2/16 Recap

We got a hot PPI print this morning, another sign that our battle with inflation is not over. This was on the heels of a hot CPI print. With every passing datapoint, it seems less likely the fed will begin its cutting phase soon. Estimates have plunged now from 7 cuts to 3 in 2024 and 7 cuts were a big part of why the market had the strong rally that it had. Today is OPEX so there should be a lot of weird moves from here into the close as well. This weekly candle is going to be a interesting finish, for now we’re green this week, again……

Oil hit new recent highs today crossing 79+ for a little and is looking very bullish now. We will have to see what comes in the next few sessions, but stock bulls would like to see oil reverse here and form a double top. Any higher and inflation data going forward is going to get even messier.

Recent Trades

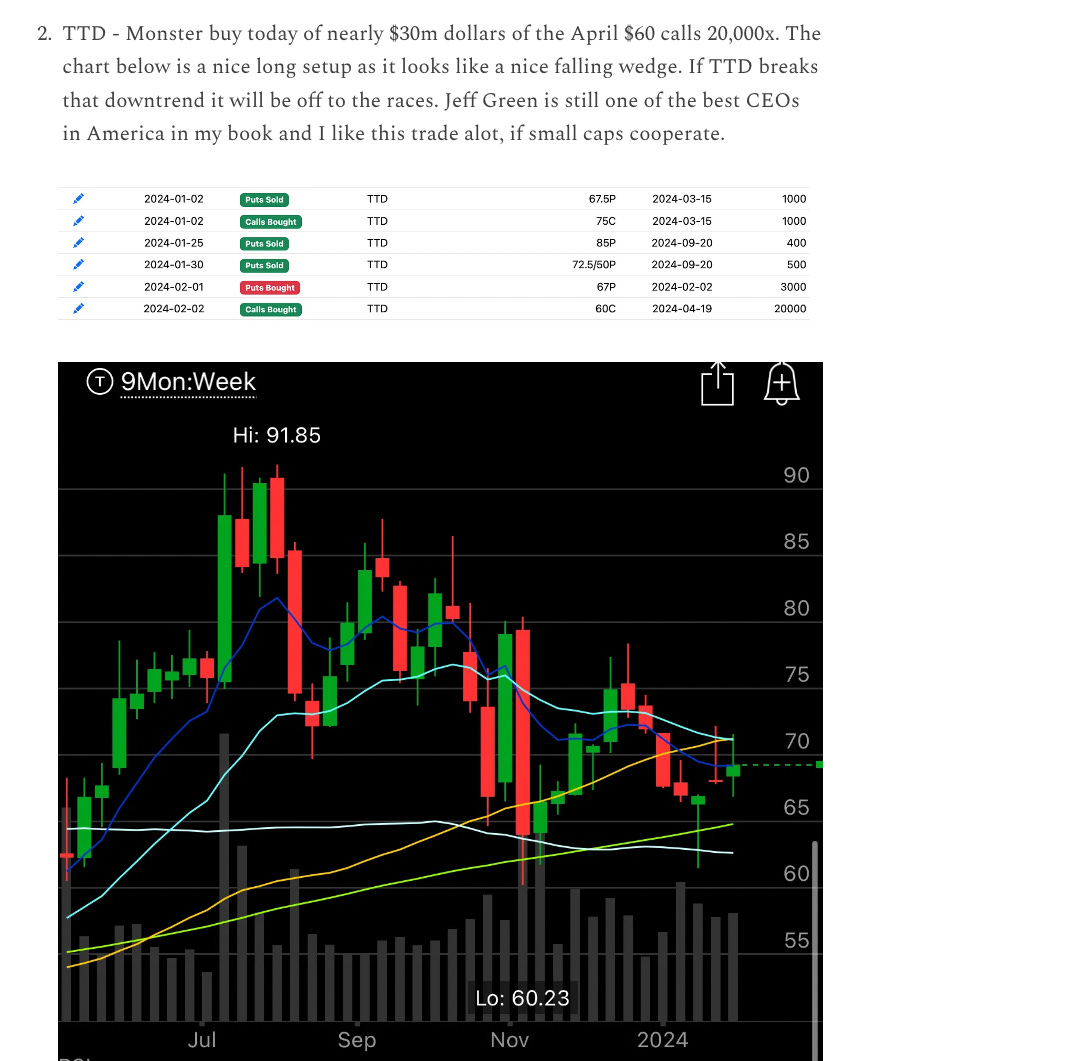

TTD is up over 18.5% today to 89.50 after earnings as I type this. Back in the 2/2 recap I highlighted a monster buy of 20,000 calls on it at $60 for April.

That player cashed those in today at 9:58 am CST. The calls went from $13 the day I posted them to $29.68 netting that player over $30m in profit. Not bad for 2 weeks of work.

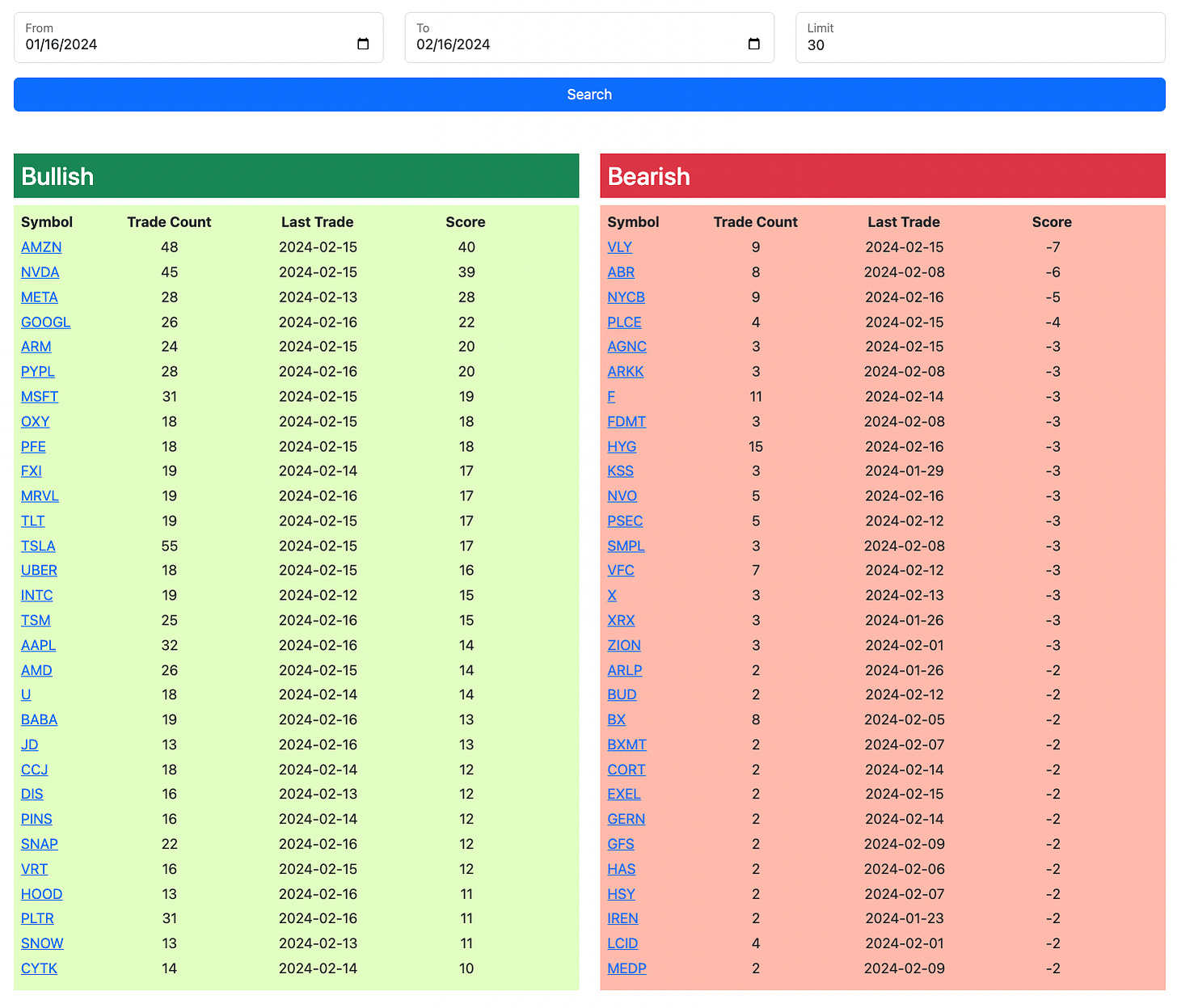

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Below is the link to the database for today, it will be up all weekend and expire monday morning at the market open. I will add the rest of today’s trades in by tomorrow and you can check back and see the updated trends and table.