2/17 Best Idea For The Week Ahead

We closed yesterday with a pretty ugly candle on the SPY. After being up 14 out of 15 weeks, we needed a breather, how long will it last is the question. Now most of the megacaps have reported with only NVDA left on Wednesday this week so for the time being we are mostly out of short term catalysts. Combine that with the hot inflation data we’re seeing and a small pullback seems warranted at this time. We’ve literally gone up in a straight line 20% in 16 weeks. Personally, I would at least like to see a touch of the 8 week as a start, we got close this week but the market was just bought back near the highs.

Also the market sits at overbought levels on a weekly basis, if you zoom out, below, you can see every time we’re overbought like this, a selloff follows. It doesn’t have to be this week, it doesn’t have to be next week, but it should be soon. There is also a nasty bearish divergence unfolding in the charts as well.

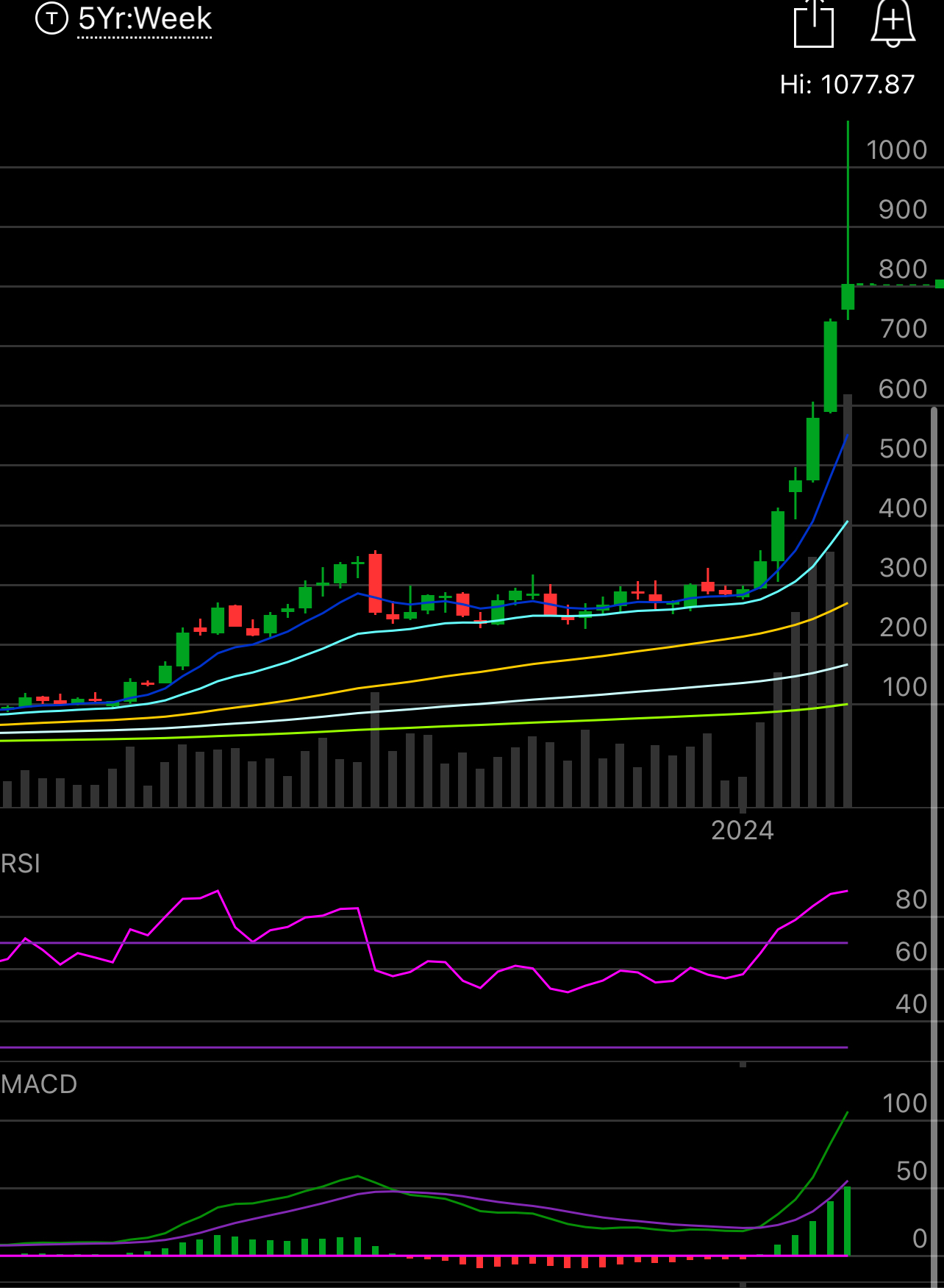

Yesterday we had SMCI completely collapse, and along with NVDA those have been the 2 hottest names in this market. Look at this daily candle below, maybe the worst one I’ve ever seen, SMCI fell nearly $300 from high to low yesterday and put in a massive bearish engulfing candle as it finally touched the 8 ema for the first time in weeks. Is this a warning sign?

But then if you zoom out, even with yesterday’s insane $300 selloff, SMCI closed the week with a green candle, yes it closed higher than it opened the week, that is nuts.

Also you had Apple which I pointed to the other day finally close below the 200 day yesterday for the first time since this entire rally began. The last time it closed below the 200 was right before this all began. Just another warning sign when the 2nd biggest company is breaking down technically.