2/9 Recap. Nasty Reversal

I had to head out early today, flight to catch,this was a very ugly reversal. The market looks to be running out steam before CPI on Tuesday. Where we close today is important. We basically retraced the whole FOMC move now. There isn’t much to say other than the data remains awful and this is exactly why I sell puts. I don’t really care much about what the market does up/down/sideways and just focus more on trying to get long quality names at levels that interest me. I won’t post charts today just because I have no idea how they will close but right now small caps are definitely leading to the downside. All I will suggest is you de-risk your book however you like the next 3 days before CPI because that could very well be a catalyst for a leg lower.

Trade Of The Week Update

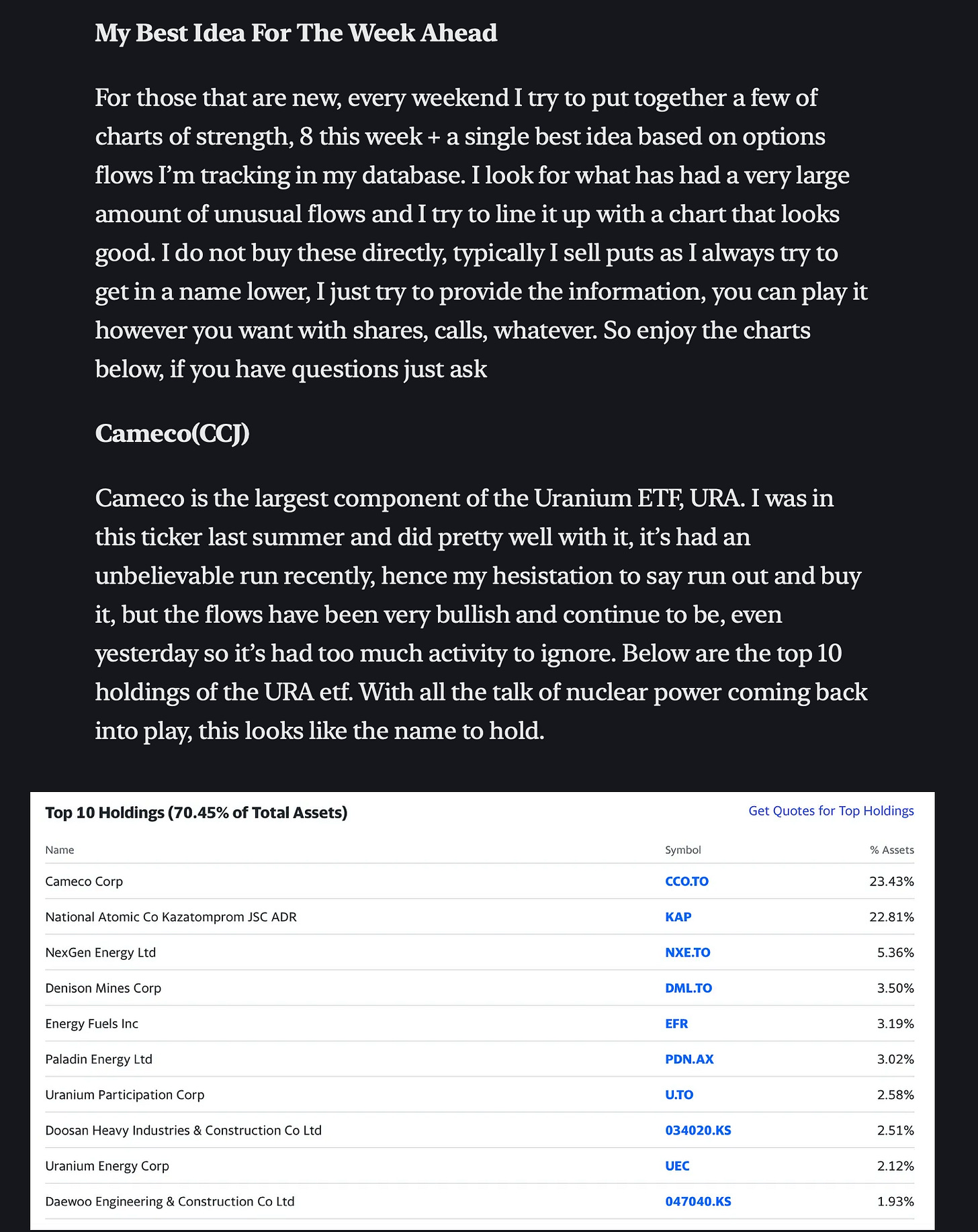

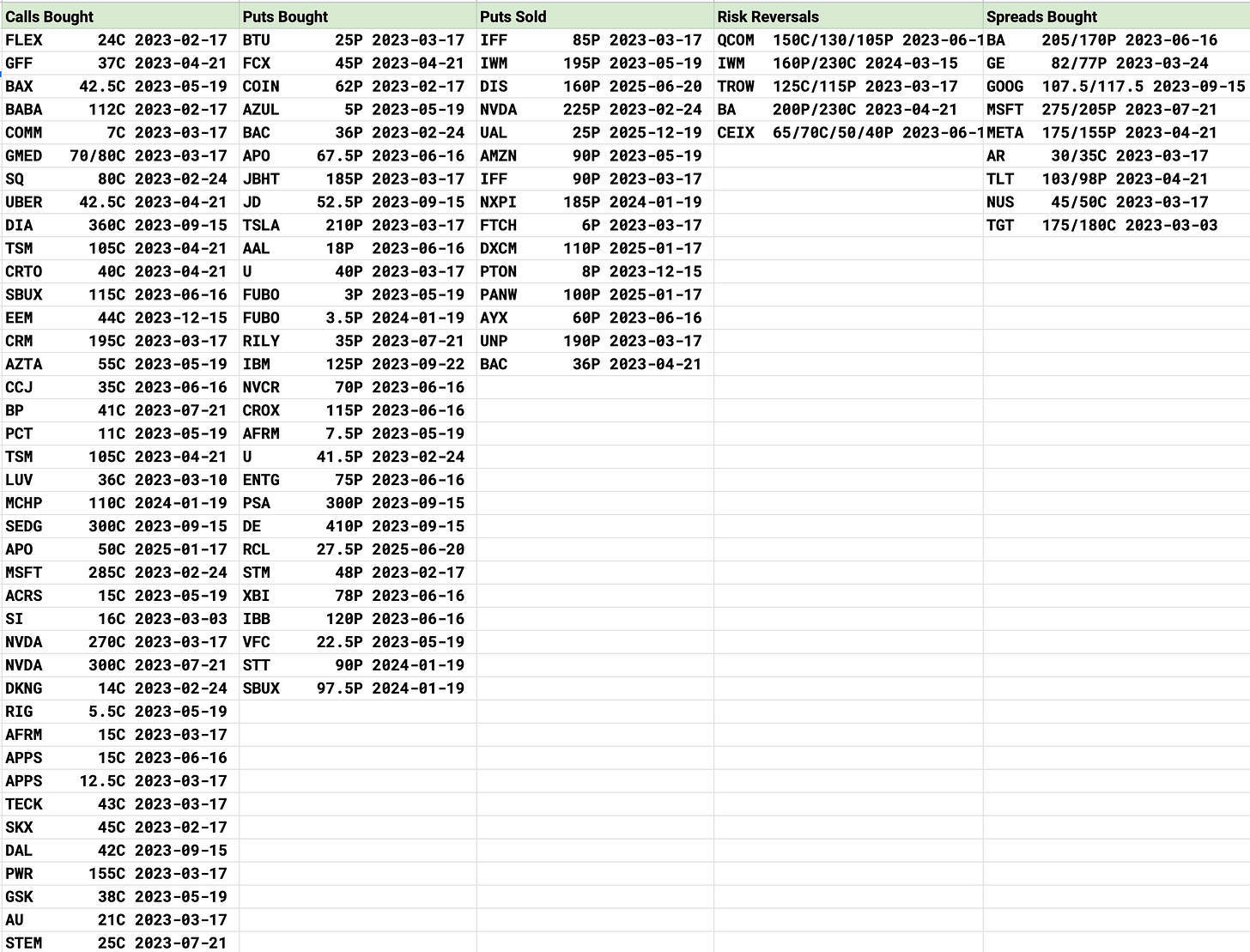

Everyday I post this table of unusual trades and I think those of you that have been here long enough see a pattern. The flows rarely lie, occasionally they are wrong in larger caps because many are hedges but in smaller names they often give a great guide on direction. This past weekend I said CCJ was the name that looked most intriguing for this week and what happened today, CCJ had fantastic earnings and is up 7% as I type this.

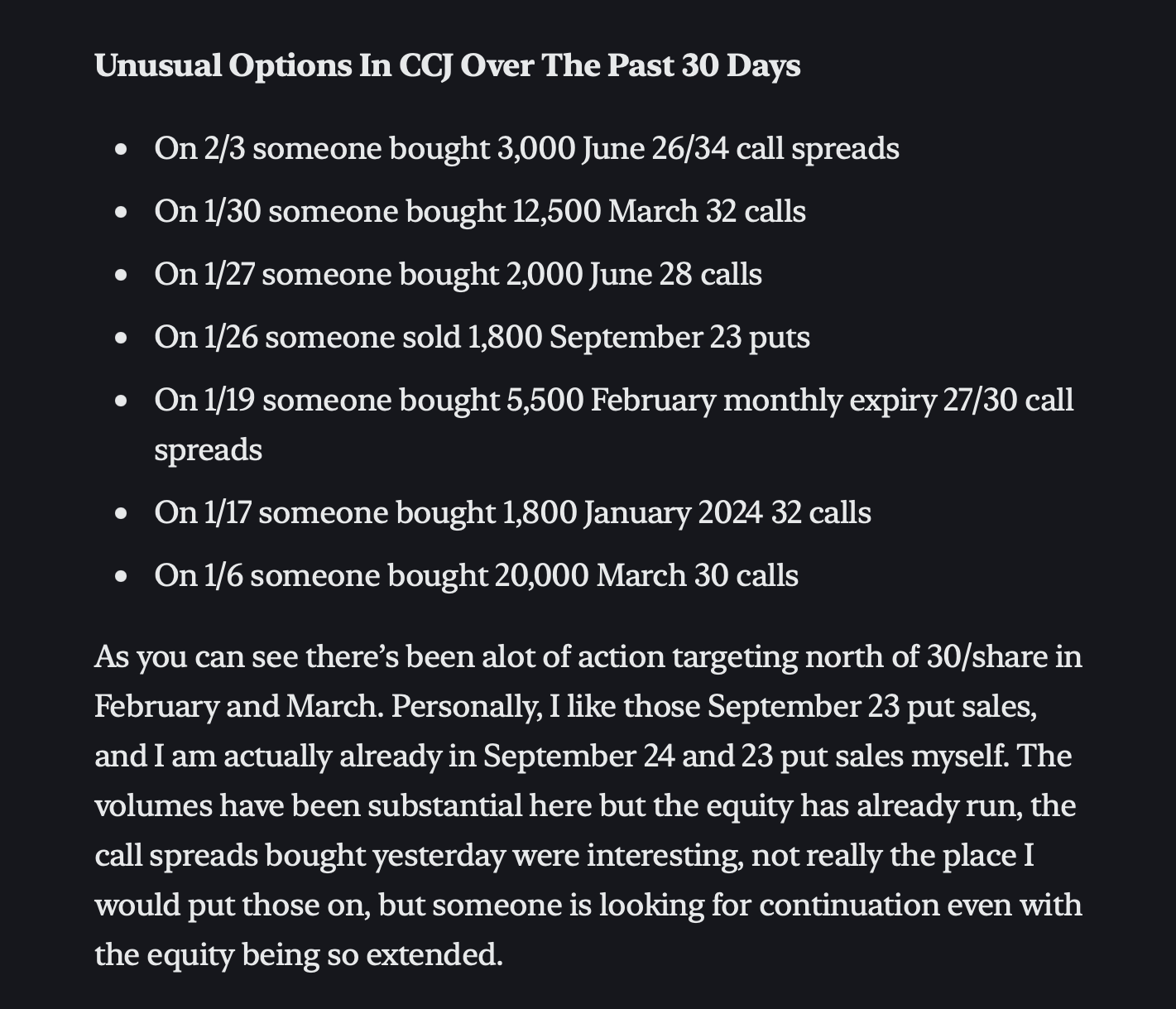

For those who think it was just a coincidence, nothing is, if you remember I even laid out every single unusual trade I had taken note of in the last month on CCJ and here was that long list, all those players were rewarded handsomely today.

Today’s Unusual Options Activity & What Stood Out

This is starting to get interesting as you will see below today, 2 weeks of putting all this data together and being able to search through it is definitely making it easier for me to share previous options trades and the trends over time. 3 months from now the data will be fantastic but if you have any names you want to see specifically just post in the comments below and I will share the trends from the last 2 weeks, I’m up to around 800 unusual trades logged in there now.

CCJ had another 10,000 calls bought today for June expiry at 35. They are nonstop on this name.

CRM with a big buy at 195 in March. This has become a base for activists and hedge funds have flocked in behind them.

DIS had a really interesting put sale today of 160 puts in June 2025. The stock is 112, someone is looking for some substantial upside, these are always weird trades to see executed.

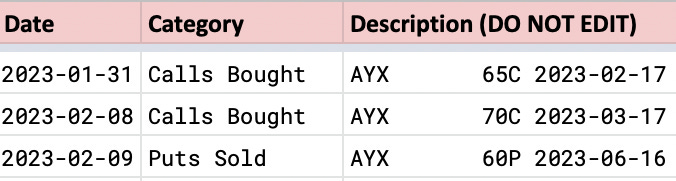

AYX continues to see bullish flow and has their ER today this is what I have noted in the last 2 weeks, notable size for a small name

NVDA has been on a roll, nothing can stop it today it saw March 270 calls bought, July 300 calls bought and a put sale at 225 for February 24th. The AI trade has been on an insane run.

CEIX saw an interesting bearish risk reversal selling upside call spreads at 65/70 to finance a put spread bought at 50/40 for June expiry

IWM saw a large risk reversal selling 160 puts to buy 230 calls for March 2024. Pretty bullish bet on small caps continuing their run.

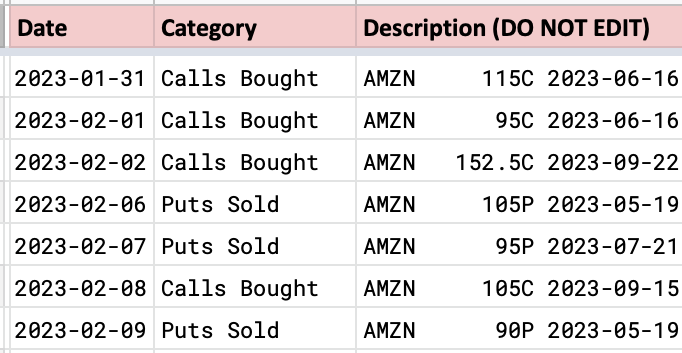

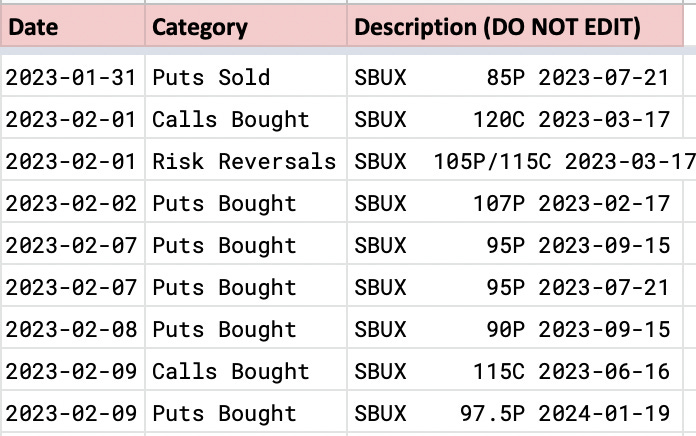

AMZN continues to see a ton of put selling. Hard to argue with the valuation, from a chart perspective I think 85 is a better spot to put these on, but today had a large put sale at 90 in May follow 2 other large put sales in the past 3 sessions that you can see below.

IFF was crushed on earnings today and saw 2 large put sales at 85 and 90 in March. Put sales always catch my eye because they are not hedges, just levels someone wants to be long at.

SBUX continues seeing put buys daily, overall from what I’m seeing unusual put buys outpace call buys by quite a bit. Today more puts bought at 97.5 in January

What Did I Do?

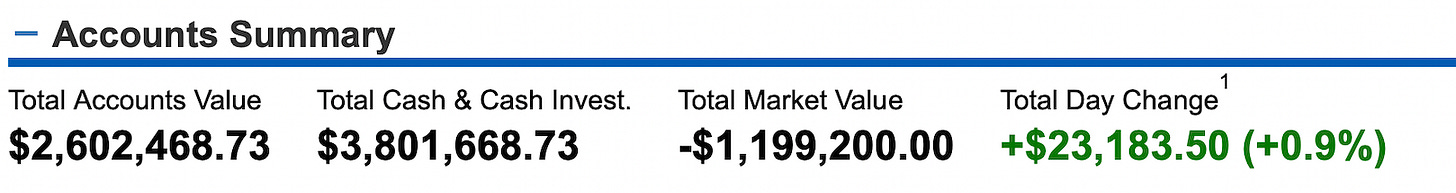

I actually was nice green today mostly because of my short puts on CCJ,Disney, and Wynn. Those offset the weakness in other names. I closed out WYNN and DIS today along with MDT and MSFT. I wanted to play PYPL today and so I sold Jan 2024 45 puts into their ER today and as I said above, I wanted to begin to lighten up a little bit into CPI on Tuesday. For me, my target is around 20% available margin. I usually run it very low around 10% but I would like to be around 20% maybe 25% to cushion a blow and not be forced to sell if we get a huge reversal after CPI.

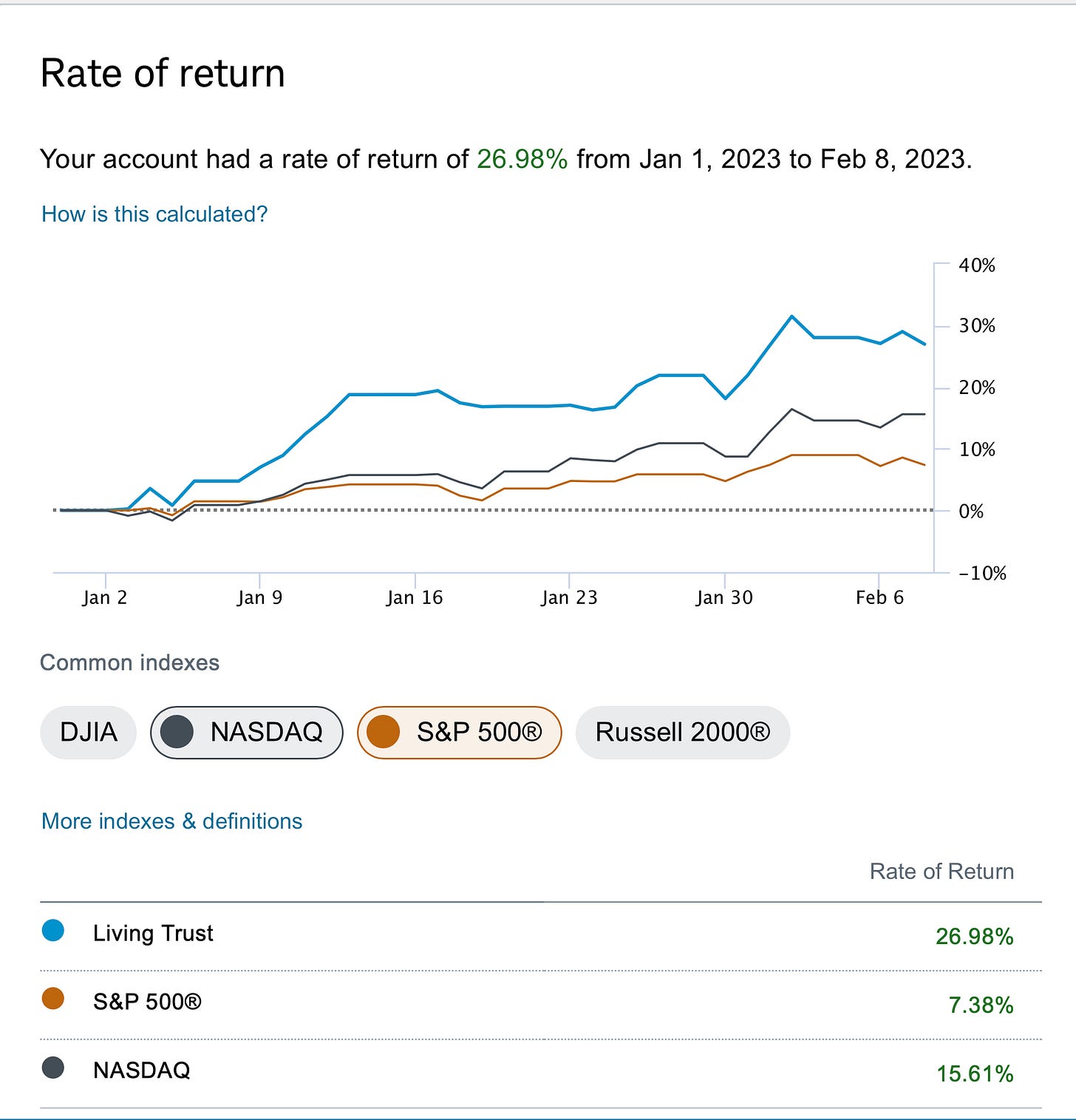

As I wrap up this 5th week of 2022, I can’t say anything but good things coming into today I was up 27% outpacing the S&P at 7.38% and the Nasdaq at 15.6%. Again as a put seller, my objective isn’t to outpace the market this early in the year, typically because most of my trades are short puts out in 2024, the back half of the year is where my portfolio usually takes off. So I’m pleasantly surprised with the early outperformance. I still think the market mostly goes lower from here the rest of the year which probably stings me for a little, but allows me to outperform vastly into the 2H and into the end of the year. I still stand by my prediction from week 1 that I will end the year up 50%+ and the market will be flat. A decline from here could do it.

As always no recap on Fridays and I will post my best idea for next week over the weekend. Hope you all have a great weekend.

The log of all the unusual options will be amazing in the next few months. Very excited! Been doing a similar thing on the notes section of Trading View, but only with limited names that I like and/or notice flow patterns on and has been working nicely. Have a nice trip!

Selling long dated puts in a bear market, are you really just relying on decay latter half of the year? How long do you typically hold these contracts before buying back?