2/9 Recap

I have an update on Amazon at the bottom, but I don’t want to bore those who aren’t in it so I wont’ put it up here.

We finally got that move over $500 on the SPY today, this trend has been so strong, now 6 days without an 8 ema touch and 1 break of the 21 ema in 4 months is unheard of. I don’t know how much longer this lasts but this could be the greatest stretch in the history of markets.

It’s more amazing how many have been on the sidelines in cash or short because they thought things were overvalued, just more proof that the trend is all that matters in the end. In the end we have people back to discussing breadth and the lack of it. That really isn’t important, this market is over 30% weighted to 6 stocks and they are buying those 6 stocks at a furious pace right now. If you want the market to go down, those 6 names need to find a reason to sell. They’re all posting record profits for the time being.

Oil was rejected right at the key moving average below, that was the last level it needed to clear to really take off. There is still some hope it reverses here and pushes lower until it does that.

The TNX continues higher, yields up and stocks up, this remains a serious headscratcher as they don’t move in tandem. TNX looks like a huge inverse head and shoulders that wants more, but stocks seemingly do not care anymore. Has the fed lost control? Nobody seems to care what they think or say anymore and every dip is being bought without a care in the world. This has to be eating at the fed because their whole objective was to keep rates high to hopefully push equities lower and it has not worked for a long time.

Recent Trades

I want to start with one I got wrong the other day when I highlighted it before earnings, SYM. This name had a really decent quarter in my book as far as small caps go. I noted the trades I saw before earnings and it still fell 20%+ on earnings but that was inline with the expected move. The thing that’s tricky with earnings is its chaotic and you can’t really take the moves seriously especially with small caps like this. I said this was a multi year trade as a warehouse automation play and look at the last 2 days, back to back nearly 10% gains to 47+ now when it closed at 49 before earnings. That is why I really never used to suggest short term trades or earnings plays in the 5 I highlighted below, but so many kept asking for it so I do now. Earnings are not for faint of heart.

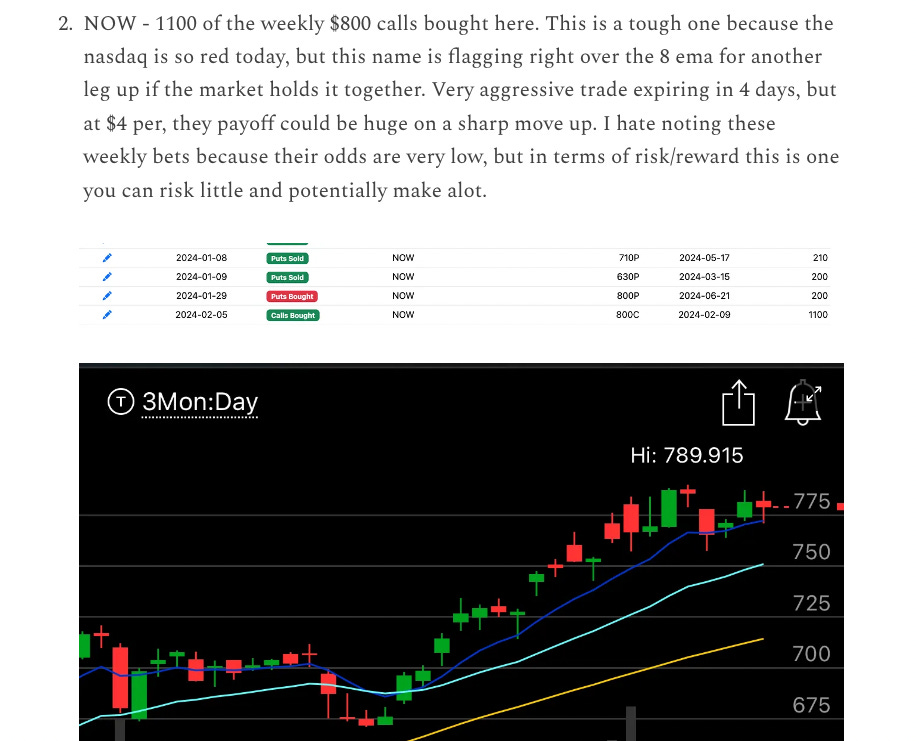

NOW - This was one I highlighted in Monday’s recap when a player bought 1100 weeklies with the stock at 780. It is 810 right now and those calls paid out very nicely, very gutsy trade putting it on with such little time to go, but they are up 3x on them right now.

Do you remember MDB 2 weeks back? It was barely over $400 and a put seller came in selling 2000 of the $300 puts in March, that was huge notional value if they were assigned. 10 days later the stock is up 6% more today to north of $500 a quick 25% move up in the name. That is why I try to focus on the put sales more, they are levels where big money is looking to take a long position and more often than not marking a bottom.

Just remember there is no 100% guarantee in anything, even these big funds placing these trades can be wrong and many are often, if they weren’t they’d all have superior returns when most can barely keep up with the market. They’re just making calculated bets with big dollars after their team does the work deciding on when and where to place that bet. As I’ve said the key is sizing your bets to what fits your narrative and goals. Warren Buffett made countless horrible calls over the last decade that he’s cut for losses but it didn’t matter because he allocated 50% of Berkshire to Apple and that worked out. It sucks having losers, nobody wants them, but just remember in the end nobody cares about your losers as long as the overall gain is there.

Trends

I’m shortening these trends down 20 from 30, all these are in the database, you can just scroll through as many as you want on whatever timeframes you want.

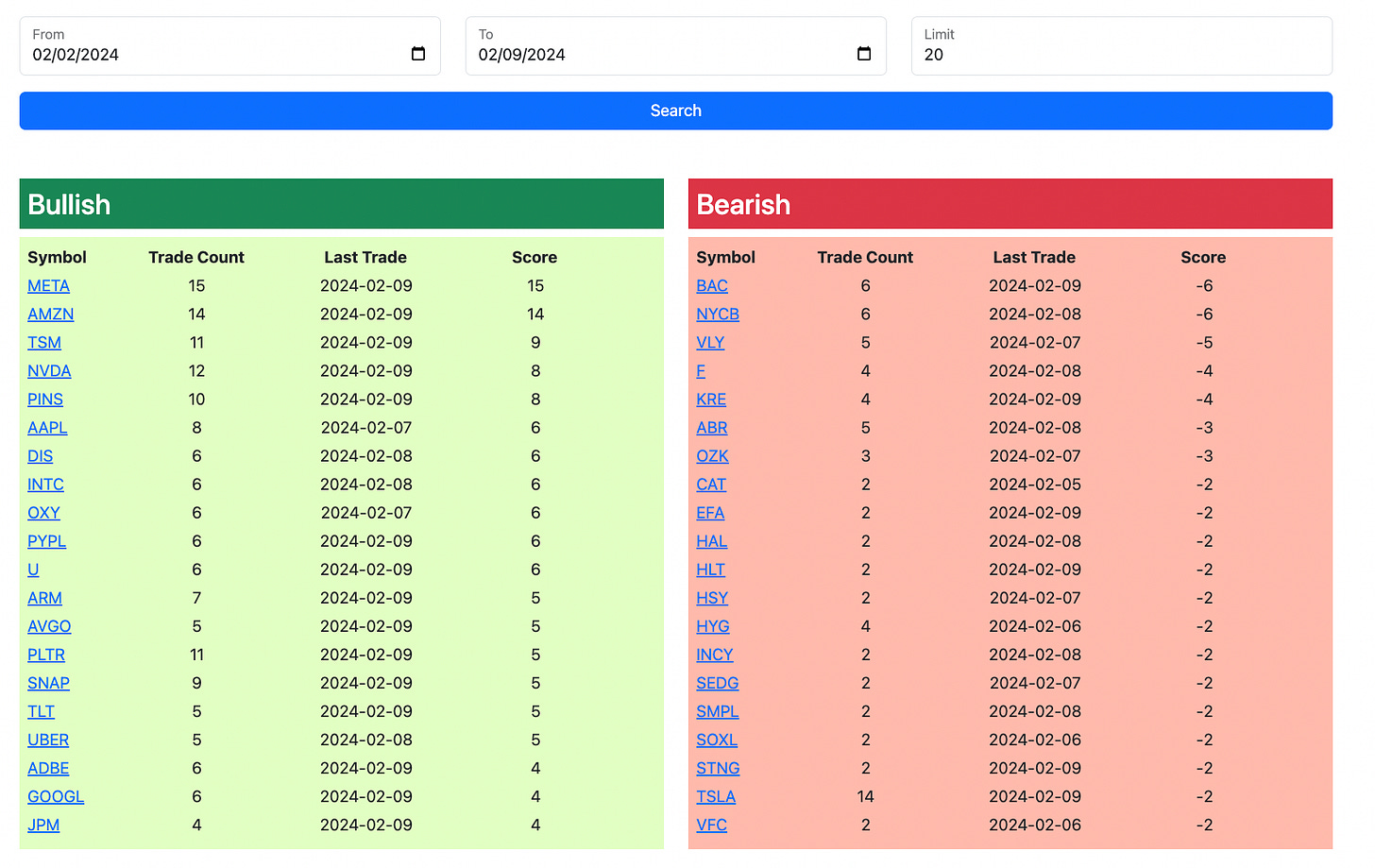

1 Week

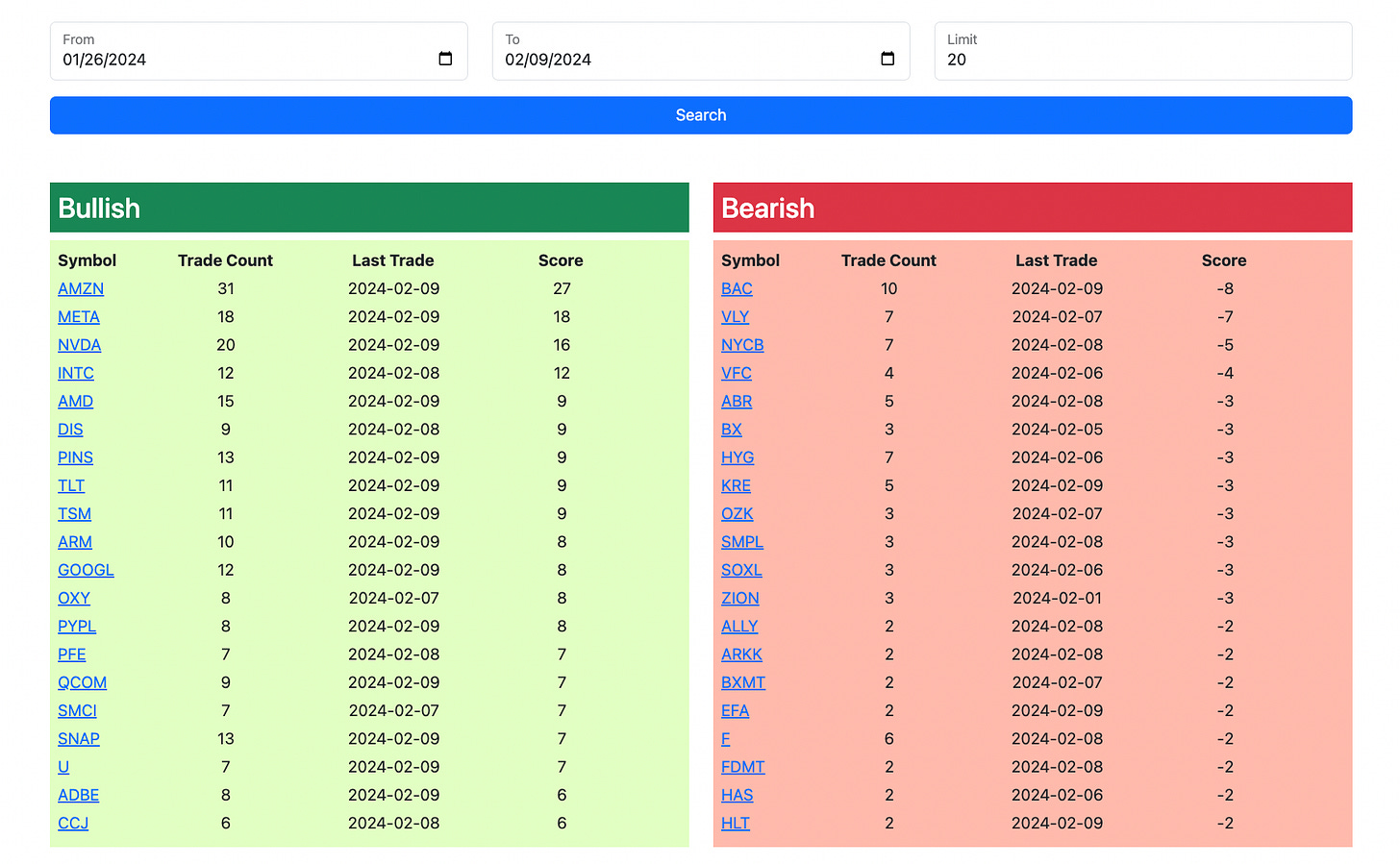

2 Week

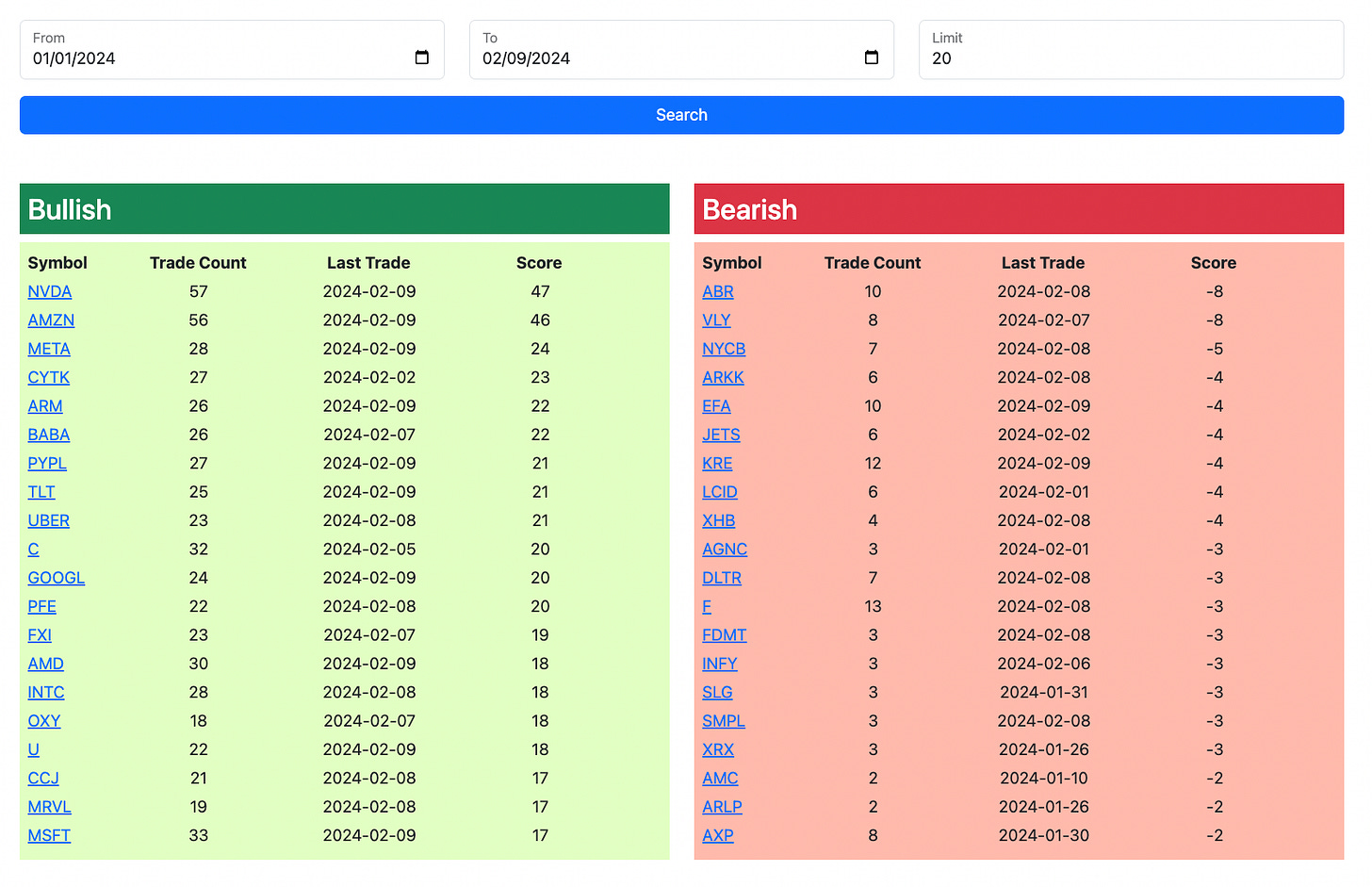

1 Month

Today’s Unusual Options Activity

Here is today’s database link, I will leave it up until monday at the open for those who want to use it over the weekend, as always I will add the rest of the day to it by this afternoon so check back for the updated list and trends