3/10/25 Recap

The SPY officially broke down today. We gapped below the 200 day and even broke the horizontal breakout from September at 565.15. The issue now is you have a ton of overhead supply. Look at this chart below and look at the close we had below the 21 ema on February 21. While it has been tough over the last year because every 21 ema break ends up being saved, if you had just stuck to the rule of closing up below the 21 ema you would have avoided all this pain. That was around when I closed and went to TLT. My move on friday to try and catch the 200 day bounce on the SPY was the wrong one as you can see today’s move, but that’s why you try to go long at spots like that with a tight stop loss and I am now out of META and AMZN for a loss. I will discuss more in my open book below. You have to be wiling to cut things, look back at when I first cut META because I didn’t like how it was acting then, it was 716 and alot of you said what about 800,900,1000??? I still think META sees all of those levels, but it also saw 589 today so you just have to not fall in love with this stuff and trade what you see infront of you. When major moving averages break, you have to move aside.

There isn’t much to say other than the market is broken until it is not. For me I’d need to see a couple closes over the 200 day before I’m confident in longs again. Does that mean sell everything? Yes and No. If your timeframe is 3 years out, then buying all these megacaps at deep discounts makes sense. If your goal is to trade, then short term these names will remain weak. The only pocket of the markets doing well right now is defensive names, these tech names are just dead money for the time being. We need a close over 565.15 on the SPY at a minimum today, below that and we’re really in trouble.

Recent Trades

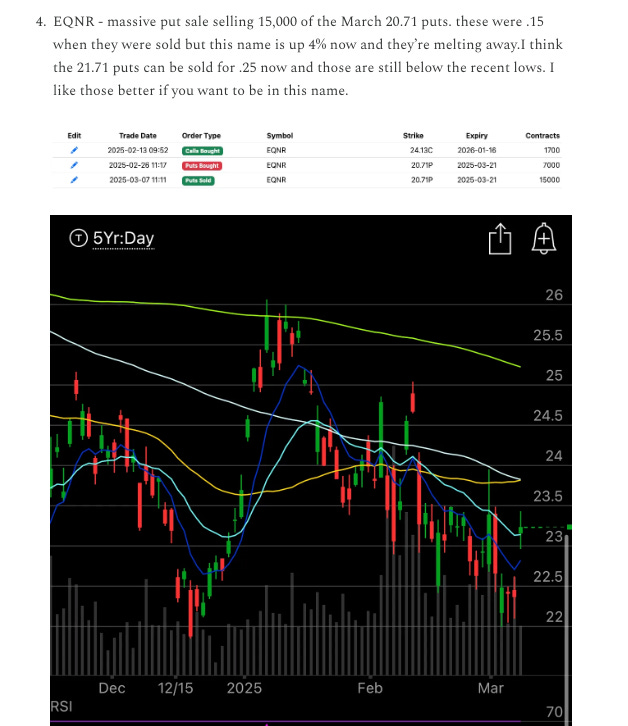

EQNR - I wrote this one up in friday’s recap after the massive 15,000 block of puts sold and today it was up 6% at the highs and these puts have melted away just 1 session later.

My Open Book