2/22 Recap

NVDA saves the market. That really shouldn’t shock you in here as that has been by far the top trending name in my database in 2024, they were nonstop with the NVDA calls all year long and it is hitting new highs today. The trend was definitely right. As for the over the overall market, wow. That’s the thing with these uptrends and realizing when you’re in one and when you’re not. Look where we went yesterday at the lows, right up on that 21 ema but we didn’t close below it. It was just a headfake and after the first 2 days this week of weakness, look at today’s move. That is why being short is so difficult and really a frustrating proposition. Everything looks good to be short, all the economic data is terrible and then 1 company like NVDA reports and its off to the race again. That’s why I’ve tried to be level headed this whole rally and as long as the 21 ema is holding, it is an uptrend. It’s crazy, but in 4 months we’ve spent 1-2 days below it. This is an incredible run that we’ve been on and the market is hitting new highs today despite all the inflation warnings we got in the past 2 weeks.

Recent Trades

Lots of good ones today, MRVL from yesterday was up 7% today on nothing other than the NVDA report. RELY was one I highlighted back on 2/2 and it is up 15% today going well over 20, those 6000 April calls were right at 20. Excellent trade by that player.

Another was NICE which I mentioned multiple times starting back on 9/29 last year when the stock was sub 170. It is $250 today up 11% on a nice print. They were loading these risk reversals for months on end starting last summer and targeting February 2024. Since then there have been more in the database including some added today. This is a smaller, underfollowed tech name but the option players were all over it for months.

Trends

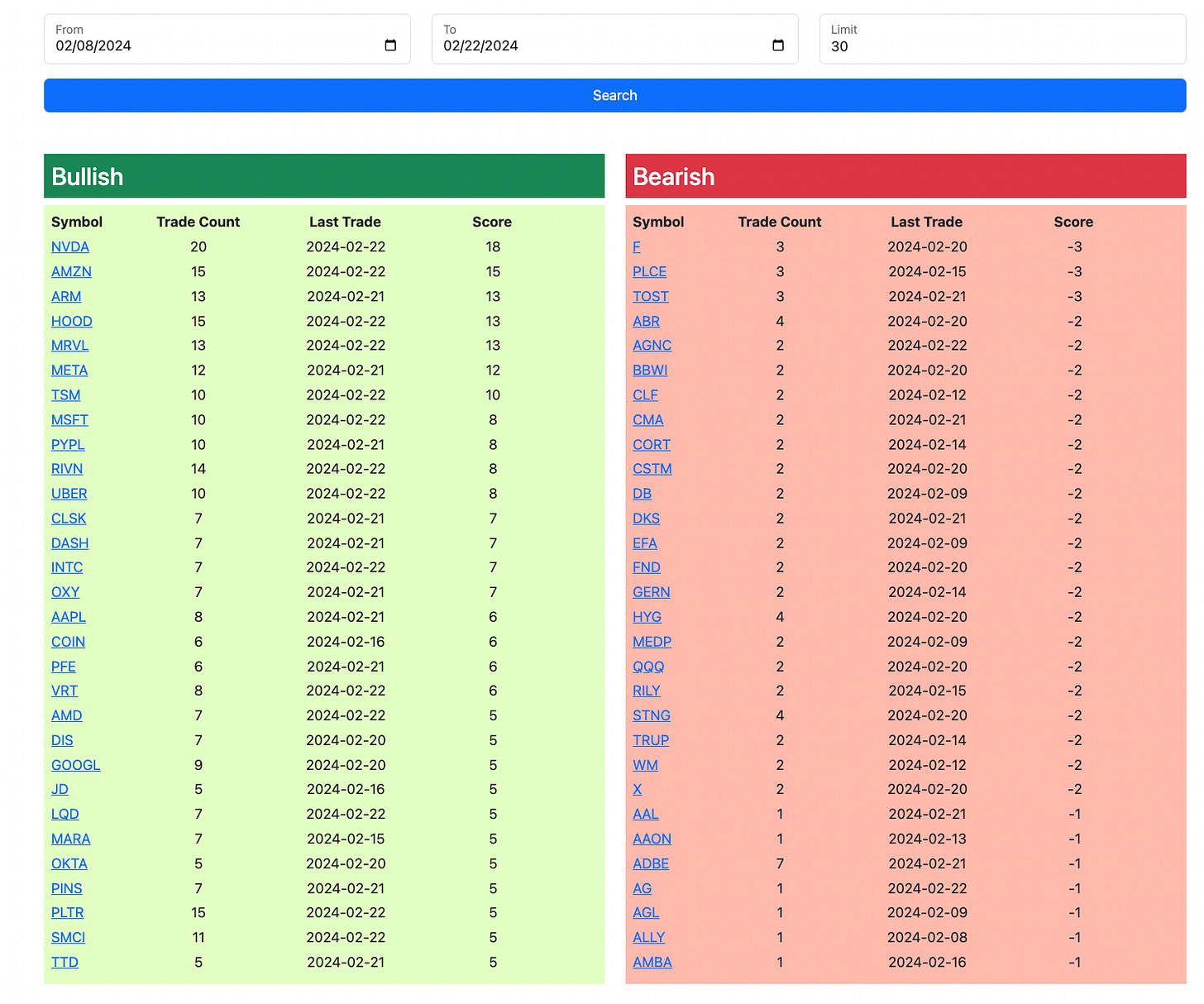

What’s interesting with these trends is look at the year to date and look at how AAPL and TSLA are way near the bottom of the bullish trends and how NVDA META and AMZN are 3 of the top 4. Those have been the 3 best names all year in large caps. The weaker ones haven’t been seeing the heavy call buying. Even look at MRVL over the last 2 weeks they have been all over it and it is flying today. It’s rare to see a name take off without the sharpest money, the option players, being in it beforehand.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire at the market open tomorrow and I will add in the rest of today’s action by tonight. Today was another one of those sessions with way too many call buys for me to post the table in here, but just click the link below and check the daily chart you can view it all much better in there anyways.