2/18/25 Recap

The SPY is flagging here over the 8 ema, nothing crazy, it looks good, we’re seeing a rotation to the other names besides the mag 6 which is always healthy to see. As long as we remain over the 21 ema, the light blue line, we’re in an uptrend, the end.

Where should you be concerned? META has been our clear leader all year, this is the first time in a long time it may close below the 8 ema. That is your first warning sign of weakness coming. Now it may very well move up into the close and close over it, but even testing below the 8 ema is a sign of caution if you’re a META bull. Will this be higher in a year, sure, but stocks do go up and down, and you get plenty of warning signs that a name is overheated short term and this is flashing some.

Look at another name like AMZN below, you all I know I closed up my huge call spread last week after over a year. Look at the chart today losing the 50 day for the first time in a very long time. That isn’t bullish and AMZN is an amazing company, a forever stock, but as a trader, ideally you would avoid being in weakness so I closed up the rest of my short puts on AMZN today as well. If you were to play AMZN you’d want to short puts off 195 or so below the 200 day and see if you can steal some shares.

Recent Trades

WGS - I flagged this one 2 weeks ago in the 2/5 recap here. It is flying up 35% today and those June $85 calls went from $12 to $31 today. Great 2 week trade.

My Open Book

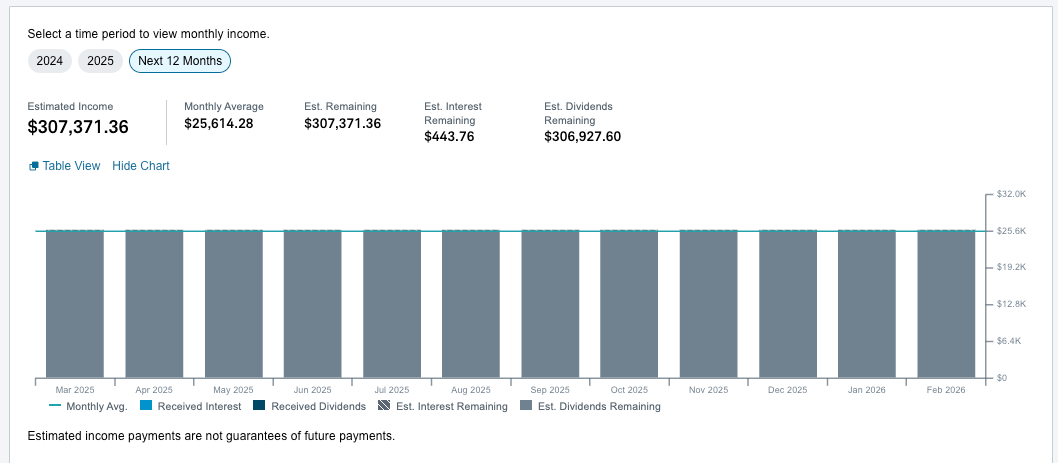

Here is my book right now, you will notice I added alot more TLT and I know what you’re thinking, James is nuts, but those of you who’ve been here long enough know I press my chips when I have a thesis. Here is how I’m thinking about TLT, and again, I want to reiterate, my book isn’t your book and my goals aren’t your goals. So here we go, with this massive TLT position I look at my book this way. YTD I’m up 19%, trouncing the market. I have a ton of short puts which will do well if the market is flat or up, so technically I’m very bullish, just at lower levels. The TLT trade is just me parking my cash and having this instrument that will go up on market weakness, pay me a monthly dividend, and let me sell calls on it weekly. I make money in all sorts of ways holding this thing. This morning I rolled my $90 short calls to 89.50 and will continue selling calls until I’m called away at a profit.

Hypothetically speaking, let’s say TLT keeps going down and I can’t get out, I think downside is maybe $4 to 84.xx, the recent lows and here is my worst case scenario, I end up collecting another $300k in dividends this year from treasuries as I await my short puts to play out while I keep selling covered calls. Not really a horror story or anything. At some point we’re cutting interest rates and TLT will go up, when it happens, we’re likely facing tough times in the market and this is the perfect wait and see trade for me. I’m not out there trying to hit 300% on weeklies though, so I probably have a different objective than you do. This fits my goals and again with that massive gain I cashed in on AMZN and META, let’s say I’m horribly wrong, I can sell this for a loss and offset some gains, but I don’t see that happening anytime soon. maybe if I was stuck till December.

So I am just playing it safe until I feel better about the market, that is all. Here is my open book at the moment.