2/14 Recap. CPI Happened. The Put Sellers Won

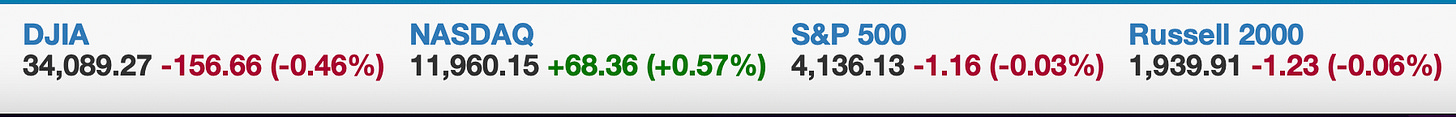

Incredible day, we rallied hard, we crashed hard, and we ended the day flat. Days like today are exactly why I try to stick to the premium selling side of things and I made a bundle today, but I’ll go over that at the bottom. CPI came in hotter than expected at 6.4%, if this was 6 months ago, we would have been down 300 on the NQ, the market is slowly accepting this new reality, it doesn’t have to make sense fundamentally. Could stocks still decline? Sure, a 10% decline puts us flat for the year. At the moment, it’s hard to look at charts and be bearish.

SPY

This chart below is breaking out of the bull flag I mentioned yesterday. It could very well reverse by the end of the week,I don’t know, but for now it’s another green candle, breaking a downtrend and sitting over the 8/10 EMA, there isn’t much to say other than this is quite strong for now. The RSI pointing south is a concern as is the MACD rolling over, but those bearish divergences haven’t played out for now.

IWM

This is notably weaker than SPY with the MACD confirming but it too closed over the 8/10 EMA today and continues to be strong in 2023 as rates are not shocking small caps anymore.

Dollar

The dollar remains in a tight flag, it tested lower but closed over some big moving averages, bulls would like to see this close at 102 or lower, bears would like this to break over 104, either way a big move is coming soon.

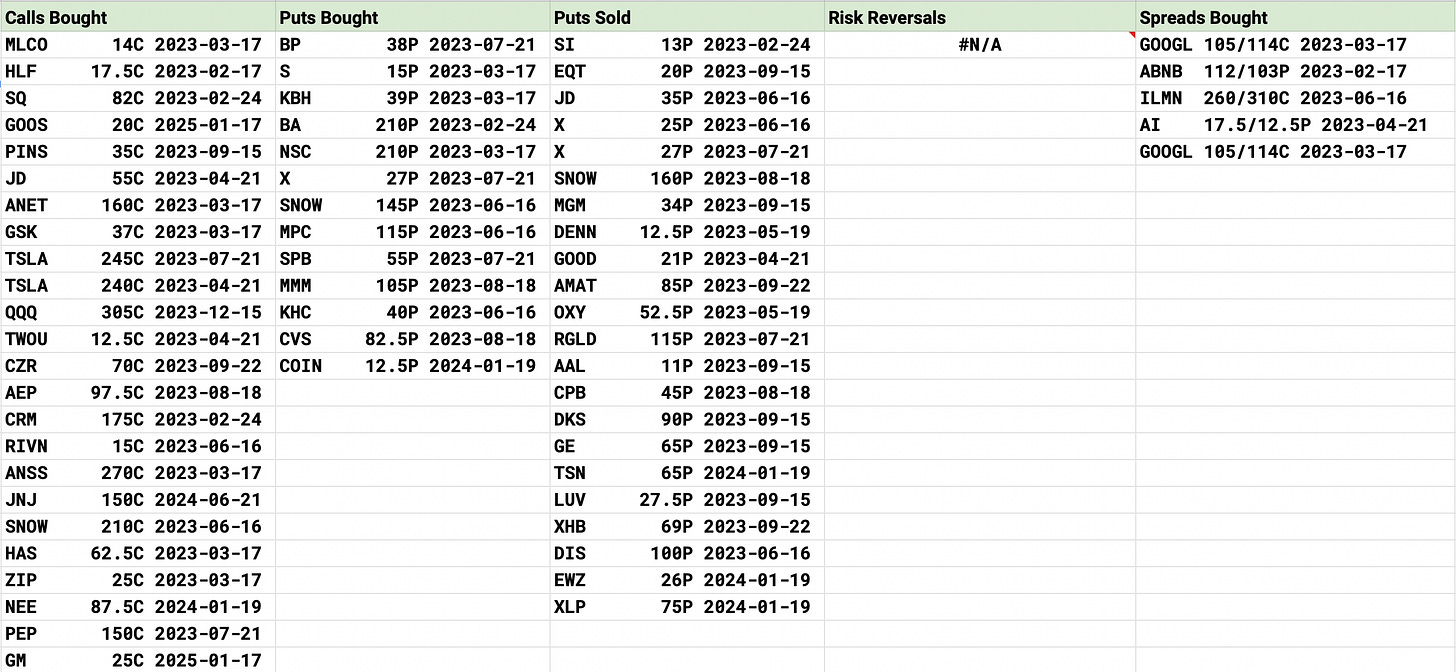

Today’s Unusual Options Activity & What Stood Out

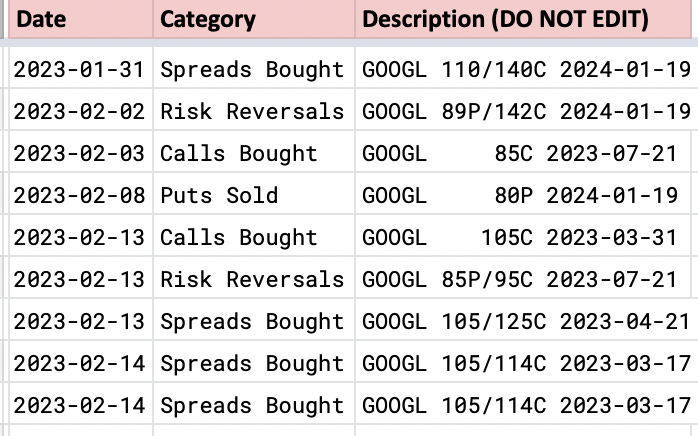

GOOGL they keep going at this name near daily, there were 2 huge trades in the same 105/114 call spread in March today. It put in a nice hammer candle, the chart is still mangled but its not being displaced by ChatGPT, that is silly. Here are all the recent flows I’ve noted

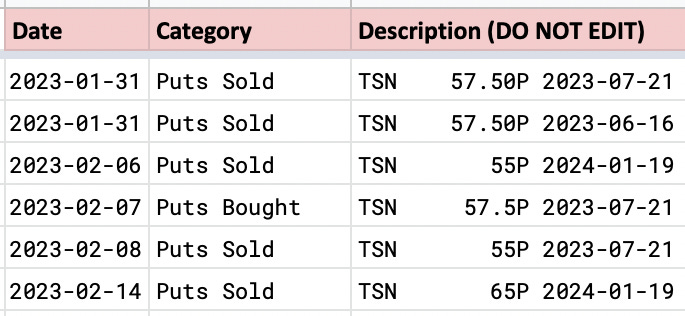

TSN is one I’ve noted multiple recent put sales on, they came back again, today selling in the money 65 puts in January 1000x. Here is all the recent action there, put sales galore.

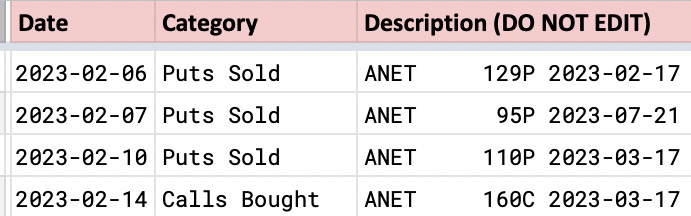

ANET 160 calls in March stood out because over 6000 traded today with the stock at 140. They had a nice quarter and looking through my database, the put sellers were on it for awhile

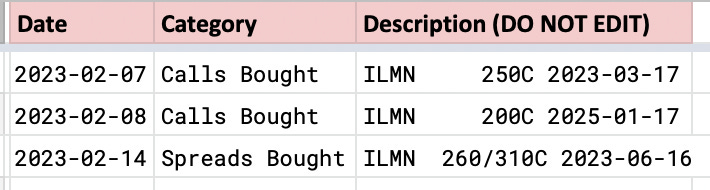

ILMN continues to see all bullish flows today with a large 260/310 call spread bought in June. That is the 3rd large, bullish trade I’ve noted recently, it is currently sitting at 213.xx

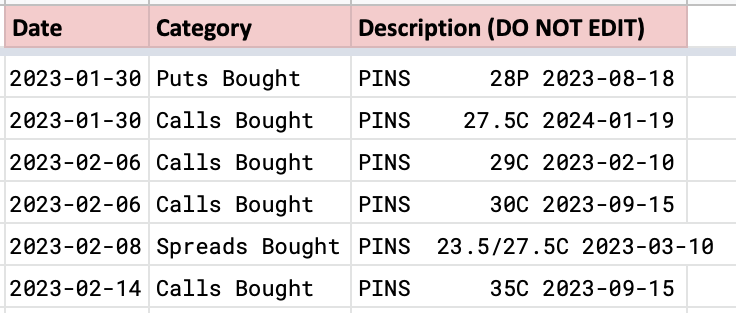

PINS with a very odd lot of 4000 September 35 calls bought, this name has been very weak since earnings, expected, but it’s still holding the large uptrend it has been in since last May. Here is all the recent action I’ve noted on it. It remains a buyout target with Elliott Management involved.

Trade Of The Week Update

PANW wow what a move today up almost 2.5%. That’s why you try to focus on strong charts with options flow backing them for your short term maneuvers. What a beautiful continued move as it lingers over the 200 DMA. It remains incredibly extended but all those put sellers I noted are sitting pretty right now.

What Did I Do?

I outperformed nicely on the move up. I was up 2.2% with the SPX red, the IWM red, and the NQ up .6%. I didn’t place a single trade today. I have a nice chunk of margin rolling off Friday when all my Feb expiry short puts come off, I likely won’t do much till then. Days like today are when the put selling really shines through. Volatility is high, the event is a non event, the premium melts away and you’re left with a large gain vs the market.

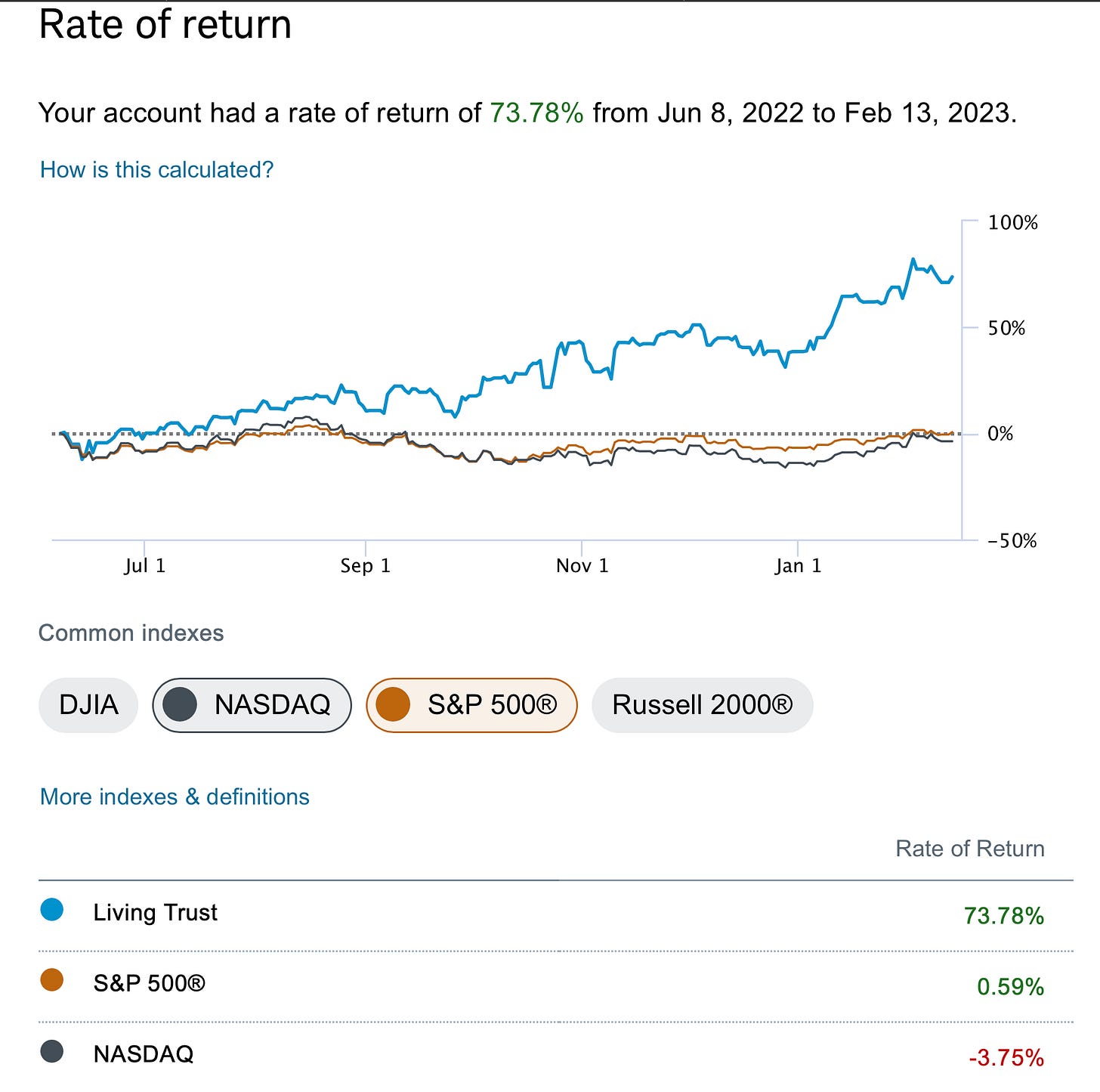

What’s especially amusing is people think the market has been on a tear, I looked back. On June 8th, 2022 when I started this substack, the market was where we are right now, we have done nothing in nearly a year think about that. We closed at 412.64 today and we closed at 411.22 on that day last June.

In that timeframe I’m now up almost 78% vs the Nasdaq and 73% vs the SPX while mostly trading around tech names. See the importance of selling premium, now? When stocks going up, people who sell premium can still outperform by a lot while the rest of the market participants scratch their head about what is going on and why they’ve made nothing.

I hope you all have a great Valentine’s tonight and I will see you back here tomorrow.