed. I also know how these big options trades come together and why they’re important. If you’ve never worked in the space you have no idea the amount of work that goes into these trades you see. The meetings, the strategy sessions, the time involved, you can’t comprehend it. You have a portfolio manager who meets with analysts and traders to discuss the thesis. What are the price targets from the analysts and what are the levels of note from the traders. These trades aren’t 1 human making a decision, they’re a collaboration of a team of intelligent people deciding how to deploy millions of dollars and the final product is what you see in my table. That is just the end result of all the hard work of multiple teams translated into 1 dataset. I then try to structure trades in a different manner. What is the point of “options” if it isn’t to give you the option of profiting when you’re wrong? Think about the above. We’ve all heard the saying “ Follow The Money”. That’s all we’re doing here. We are stock market investors. If big money makes bets, I simply want to take note.

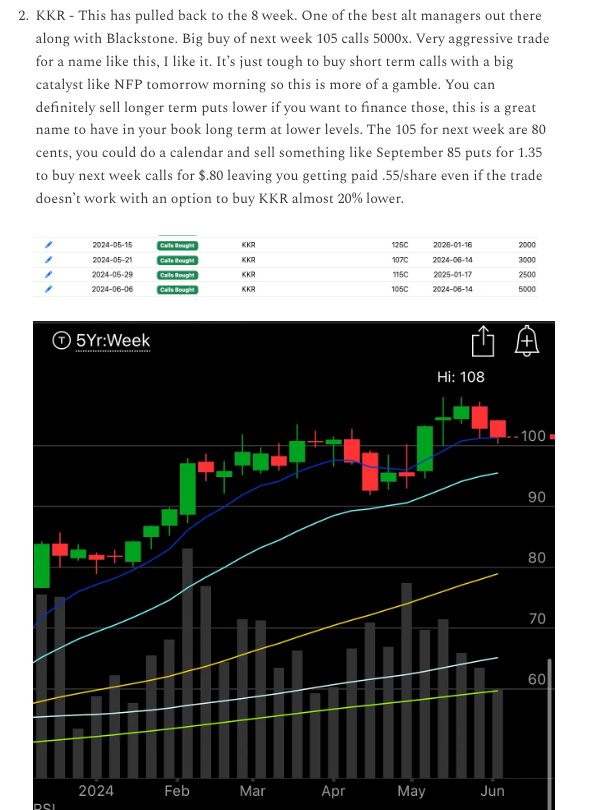

Is this alot of information and work daily, yes. Making money is not easy. Why is it so important to look at this daily and see all the new information? Markets move quick, hour to hour really. Getting data from the CBOE daily on what big blocks of trades go off is following big money, not finding out months later who added what without a specific date. Think about something like KKR yesterday. It was up 10% afterhours, I highlighted tha in the recap 2 days ago. Someone bought 5000 calls for next week at 105, that’s 500,000 shares and it was out of the money on a name that doesn’t really move quickly. Something was up, sure enough today it got S&P inclusion and rocketed to 106+ after hours from 97.xx at the close. That trade is going to be a few hundred percent monday. Someone always knows and that someone, they usually play it in the options market.

The reality is that this is a dirty game and I’m honest about how dirty it is. Actually sometimes it’s so bad all you can do is laugh. I just try to level the playing field to where people at home can see this dirtiness and make informed decisions. For some it has been lifechanging, I get your emails and I’m happy you’ve improved your trading. For those who aren’t getting the results they seek from this, I implore you to join the community discord, there are so many brilliant people for you to watch and learn from. The link is in the welcome email when you paid. Just get in there and ask questions, nobody is going to bite you, we all started somewhere. I’m biased but I can’t think of another subscription where you can generate this much alpha for under $4/day. I mean really if you cannot return 100% at least on what you spend to access this, then you are in the wrong game, no offense. Really, even if you swing a few shares in the right direction on 1 trade a week because of option flow I highlight you should be able to make $100 back.

Wrapping this up, this whole experience has been incredible. I’m 2 years into this project and what went from me just tweeting memes and charts has turned into a very big thing. I could never have imagined building a community of this size around my daily notes and if I wasn’t putting out valuable content, most of you would have left by now. So I feel validated in what I’m doing.

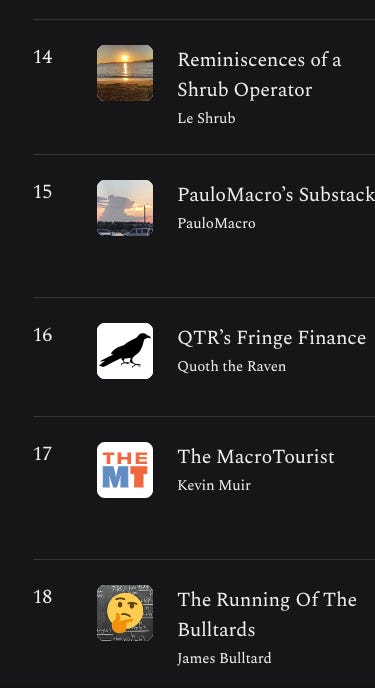

This is now the 18th largest Substack in the finance niche in terms of revenue. I barely have 8,000 followers on Twitter, I’m a relative nobody in this world. Quoth the Raven is 2 spots ahead of me and he has 260,000 followers on Twitter and a massive podcast. This is crazy to me when I think about how many people are here now.

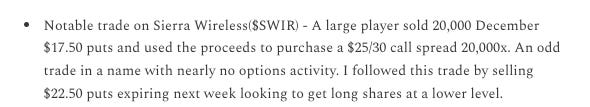

As for my returns, there’s 2 years of archives where I’ve always explained what I’m in in and when I entered and exited. Really look how far this has come from my first post here. That first post had maybe one of the dirtiest trades in market history highlighted as SWIR was acquired 2 months after that insane risk reversal in there. That was the very first trade I highlighted in this whole journey.

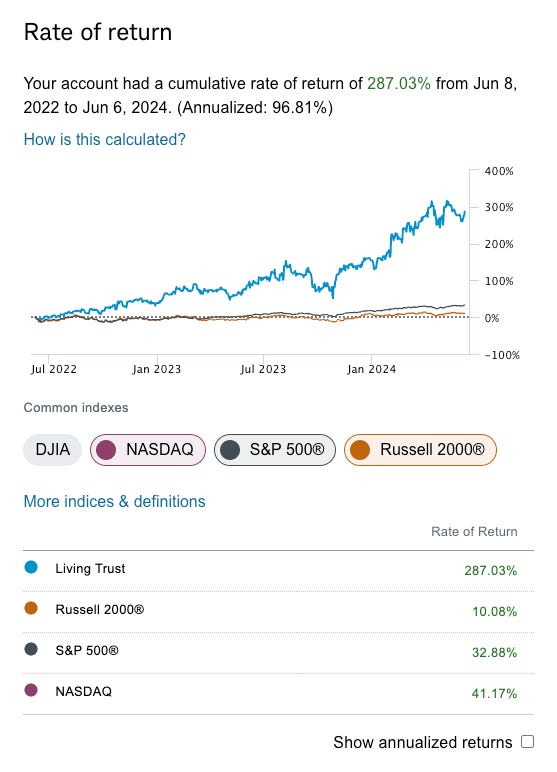

I’m now up 287% from when this substack began while the Nasdaq is up 41%. Again, I wanted to do this because I had my approach and I wanted to document everything I did so nobody could say “prove it”. Here is your proof, 2 years now and outperforming by a mile even during the bear market in 2022. I would say a 7x return vs the best index we have since is proof that maybe this Bulltard guy isn’t nuts and his process of following the flow of money works.

Thanks for trusting me to help guide you in your market journey. If you’ve changed your approach to trading from reading all of these daily, leave me a comment below, I always enjoy reading how you all have improved and grown.

Thanks for everything James; I really appreciate all you do. Cheers to another 2 years worth of returns.

You have made me a better trader/investor. Thank you sir!