2/29 Recap

We opened up on cooling PCE inflation data. Combined with end of the month buying, so far, we have had a strong session. The SPY refuses to break this 8 ema and recently every dip was supported by the 21 ema, there’s nothing to fight here, this remains firmly an uptrend. The scary part of it is how long we’ve been mostly sideways because as that 21 ema creeps up closer to the 8 ema, one break of it and we will have a trend shift for the first time since this run began in October.

Yields are looking to reverse lower with the TNX putting in a bearish engulfing candle right where it should reverse if you’re a bull on stocks. There is a big open gap just over 40 that would be the target if it wants to move lower but it is still holding right where it should at the 21 ema so tough to say which direction this moves yet. It’s still technically in a bull flag, but today is a big reversal.

Trends

1 Week

2 Week

1 Month

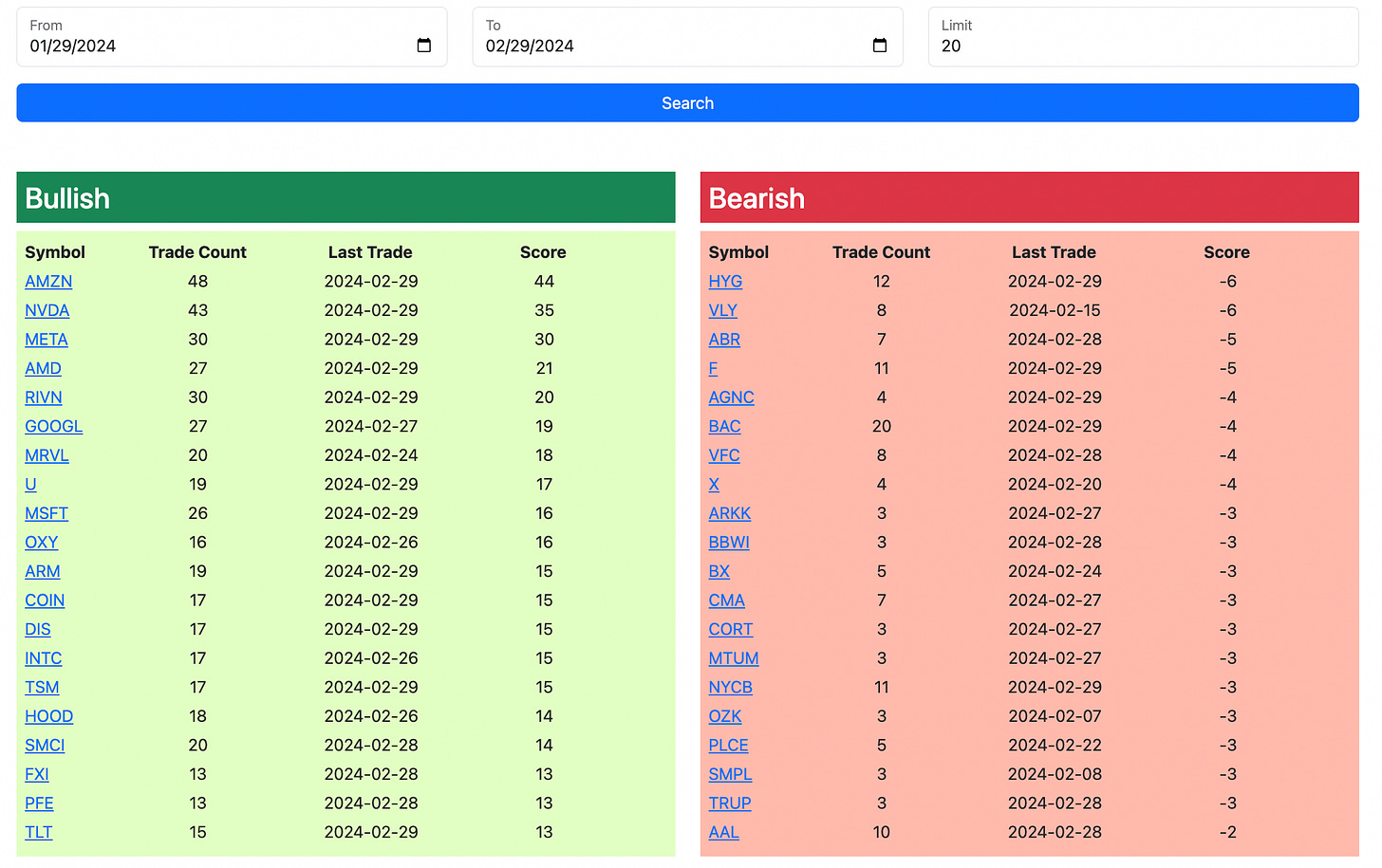

Today’s Unusual Options Activity

Alright everyone, here is the link to the database and as usual, before this week, it expires tomorrow morning at the open. I hope you all enjoyed this 4 day trial of the database being open all day, when I was in the hospital I didn’t have another way to post the link on the weekend from my phone except to use the link I had pinned in the live part. If you enjoyed it and want to join us, come on in there’s a whole live feed and separate chat within the discord with 74 people total. I will have the rest of today’s action posted by the afternoon, so check back in for all that.