2/13/26 Recap

The SPY broke the 100 day for a little today but has recovered so far, lots of time left in the session but it is firmly below the 50 day and all the key short term moving averages. This is a downtrend, how shallow or deep it is nobody knows but you need to be taking some things off. This is a time to be more cautious until we are back over the 21 ema overhead. CPI came in cool today and that wasn’t the lifeline many thought it would be for tech stocks, that should tell you alot.

The QQQ bounce today is nothing notable, look how far below the 8 ema(dark blue) it is. The 50 and 100 day aren’t sloping down yet, that’s when things really start to get ugly, so bulls would like to see a bounce sooner than later. I don’t really know what our next catalyst is until NVDA earnings in 2 weeks. We’ve gotten every bit of news out there from strong earnings to cooling inflation and the weakness persists. It reminds me alot of all the fears we’ve seen over the years with Deepseek last year or the GLP-1 drugs and how all the sectors potentially impacted get slammed first without asking questions. I’m sure AI will be a thing, but does that mean everything else automatically is worthless? I certainly don’t think so but that is what the market is starting to price in these last couple weeks.

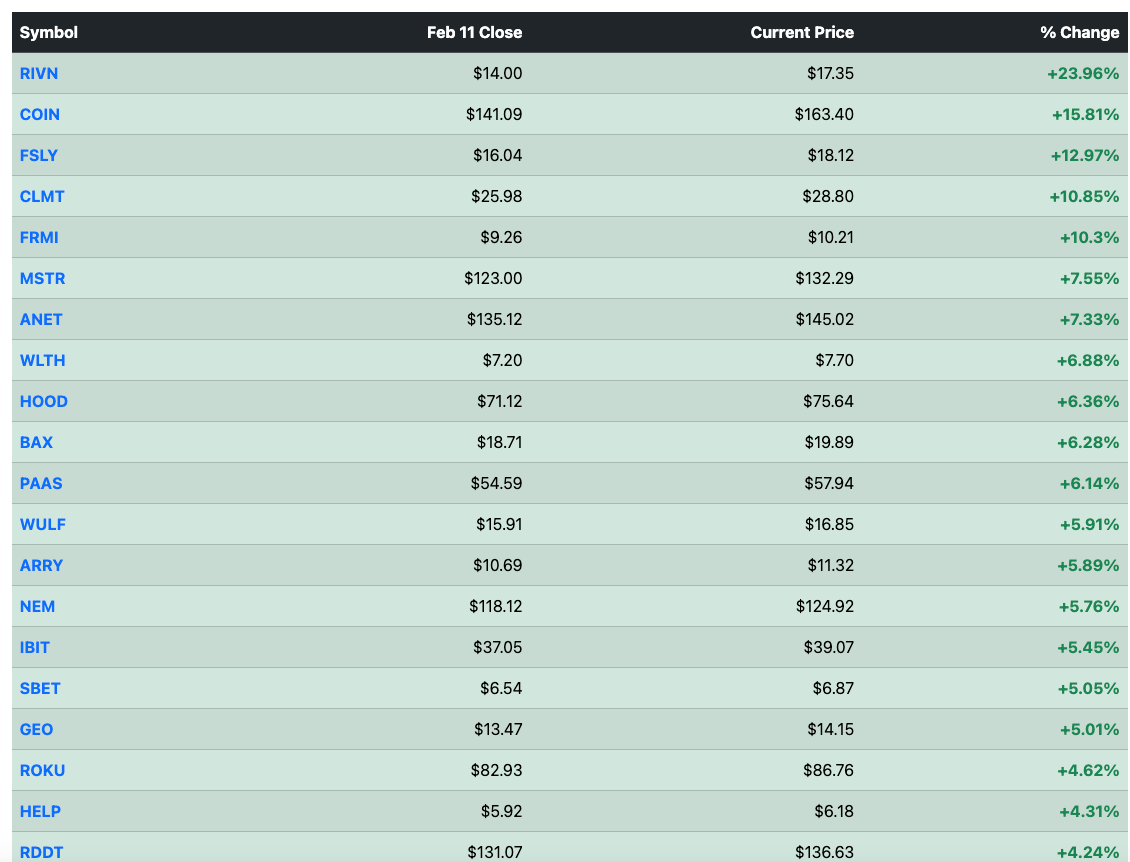

Top Gainers From Yesterdays Recap

My Open Book

Trades I Made Today