2/23/25 Best Idea For The Week Ahead

We closed up last week with a nasty bearish engulfing candle on the SPY that broke the 8 week. The last time we did that was 6 weeks back and the following week was met with a gap down below the 21 week and a huge reversal. The big level to watch now is that 21 ema below just over 590, we have not closed below that on a weekly basis since October 2023, it is now less than 2% away. A close below that in the coming weeks would signal a major trend shift.

The reason I would say this might potentially be a serious turning point is this chart below, the TLT is breaking out this time on the weekly. A breakout here means yields falling but that also means economic weakness that isn’t ideal for equities. Also note the macd is flipping green on the TLT as well, this could be the start of a nice rally in bonds.

Now in these periods of weakness in the market, not everything is selling off, flipping through charts there are always pockets of strength and right now that pocket is consumer staples, XLP, below. Look at that move last week, money is positioning in these defensive names which is another tell the market might be getting a little messy soon and that is with the 2nd largest component in the etf, WMT, getting hit hard last week. The big holdings in this etf are: COST,WMT,PG,KO,PM,PEP,MDLZ,MO.

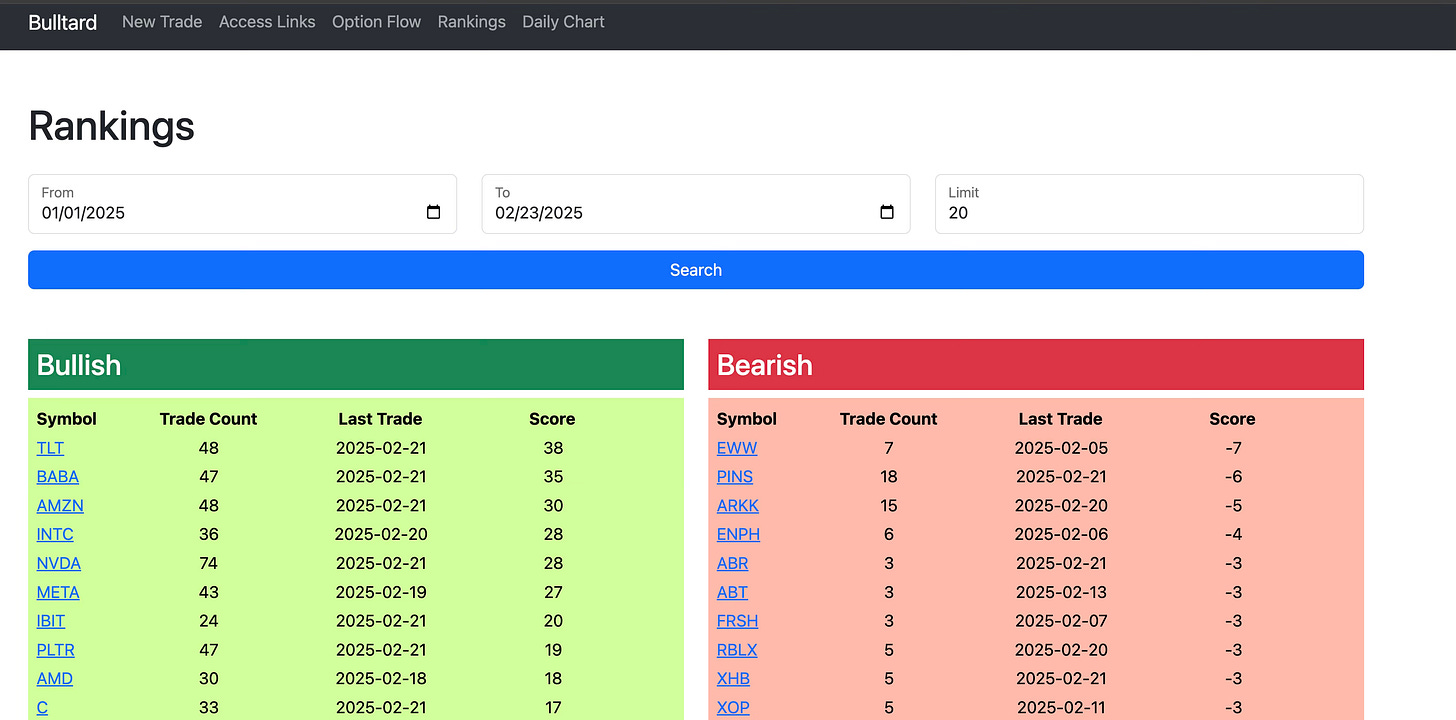

This week’s best idea is going to be different than usual, I usually pull up a name and go over the charts, option flow, and analyst targets, but with what I posted above, I’m going to discuss some potential trade ideas positioning for what I think is coming. I use the rankings tab in my database to look at the names seeing the most action and look at this top 10 list from January 1, 2025. You have a top 10 that includes BABA,INTC,PLTR,C, and META which have been 5 of the best performers this year. To nobody’s surprise, those names saw heavy bullish option flow before the move up.

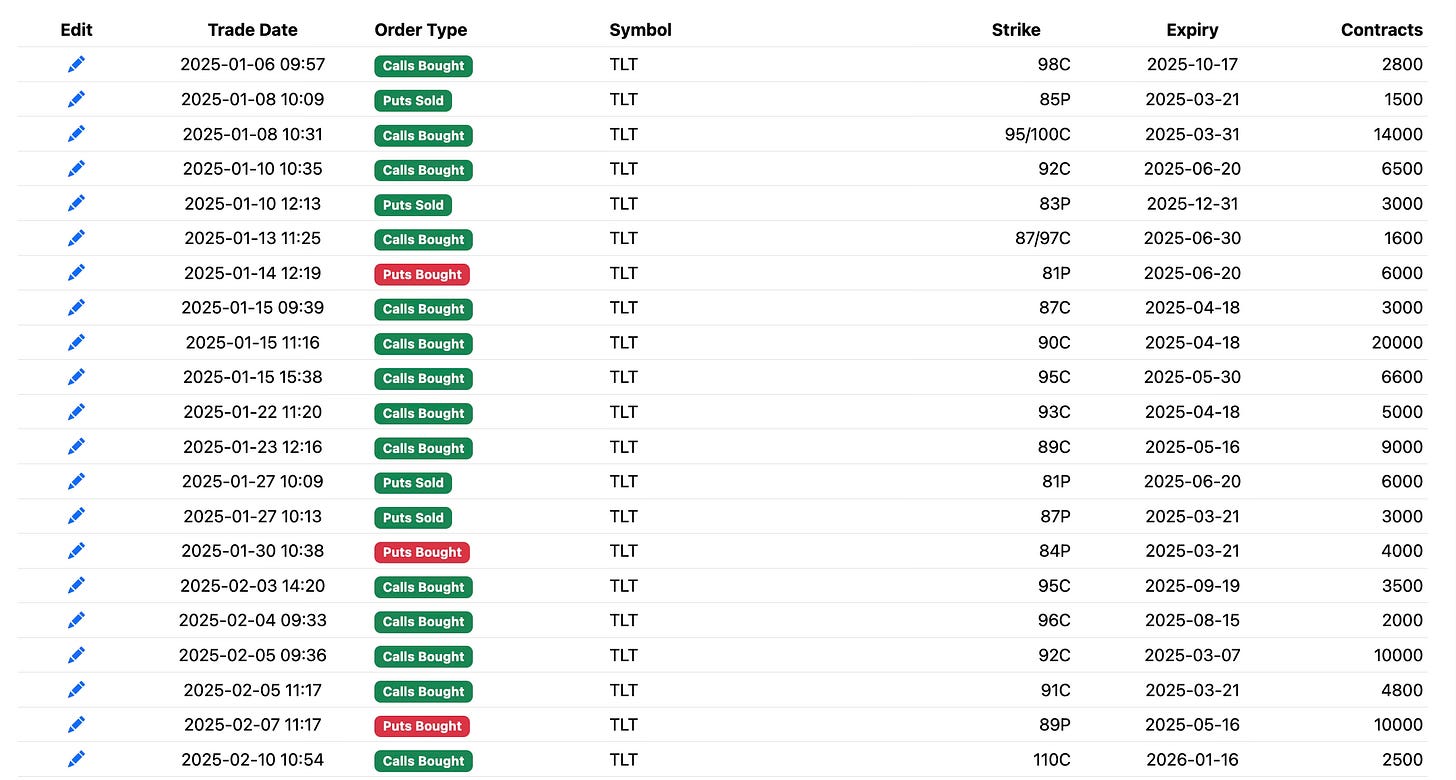

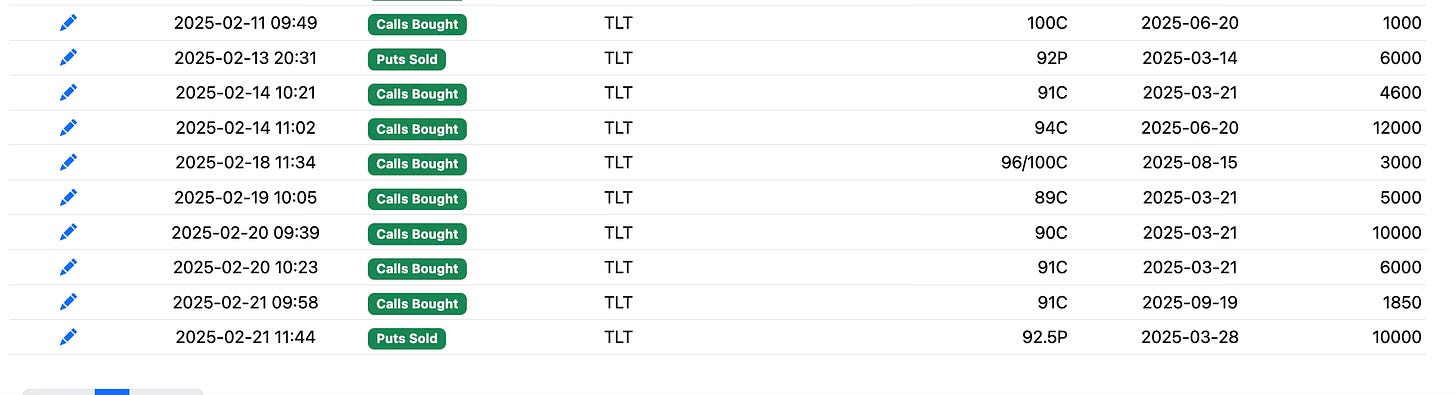

Looking above and seeing TLT be the top trending name all year is interesting, here are all the open sizable trades I’ve logged.

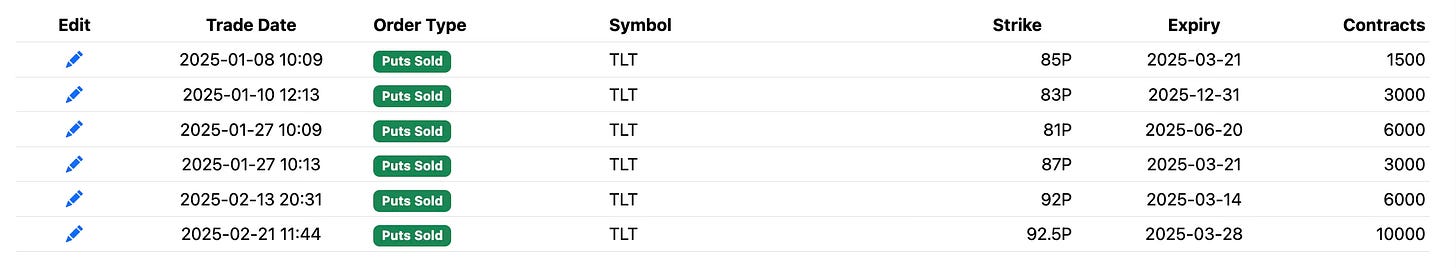

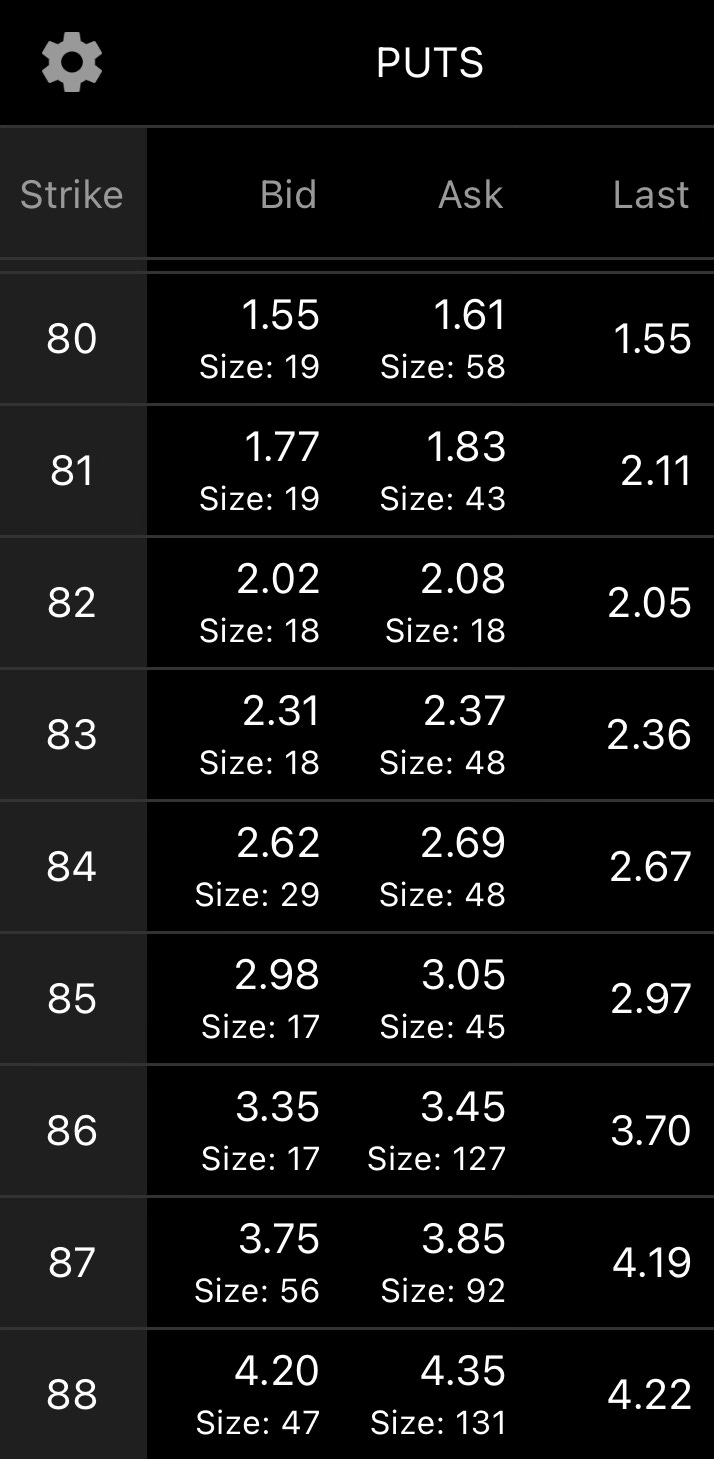

The first part of discovery in any trade is filtering to the put sales to see where the big money is selling puts, in this case lots of put sales in the low 80’s from people not looking for rates to go to 6%. Recently there have been 2 large in the money put sales as well at 92+.

With that in mind now we have to build a trade to a credit. What is the thesis? Lower rates over the rest of the year? Recession? Economic data worsening? Whatever you want the thesis to be is up to you, the weekly breakout I posted at the top is all that interests me. Could that be a false breakout? Absolutely, but that is why you build trades to a credit, in the event you’re wrong, you still walk away with a small profit and/or a buy at a good level. Looking at the daily on TLT you can see an open gap below to just over 85.

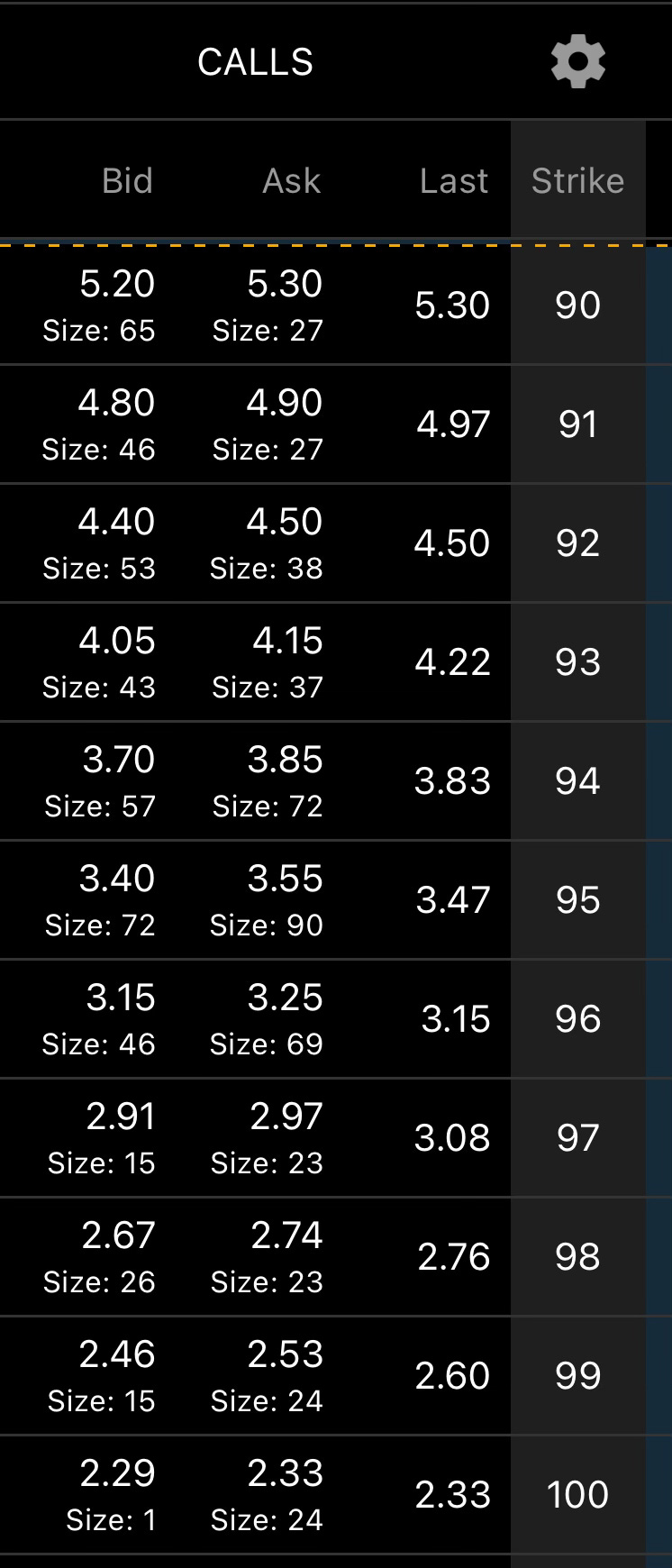

I would suggest giving this trade a long timeframe to work because rates do not move like a small cap, usually. So here are the January 2026 put and call figures

So we have to put on a longer term trade, how aggressive you want to be is up to you.

Shares - You don’t want the leverage, you buy shares and just sell upside calls every week and collect that juicy 4.2% yield as you wait for this to rise. On a weekly basis you go out of the money and collect premiums.

Put sales - you would look somewhere below that gap at 85 and sell puts, January 85 puts can be sold for 3 and put you in at a basis of 82. Unless you think rates are going to be raised by the fed, this should be a fairly smooth trade. You could also sell put spreads if margin is a concern, something like an 85/83 put spread can be sold for .65 risking 1.35 for a near 50% return in 11 months.

I think the best way to place this is through a big risk reversal. I think being conservative you want to look in the low 80’s, and just for the sake of being cautious, I would say the puts at 82, they can be sold for 2.05 a piece giving you a basis below 80 on a worst case scenario. Being put these would mean around a 5% yield on some bonds for your book, great. I would say a 2x1 or 3x1 would be the most prudent trade.

Trade idea 1

Sell 2 Jan 2026 82 puts for 2.05 - 4.10 credit

Buy 1 Jan 2026 96/110 call spread for 2.15

Total credit 1.95

Max over 110 call spread is 14

Trade is not profitable below 81 per share

Trade Idea 2

Sell 3 Jan 2026 82 puts for 2.05 - 6.15 credit

Buy 1 Jan 2026 96/110 call spread for 2.15

Total credit 4

Max over 110 call spread is 14

Trade is not profitable below 80.65 per share

Trade Idea 3

Sell 2 Jan 2026 85 puts for 3 - 6 credit

Buy 2 Jan 2026 100 calls for 2.31 - 4.62 debit

Total credit 1.38

Max profit is unlimited

Trade is not profitable below 83.62

Trade Idea 4

Sell 2 Jan 2027 80 puts for 3.25 - 6.50 credit

Buy 1 Jan 2027 95 call for 6.50

Total outlay - 0

Max profit is unlimited

Trade is not profitable below 80

I threw in a few different options all with the same notion, you don’t mind going long TLT lower because you think rates are being cut over the coming 12+ months. If you don’t want to cap the upside like the first 2 trade ideas I posted, you can just not sell the upside call, I did that to lower your basis.

If you don’t think rates are being cut, you would completely ignore this idea. The point is you can play around with the various numbers and come up with a trade idea of your own, but as long as you can place this for a credit you are in a great position. I myself used commons as you see in my book, that is because I utilize a ton of leverage with all the short puts in my book and I want a conservative play where I can sell calls and collect the monthly dividend if possible. I was called away on a big chunk of my shares Friday afternoon but because it did close at 89.49 after-hours, I was not exercised on around 30% of my original position so depending where we open tomorrow I'll will either add more or sell puts. The other pro to commons this week is next week is the start of the month and owning TLT early in the month gets you that .31+ payout and you can sell a covered call for next week to get a double dip.

Whatever you choose to do, there are countless ways to play this, this is a repeatable process. Step 1 is always filter through option flow in the database to see trending names and combine that with what charts look like they’re breaking out. Then add your trade for a credit around that name and you have quite the edge should that name move up. If that name doesn’t work, great, your puts should be sold at a conservative level where going long isn’t going to be so bad.

Have a good Sunday and I will see you tomorrow morning.

The market dropped because Canada & Mexico tariffs are coming. Isn't that inflationary in itself? Dont understand why TLT held up.

Do you use the standard "14" RSI? Thank you.