2/15/25 Best Idea For The Week Ahead

We wrapped up the week with our highest weekly close ever on the SPY. We are entering the twilight zone here in the market. While this is bullish and a sign buyers are stepping up, yesterday was a low volume pre holiday Friday. If this breakout isn’t a false one, we can continue the march higher.

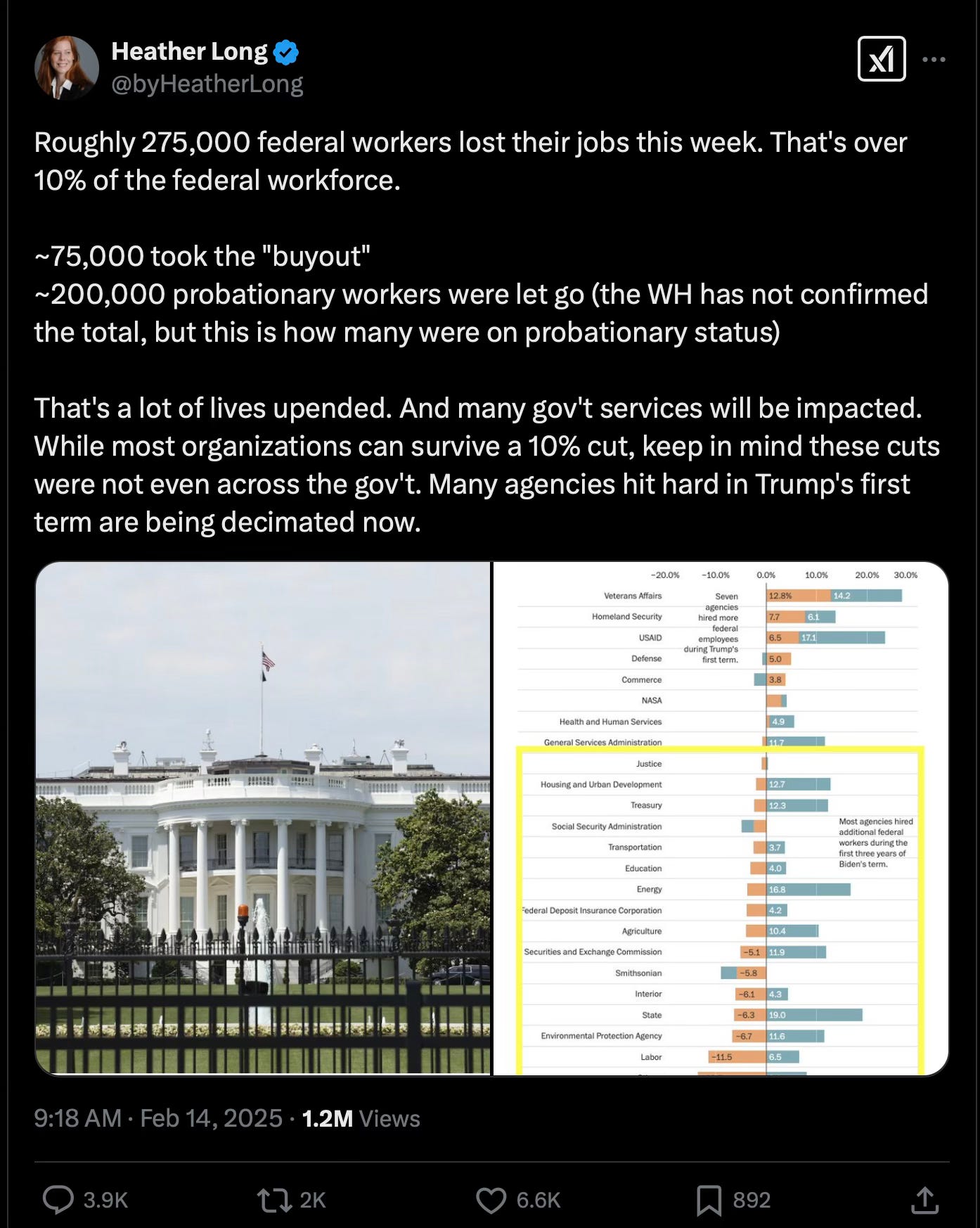

What concerns me and why you saw my TLT position yesterday is multifold. For starters we have this. Massive job losses, combine that with job losses in the private sector. Megacaps are trimming their workforce too with META announcing thousands more job cuts this week. When the biggest employers in the country, the government and megacaps, are firing people, the trickle down will happen. In that case, who is hiring? Fiscal policy is becoming restrictive. Without getting political, what do you think Trump wants? If he does this now, we have a chance of recovery by 2026 mid terms. In my opinion, some pain soon sets the path for what he wants, to cut interest rates, and a big rally the rest of his term.

Then we have this chart, TLT looks like it may be on the cusp of a breakout out of this multi week downtrend. If not, it is rejecting here and heading lower. Any move up over 90 and this bull market in treasuries is set to begin.

Just some stuff to note as markets hit all time highs. It’s a weird dynamic, we have a real life bearish divergence forming: equities are hitting new all time highs as all the economic data is heading south. This is where it is important to remember equities aren’t the economy even though people try to correlate the two. Equities are all about the flow of money, the economy can be turning and you still have capital flowing from all over the world into etf’s in the US that continue buying the same stocks. With how we’re weighted into 7 companies being over 1/3rd of the market, it is very hard to have a big move down. As long as that is going on, the market is permabid. It only starts to turn when something spooks people from continuing their weekly/biweekly/monthly purchase. Even then it usually doesn’t last long as there is so much money on the sidelines constantly waiting to buy this handful of quality assets. So while I sound bearish, I’m really not, whatever happens, we will eventually go higher, but if ever there was a time to be concerned, it would right now these next 30-60 days.

This week’s best idea is another one of my well known swing for the fences risk reversals. I think those of you who’ve been here long enough have seen some major winners in these whether it was Shopify last week, NET a few weeks back going over 100x, or even one like Citi last summer here

That C trade if you were still holding has seen the short puts vaporize and the long call has gone from 2.85 to 11.50 with another 22 months to go but because it was placed for a credit your total ROI was massive.

Yes, I have my concerns about the overall market but remember the thing with these risk reversals is as long as you can place them for a credit, in a spot where you don’t mind going long, who cares what the market does.

With that said, let’s discuss this trade