2/13 Recap

I’m sending this out a little early today, I have a Dr appointment I couldn’t schedule later in the day. The SPY looks good right right now, we’re clear of all the moving averages but have yet to get over that high from 4 sessions ago. Bulls would like to see us push over 608.13 to say we’re finally making progress.

On the other side of things PPI came in really hot this morning, not that this macro stuff ever seems to matter, but ZeroHedge who is notoriously bearish had this chart and you can see the massive upward revision today. We’re always constantly revising things, who knows what the real data is, but it seems the stagflation everyone was worried about the last 2 years is potentially finally here.

Why are equities not reacting poorly? I don’t know, it sort of reminds me of the covid era where everybody saw the videos coming out of China and ignored them until they didn’t. Something is really off here and when will it impact equities, likely soon, and you will see it when the SPY breaks below that 21 ema and you need to slowly begin to take things off. This was a big part of why I removed my AMZN trade yesterday, I could be wrong and we keep going up, but I’d rather be safe than sorry after making that much on the trade. Again aside from all the inflationary data, the US Government is the biggest employer in this country and while everyone is cheering the fat being trimmed, that is a lot of job losses and families who will consume less. The impact won’t be felt right away, but it will be felt, and combined with inflation ramping up again, you have an iceberg ahead. The reality of the matter is this inflation is stickier than the fed hoped and only a recession and/or prolonged decline in equities can put it back into their 2% target if they’re being honest about their dual mandate. Now if they give it up and say 3% is the new 2% then all bets are off. I joked about that many times in the past, but that may just be a real thing now if they don’t want to endure a recession.

Recent Trades

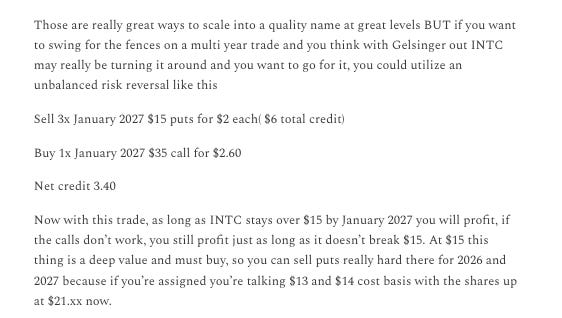

INTC - Back on 1/19 in the weekend best idea post I shared this trade on Intel here. The $15 short puts went from $2 to $1.40 x 3 and the calls went from 2.60 to 3.70 for a total gain of 1.80 + 1.10 or 2.90 on a trade that was placed for a monster credit. Now you can hold this trade till 2027 if you want, but when you’ve made this much in a week as Intel jumped 20% this week, it is prudent to move on in my book.

My Open Book

Here is my open book, I’m a bullish bear, let me coin that term. I’m short all sorts of puts lower, but I’m not too thrilled with where the market is. If we go up, I will make money and if we go down I will hopefully get assigned some names I like at places I like. I closed up my last remaining calls, the SHOP ones we discussed sunday, they were up alot and I kept the short puts. That’s how I’m thinking about things right now. Why? Because there’s always 99 reasons for stocks to go up and rarely is there a case for them to go down. Equities are about the flow of money and the bulk of our market is just passive flows weekly, so up and to the right isn’t a joke. There are however times where people start to sell and if the terms inflation, stagflation, recession start becoming mainstream again, well that is your catalyst for a sell off. I am pretty levered up still, but if you notice it is all on good names at much lower key chart levels. So the leverage doesn’t really scare me.