2/5/25 Recap

The SPY still has me skeptical. I guess it all boils down to what we see with the economic data this week. We continue to hold the 50 day and are just over all the moving averages but I can’t help what I’m seeing for now which is a series of lower highs. Could we rip higher, sure, we’ve done that for the last 100+ years but the way TLT is perking up signaling lower rates, the way megacaps are acting ex META just has me feeling like a rotation to small caps is unfolding for the moment. Breadth is fine in the overall market, but megacaps do make up the bulk of the weighting and so far most have not impressed on earnings. So for me I took some chips off in my book as you will see below. I’m cautiously optimistic about things until we make a new high.

Recent Trades

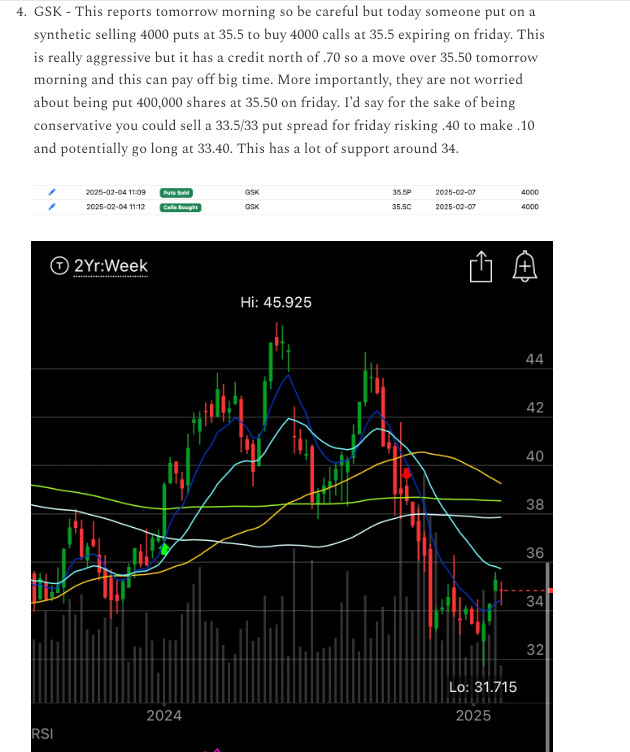

GSK - In yesterday’s recap I highlighted this synthetic with GSK under 35. It was an odd one selling puts at 35.50 with the name .60 lower and buying 35.50 calls expiring this week, sure enough GSK had that great ER this morning and this popped nearly 8% this morning. This was an incredible trade and they got paid to put it on too. Whoever put it on had some serious conviction going into that print.

My Open Book

Lots to say here today. So I cashed in my META risk reversal today, why? It was up an insane amount in the 2 weeks since I put it on relative to what I laid out, META rose from 650 or so to 718 this morning and when you have a gain like that in 2 weeks, especially while the rest of the megacaps are lagging, you take it. MSFT, AAPL, GOOG, NVDA are all struggling and I happened to put on size in the 1 megacap that worked. Call it luck, call it skill, a sixth sense,whatever it was, it worked and I realized the profit at nearly the day highs. I also sold some GOOG puts, some near the 200 day and some in January 2026 much lower. Google had a fine quarter mostly, nothing to really cause it to fall another near 20% on the horizon imo. Most of my red today was my AMZN call spread, honestly, I don’t think AMZN has a monster move tomorrow, best case we stall somewhere around 255 as the 1.618 fib extension off the lows, worst case it lags like most of the other megacaps. Personally, I always figured I’d be in this trade till July/August at least, but I would be pleasantly surprised if AMZN pops tomorrow and I can get out sooner.

I tweeted when I sold this morning, you can see the timestamp on my trades at 9:59 EST and you can the see them in the volume for those of you not in the live part of the discord. It was 715 or so then.

and META promptly sold off 2% in the following hour as you can see below. While I’d like to tell myself I move markets, no I do not move $1.5T companies with tweets. This was a blowoff top and I’ve seen this many times in my life. META will still go over $1000 in 2 years, META is fine. I made alot of money and frankly as I said above, I do not like what I’m seeing the SPY. I booked gains and if you notice I sold some puts at 695 and a ton at 685 expiring this week. If I can get these shares, great, but I’m done with the leverage and the risk reversal. There is no crying over booking profits. I got this flurry of DM’s asking why I didn’t do that with Amazon, the answer is when the hell did Amazon ever go up 10% in a week? It was this slog of a trade that took forever to work, this just worked very quickly.

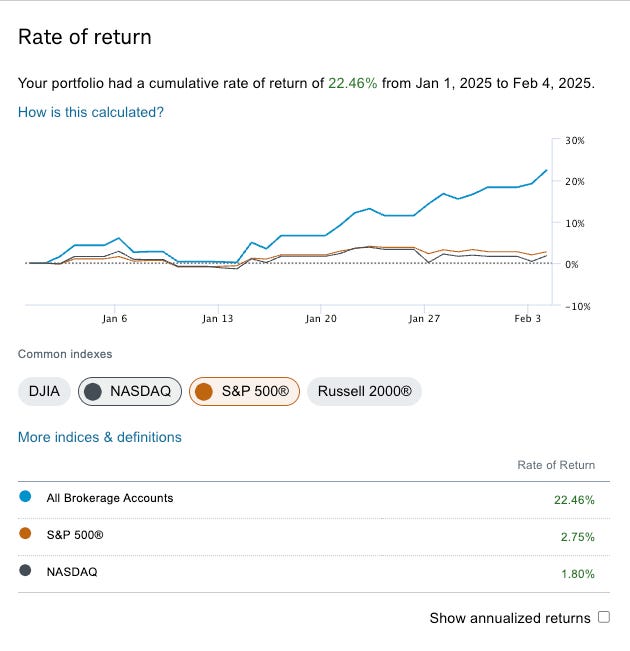

I don’t think you realize how much META has outperformed the market this year if you’re not selling here. Before today I was up 22.5% in basically 5 weeks in my trading book and the Nasdaq was up 1.8%. I was in the right name at the right time, but I also knew it was time to dial it back. If you want to stay in META till 2027 be my guest, personally I would wait for the name to pullback to the 8 ema, it is wildly extended. Anyways great trade, if you took it you made a tremendous return in 2 weeks, don’t cry over what you might miss, there’s always another trade.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be open until tomorrow morning. So check back later for the updated trades and trends.