2/14/25 Recap

Fairly slow session today, holiday monday so not many people are around. The SPY made new highs today, but it did so on light volume and is stalling out for now. We are looking good now, yesterday was a power move late in the day and we seem to be pushing out of this consolidation we’ve been in for months. Rates are dipping today and hope is on the horizon. Still though the data coming is has to be concerning……

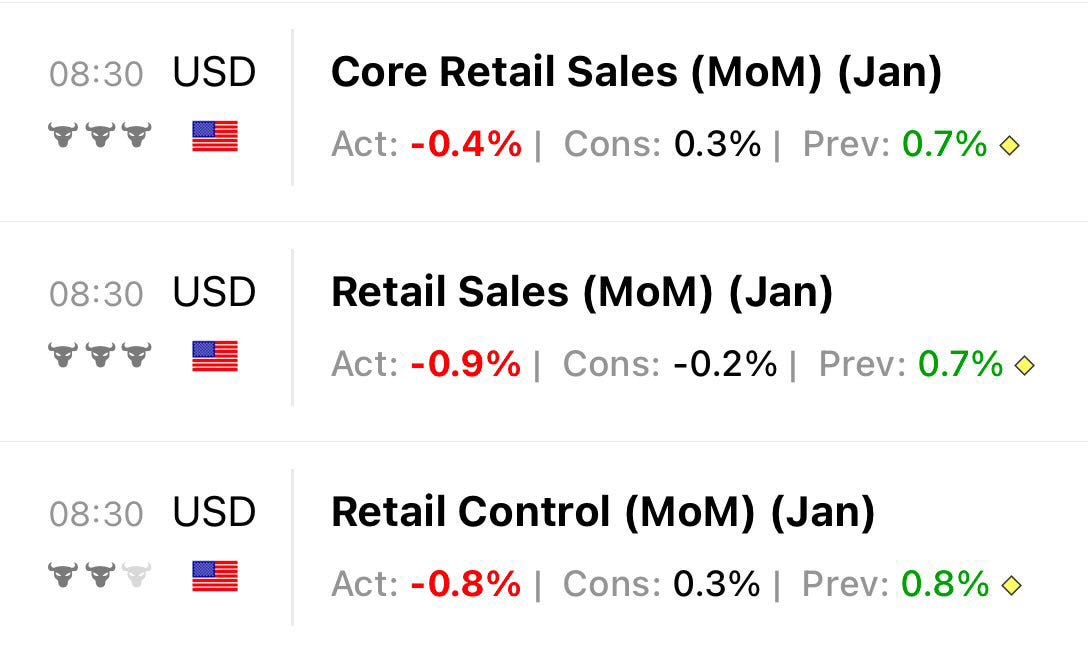

This morning we had some terrible retail data. Some will say it was because of us coming out Christmas but we missed estimates by quite a bit. With all the other data we’re getting recently, this isn’t looking good. Stocks did not care, they never seem to, it always feels like bad news is bullish because then we finally get our rate cuts and good news is bullish because earnings will surprise. That is just silly talk, if rates go lower, it is because we’re in some tough times. We have to wait to see if this was a one off or if next month will be more of the same. This week has been full of bad data and markets just shrugged it off.

Recent Trades

ALB - earlier this week I highlight the ALB put sales that were just massive in the 2/10 recap here I mentioned following it myself and you can see in my book below I had those and they’ve gone from .41 to .08 in less than a week and on a put sale you couldn’t ask for a better move. You can close them if you want, but it has bounced back over 80 and I’m going to wait for the trade to expire hopefully over 60 in weeks.

My Open Book

You’ll notice one new position I took a big stake in today, its more of a defensive trade. I sold some aggressive covered calls on it for next week and hope I’m called away. Either way I will make a good bit of money from the covered calls and I’m putting my cash to use because it isn’t doing anything while I wait around. Let me explain more below.