2/12 Best Idea For The Week Ahead

We have a big week ahead with CPI on tuesday, that is going to really give the market a firm direction tuesday morning. I expect a pretty substantial move in either direction so tomorrow is your last day to lighten up whatever you want going into that. Please take advantage of it if you’re not keen on the huge swings because we are definitely getting one tuesday morning.

We seemingly have one of these binary events biweekly these days and it’s a dynamic we’ve really never had to encounter before. We’re in the middle of a long battle with inflation and just friday we got the news that the data we got in December was revised and inflation was actually worse than we were told. Mind you this is after the huge rally in equities we had because of how inflation cooled.

With that said, let’s look at the chart of the SPY below. The talk going around is inflation will come in hot and equities will plunge. While that is possible, I want to point out that for the moment while we are below the 8/10 EMA, the market remains broken out and actually it could be debated that we are forming a bull flag right now in the channel I drew. As long as we remain over that downtrend line, we remain broken out, so keep an open mind, anything can happen tuesday, we’ve already changed the defintion of a recession countless times this year. If we breakout I would target 430 on the upside and if we breakdown I would target the 380 level as a place to look for a floor with all that support. The MACD does look set to go negative tomorrow which would be a counterpoint to the bullish structure.

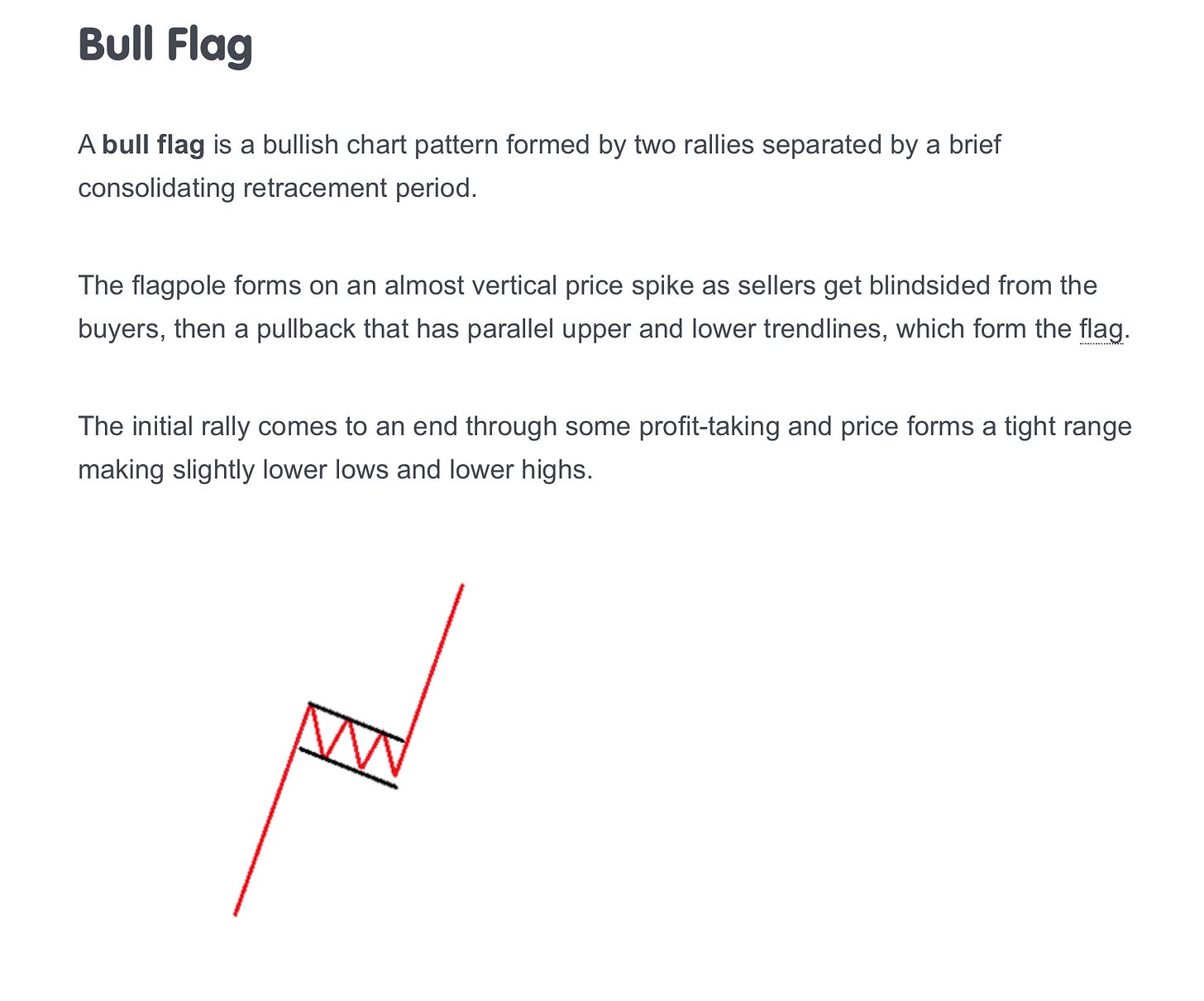

For those who don’t know what a bull flag is read this and look at the chart above. Going into such an event technicals really do not matter as the data is going to change it all, but I wouldn’t exactly say we’re bearish even after the pullback the last few days.

My Best Trade Idea

What caught my eye with this name in particular is the huge amount of put selling the last couple weeks. With all the unusual trades I post, calls and puts can many times be hedges, but put sales never are, and this name has had countless huge put sales recently marking a level institutions are willing to go long in size at, but if you look the dates aren’t anytime soon, so if you want to play this, remember they are trying to get in lower, so please don’t just jump in long shares tomorrow.