2/4/25 Recap

The SPY is back over the 21 ema and stuck right below the 8 ema. Things are looking so so again, but with Trump in office we’re always at the mercy of whatever he says says or tweets at any moment. Will he announce anything regarding Europe? Will he ramp up tariffs on China? I don’t think anyone could say with certainty but you have to take your wins on short term trades where you can because his markets are volatile. We have some pretty sizable earnings today besides Google you have AMD which will readthrough to the semis, SNAP which will read through to all the social media and ad names, along with Chipotle which will give insights on the consumer. Overall we’re ok for now but you have to be cautious of another move back below the 21 ema or friendly fire during earnings season. I won’t say we’re overall “bullish” until I see a move over those recent highs at 610.78 otherwise we’re just making new lower highs.

I wanted to bring up a point about general strategy as someone mentioned to me still being long SPOT commons from last January when I wrote up Spotify as a weekend best idea here . It has been on a tear since, tripling in a year. but the point is more about why I always discuss risk reversals and ratios when you’re bullish a name. This was the trade I highlighted below that expired 2 weeks ago. Selling 2 put spreads at 180/160 to help offset costs of $210 calls. The total trade came down to $10 from $34 and as of 2 weeks ago at expiry spot closed at 485, today it is over 600. Had you bought those $210 calls you would have paid $34 and they would have ended up at $275 for a very nice return BUT had you used the risk reversal your outlay would have been $10 and it would have ended at $275. So for me, when you’re bullish, you swing for the fences if it is a long term trade, I did that with Amazon and you saw me do that with Meta recently. You don’t want any regrets if your thesis plays out and that’s why you want to utilize these aggressive trades when you’re confident.

Recent Trades

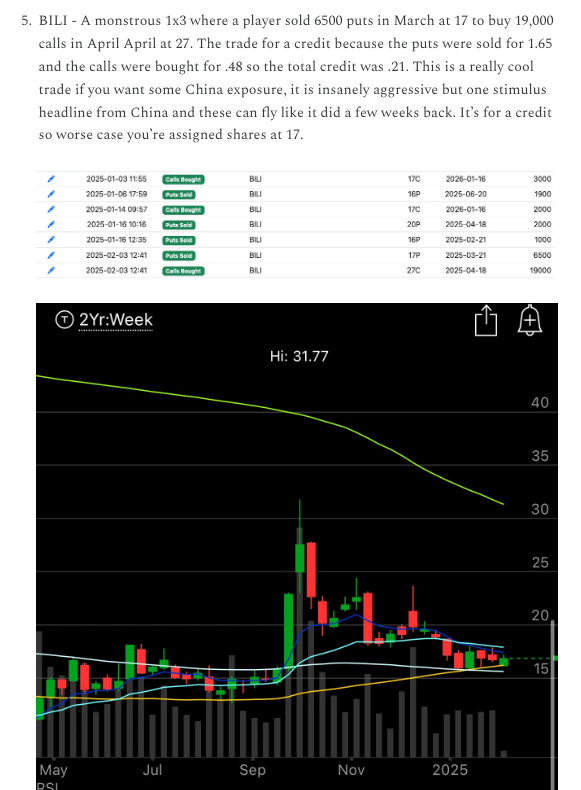

BILI - To the point above, in yesterday’s recap I highlighted this risk reversal placed using a 1x3 where 3x the calls were bought from someone very very very bullish BILI, overnight it gapped up hugely and is up nearly 8% right now, those 19,000 calls bought yesterday for .48 each are now up 30% a day later. The short puts in March are up 25% too, just an incredible 1 day trade all around with no earnings.

My Open Book

I’m running very tight on margin, hopefully this friday my META shares get called at 700, that frees up a little for me, but mostly I’m hopeful AMZN finally makes its move over 250 and I can begin to close out this call spread I’ve been sitting on for nearly 13 months now. The trade has gone well but it is currently sitting at just over 60% of its max value and I really think a pop even 5% higher will get me to say 80% of the max value where I would likely to begin to trim some or all of it. The META trade is going about as well as I could have hoped for, it is up 10% in a straight line since the day I put it on 2 weeks ago, the trade itself is up nearly 3x but Google reports this week which should have an impact on it. I don’t know what happens but a healthy move is to touch the 8 ema and carry on. META is clearly our leader this quarter.

Today’s Unusual Options Activity

Here is today’s link to the database, it will up until the opening bell tomorrow. The rest of today’s trades will be added by the afternoon