2/24/25 Recap

The SPY is green now and putting in a nice hammer so far, we broke below the 50 day(yellow line) and have recovered it. The bad news is we are still below the 21 ema and it looks like we may be seeing a bearish crossover soon where the 8 crosses down through the 21. This market continues to be a huge chopfest and every dip is met with buyers while every pop is met with sellers. We have done nothing in a long time and are in the same spot we were on the SPY back on 11/11/24. I still maintain this is going to be the year of the premium seller and not one for the call buyers who continue to get beaten and bruised by all this whiplash. This week the big data comes this friday with PCE and we have NVDA reporting earnings as well. Tomorrow we also have the potential de-listing of SMCI so lots of exciting events this week. Overall just another insignificant day but the sustained weakness in the Mag 6 names is very notable as money is clearly rotating out and the Nasdaq remains weak.

Recent Trades

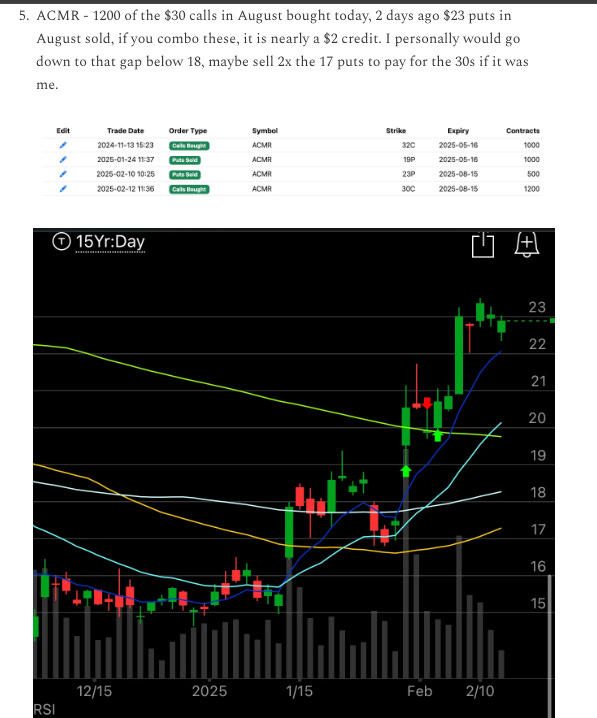

ACMR - In the 2/12 recap here I flagged these trades on ACMR and the stock has reacted nicely still up 6% even after being down 6% today alone. Not many names have done well over the last 10 days but ACMR has been a solid performer. If you have a profit here I’d close it up now, too much uncertainty in the overall market to have calls on a name like this.

My Open Book