2/28 Recap

We missed on GDP slightly this morning and tomorrow morning we have inflation PCE data. The NQ is down 155 points right now and all the Big 6 minus AMZN are red. The SPY is in this falling wedge right into the 8 ema, this isn’t a bearish setup, but we do have data tomorrow and that is always a wildcard. This sideways action has us wound up really tight, the 21 EMA is a little over 1% lower a break of that tomorrow and we’ve got an official trend shift should it occur. We could of course do what we’ve done for 5 months now and just rip higher on inflation data and never test that 21 day.

Oil had a big reversal on inventory numbers this morning. It doesn’t want that $80 level, yet. We will have to see what happens here, but for the sake of inflation data not getting out of hand, oil lower would be a good thing.

Trends

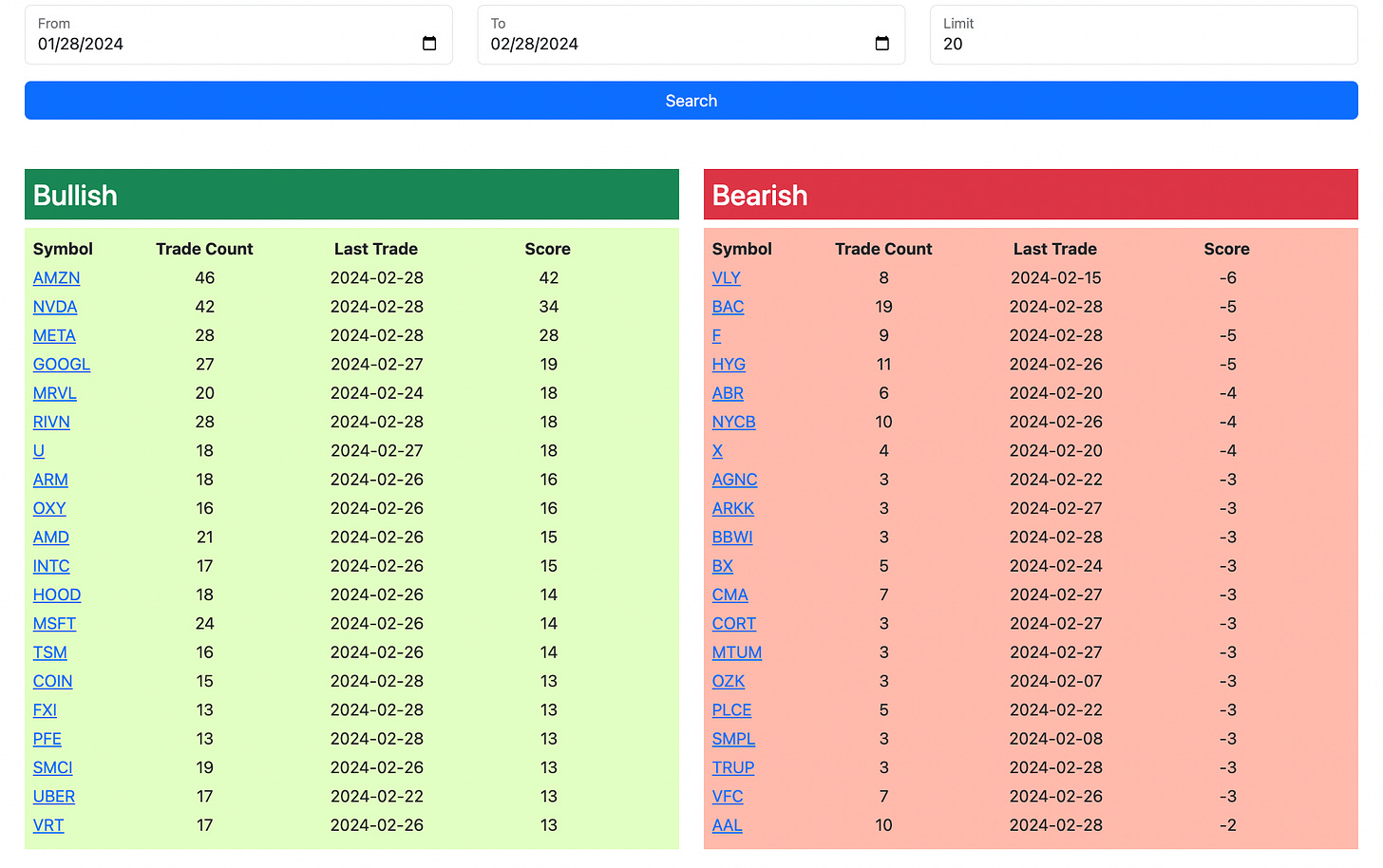

1 Week

2 Week

1 Month

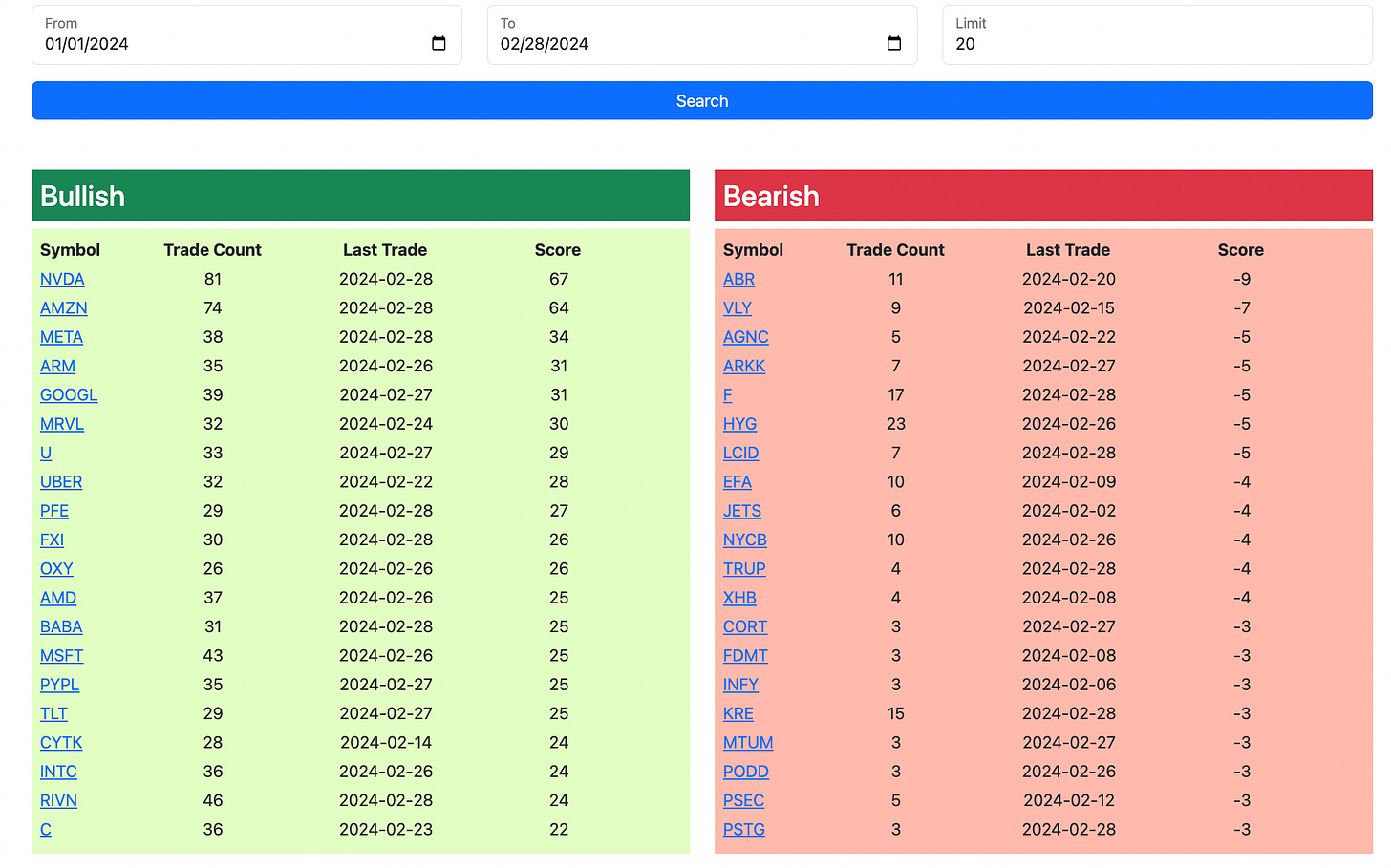

Year To Date

Today’s Unusual Options Activity

Here is the link to the database, I will have the rest of today’s action posted by tonight.