2/17/26 Recap

The SPY moved below the 100 day for the second straight session and so far it has recovered it. The close today is important because we have not closed under the 100 day in 9 months. So far we have seen a huge reversal today. If we lose that 679.41 level today then we open the door to that 200 day much lower at 650. Bulls would like to see this level hold but just being honest here, 3 tests of the 100 day in 7 sessions is not bullish and more likely than not it soon breaks and goes lower if I had to guess.

The QQQ is still well below the 100 day but alot of its component are outperforming today with AMZN,MSFT trying to carve out a bottom. I don’t want to say its a bottom because we’re not really seeing that capitulation volume or VIX 30 event that usually marks a bottom but this could well be a short term double bottom. That 200 day average right over 580 just feels like where this is headed. You don’t often get near the 200 day like this without touching it.

The MAGS etf is trying hard to reclaim the 200 day by the close as you can see below, this is your mag 7 ETF and it shows you just how weak the biggest names in our market have been with these at the 200 day and the SPY nowhere close.

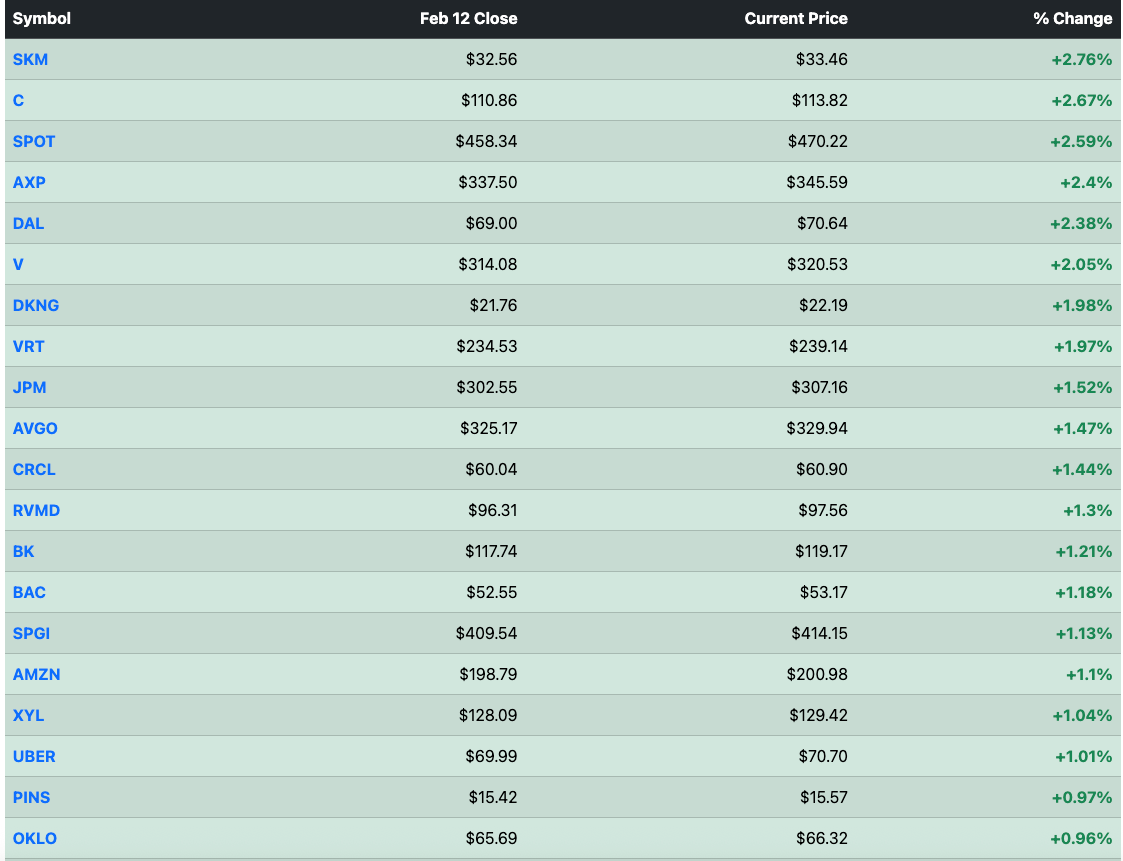

Top Gainers From Friday’s Recap

My Open Book

Trades I Made Today