2/13 Recap

We got a big down on a hot CPI print. The NQ is slammed down 300 right now. We opened below the 8 ema on the SPY for the first time in a month. 490 is the 21 ema and I suspect we will test that very soon, what we do there will tell us more about where we stand. Do we break it and go lower? Do we bounce? I don’t know from now but I know I mentioned yesterday the price action was just odd, I had never noted so many calls before I couldn’t even post it because there were so many, just felt like euphoria. Then some really hot stocks were sending major warning signals. ARM went up 100% in 3 days and is down 20% today to $120 after going up 30% over $160 yesterday. The VIX was also rising yesterday with stocks green early which was a warning sign. The VIX is up another 7% today to nearly 15 still very low historically but it has heated up in the last 48 hours.

We came into 2024 with the thesis of 7 rate cuts and that just isn’t going to happen now. Inflation is still an issue and we’re back to rates higher for longer being on the table. Higher rates are a good thing. All these junk stocks that have rallied are back to being discarded with the IWM down over 3% today. Now the trade of 2023 which was megacaps is back on the table. If you are concerned about a short term pullback after the run we’ve had, you can start to sell covered calls vs your positions and capture some weakness if it comes while not taking on the big tax obligation of selling the position.

Look diversification is something I get everyone wants to feel safe but the reality is outside of these 6 big megacaps that are all over $1T in valuation, the majority of these companies that comprise our market are just very iffy in terms of growth and profits. Those 6 are just making so much money it is very hard to find issue with any of them and now with rates staying elevated those 6 names continuing to add cash in huge quantities to the balance sheet weekly just seems like the only trade we’ve got, again. I know everyone says those names are crowded now, but I think, if anything, they’re underowned because they’re fully capable of financially engineering shares up for as long as they’re printing money.

A small pullback is normal and healthy, we haven’t broken any key technical levels so far, I will point out when and where we do if it comes. I think going forward you probably want to forget about the “growth” names mostly, there are of course some high quality ones that will do well, and focus on the names making real profits again as the 7 rate cut thesis is off the table now. The fed mandate is controlling inflation and they’d look silly cutting rates into a hot print like today’s.

Yields broke out today, but I’ve been warning that for a while now. That was a clear inverse head and shoulders and there was no weakness. Yields up, stocks down it is that simple. How high will yields go remains to be seen, we have a little resistance here above 43 on the TNX which we are rapidly approaching. Up 10% in 9 sessions is pretty rare for something like the 10 year, but we’re in very uncertain times with constantly changing narratives.

Oil continues to rip higher, over 78 now. This doesn’t help lower inflation. It went straight down for 6 sessions and now straight up for 6 sessions. Biden has his hands full with oil rising and CPI rising. He’s got an election to win in 9 months and he needs to get both lower if he wants to have a shot at winning, voters won’t be fond of high inflation and gas if those are things the next few months.

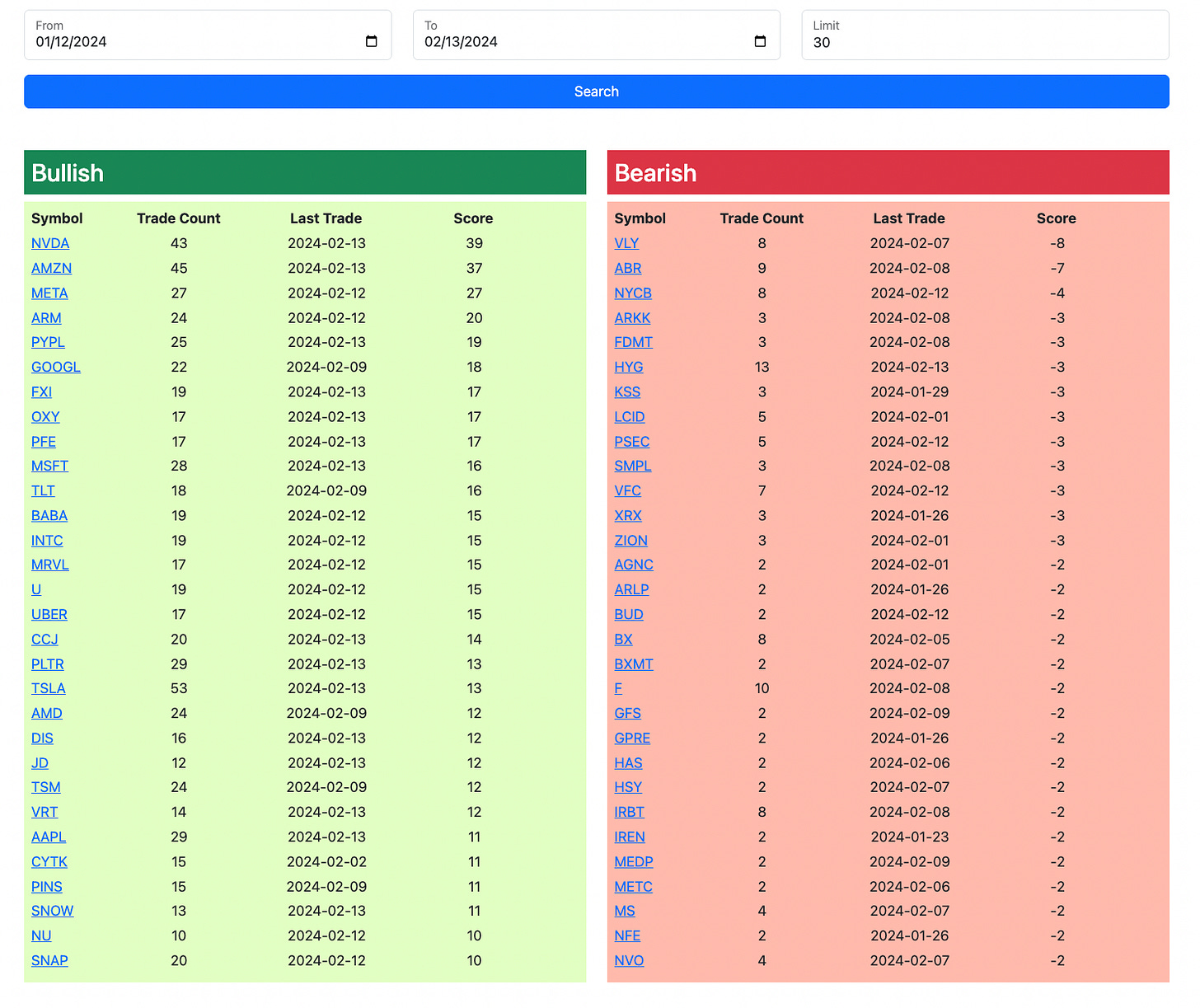

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Today’s link to the database is below, as always it expires tomorrow at the market open for all who aren’t on the live tier. The rest of today’s action will be added to the database by the afternoon. Check there for the updated list and trends.