2/27 Recap

Nothing really notable today, so far a low volume pullback in the SPY. Still holding the 8 ema, potentially looking for a touch and go. There is no reason to think we have serious downside at the moment. That gap from NVDA earnings is pretty large and these gaps tend to be magnets until they fill. If we don’t hold the 8 ema, I would look for that gap to fill quickly below 500. The crazy thing about this run is it has been so long that the 50 days is now at 485. So you’re talking a small 3-4% pullback and we’re only at the 50 day which should be big support.

Oil is going for its highest close in a long time today and currently breaking out of its range, keep your eye on this if you’re bullish oil names, this could be the start of alot more if it sustains.

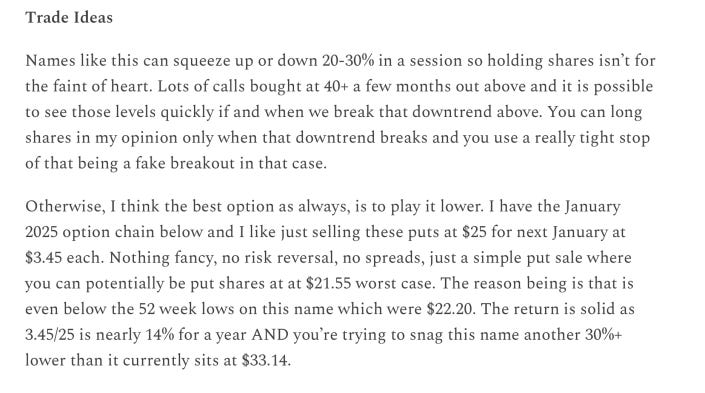

Yesterday Unity had earnings and I know alot of people played it into earnings and it didn’t go well initially dropping to 27 but now bouncing over 31. If you remember a month back when I wrote it up as a best idea, I suggested selling puts much lower at 25 for January 2025. That’s the thing with these names like Unity, they’re good stories, their current financials are terrible, and on earnings they get hit hard 80% of the time. You have to take all this bullish flow and look more at put sales and levels on the chart where the name is buyable. If you sold those 25 puts I mentioned you’re still ok, if you bought short term calls you got hit.

Aside from posting all this data daily, a big thing I want you to take from me is how you think about trades using the data you see. Specifically how to see bullish trades but think about how to use put sales to always enter names lower at key levels.

Recent Trades

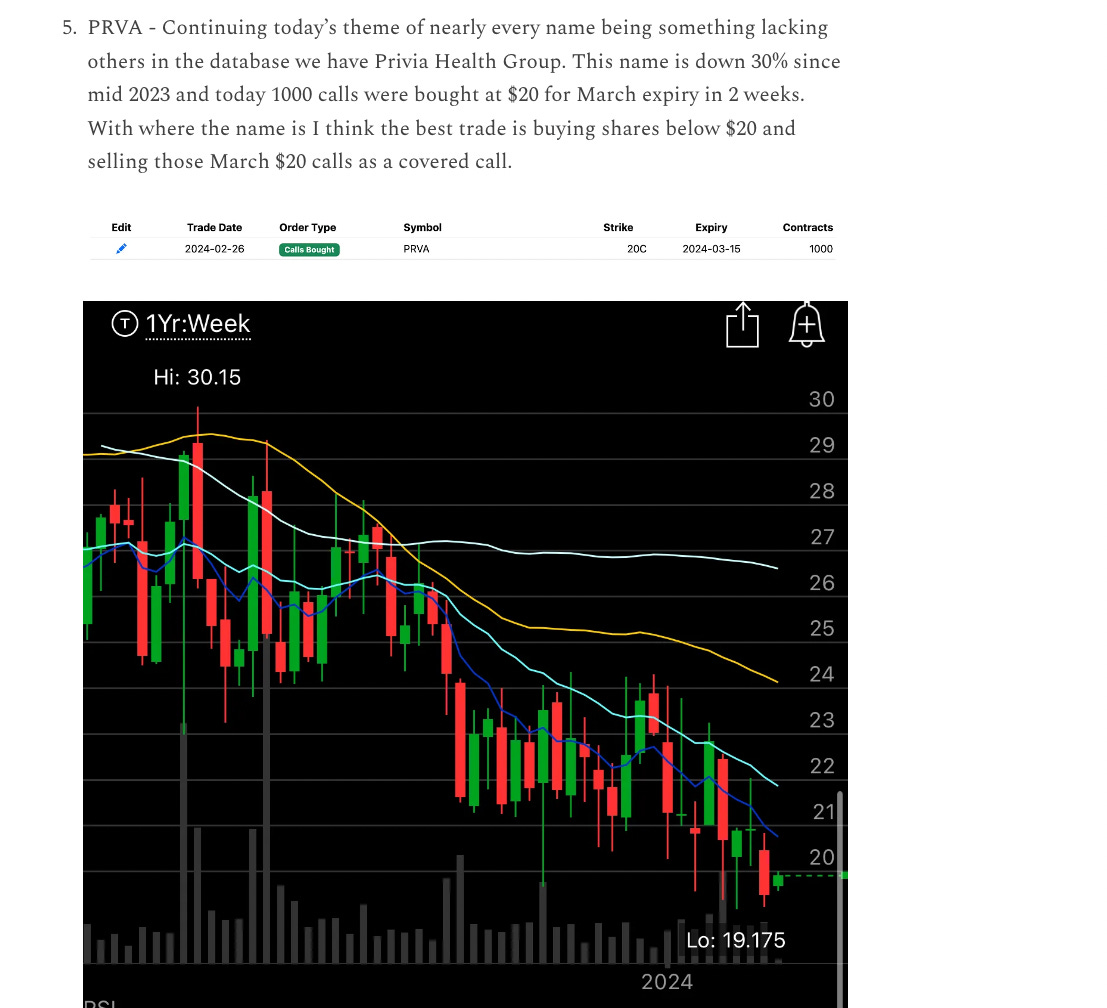

The big story today is VKTX, but first PRVA from yesterday’s recap is up 6% today. Here was a name with nothing in my data, ever, and that call buyer stepped up and sure enough the next day it’s up very nicely.

VKTX was the big story today up 95% right now as I post this. Obviously most of these biotechs fail, that’s not even in question, but for those who like to take risk and play them, this one had nearly all bullish flow since December including a ton of $48 calls bought for March expiry 11 days ago 7000x. That was a huge trade, still though very few trades in the open AI going into today and really impressive move up to $75 today. This is where I’ve told you before if you want to gamble on something like this, taking a stab with 1% of your trading book isn’t going to break you and the potential return could be something like 30x today.

Trends

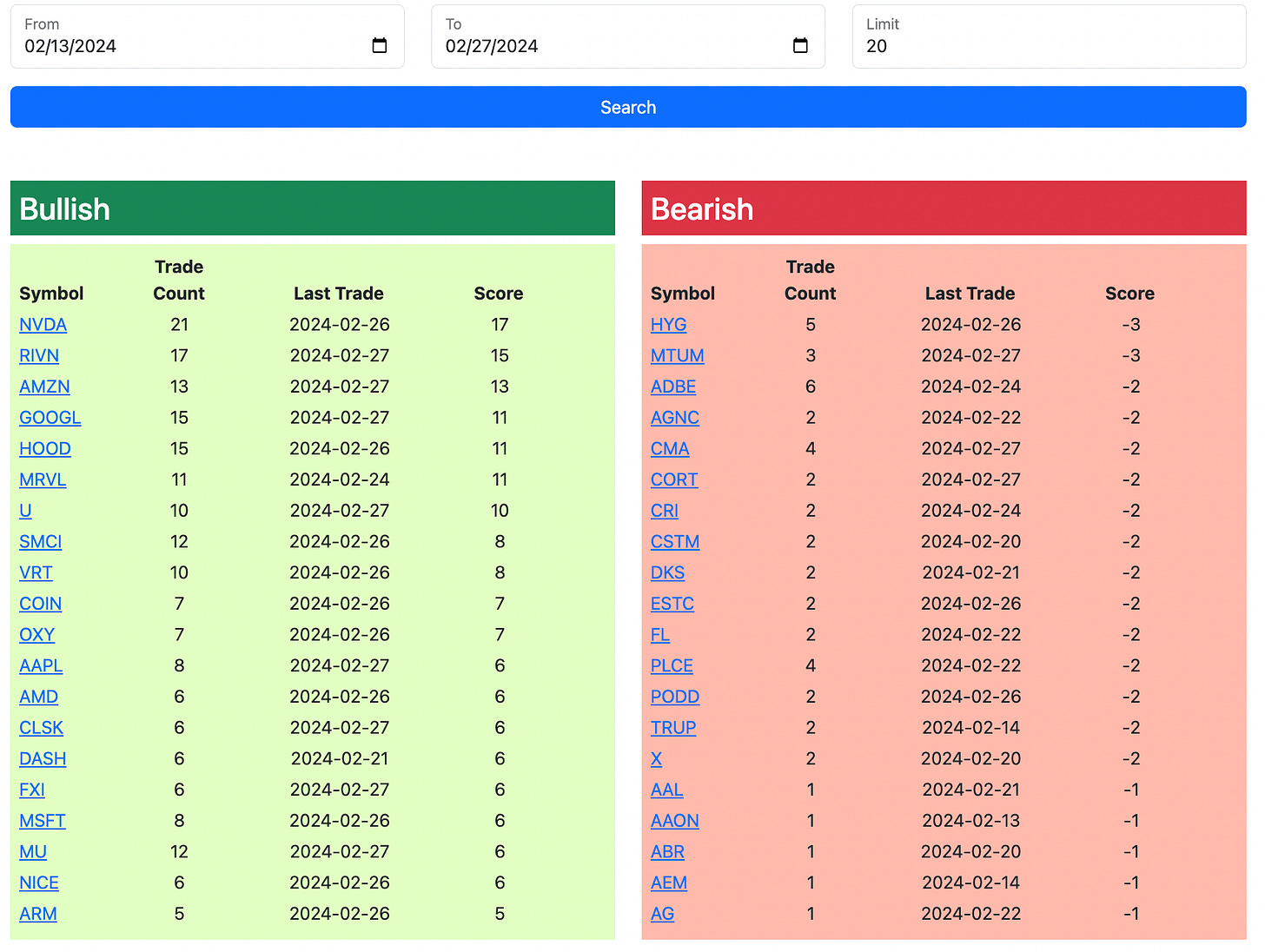

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is the link for the rest of the week. I have a doctors appointment right after I send this out so the rest of the days action will be posted by tonight. So check back there for the rest of the day and updated trends. Again remember just for the rest of this week, the database link is live so you can see the trades right as I post them throughout the mornings.