3/11 Recap

We got a small move down in the /NQ this morning. Former President Trump was speaking on CNBC this morning and he didn’t have nice things to say about META and sent it spiraling down 6% at one point. Today was the day where Google, Apple, and Tesla all the biggest laggards recently went green while all the recent names of strength NVDA,META, MSFT, and AMZN went red. Very odd little rotation. We have a big week ahead with CPI tomorrow, PPI Thursday, and OPEX this friday. There will be some very big moves this week, today just seems like a fairly normal day other than the pretty low volumes I’m seeing in some of these big names. Everyone is just holding and waiting for tomorrow.

The SPY is holding onto the 8 ema for dear life and the 21 ema is right below that, bulls need to see a move up otherwise the longer it keeps testing the 8 ema, the more likely it is to break it and knife right through that 21 ema. At this moment only 1 of the mag 7 is firmly over the 21 ema, NVDA, with AMZN and META both having broken it today and bouncing back over it. To me, the 21 ema is the best trend indicator and 4 of the big 7 are well below it with 2 more potentially joining by the close today. Something to keep an eye on.

Oil also holding the 21 ema after breaking below it today. Nice recovery this morning and it remains trapped between the 8 and 21, surprising weakness with the recent cuts from OPEC.

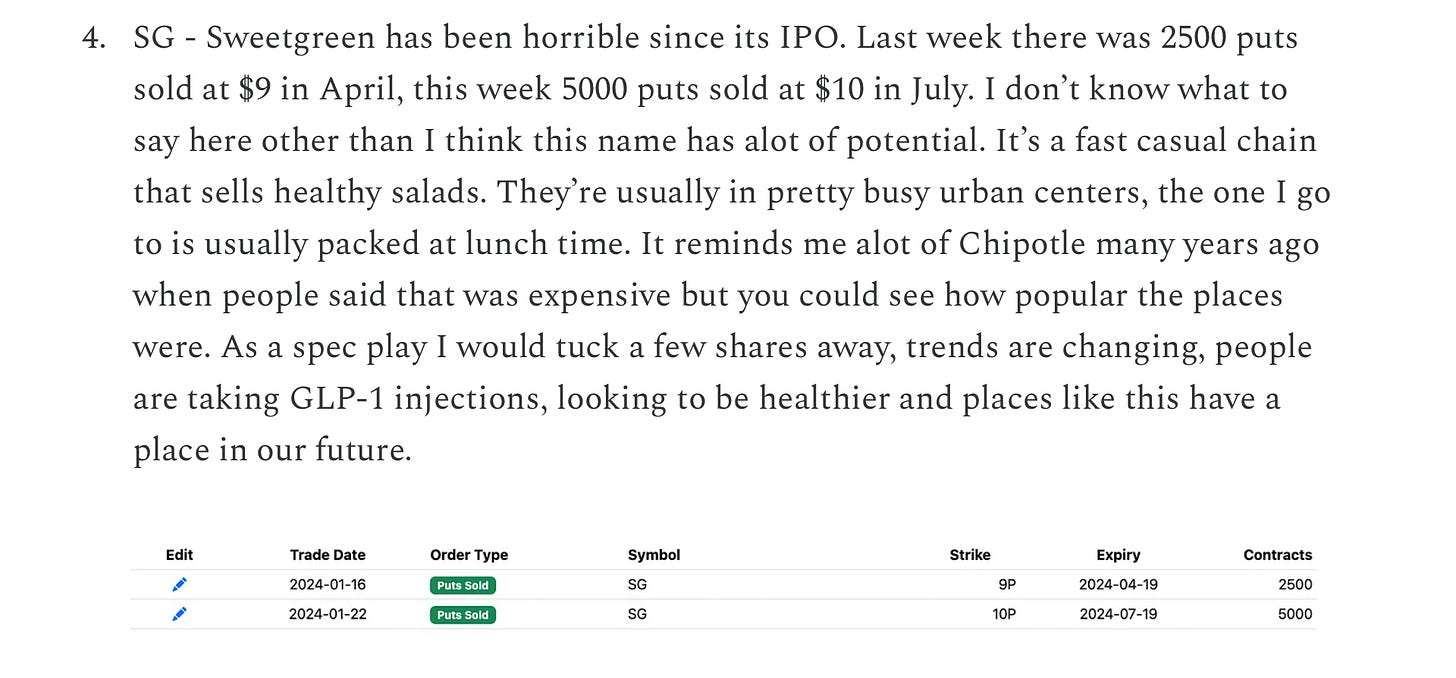

Lastly yields remain fully broken which is what bulls want to see, but that can change quickly tomorrow if CPI runs hot and we begin to price in higher yields. Tomorrow morning will be a big tell on many things going forward.

Recent Trades

Sweetgreen has been non stop, up 5% more today, it is now up nearly 100% in 45 days since I noted it in the 1/22 recap. Congrats if you tucked away shares that day.

The big one today was ETRN which was finally taken out at $12.50/share today. I had highlighted this one a couple times mostly recently in the February 9th recap with the excerpt below. It has sold off some intraday but was well over 12 pre market. This is still ripe for put sales now after the selling.

Another one that finally worked out was RDWR, back in the October 16th recap I noted a risk reversal expiring this week selling $15 puts to buy $18 calls, the timing by whoever put that trade on was impeccable with the stock up 10% today to just over $20/share. That was a great trade and congrats if any of you held all this way.

Trends

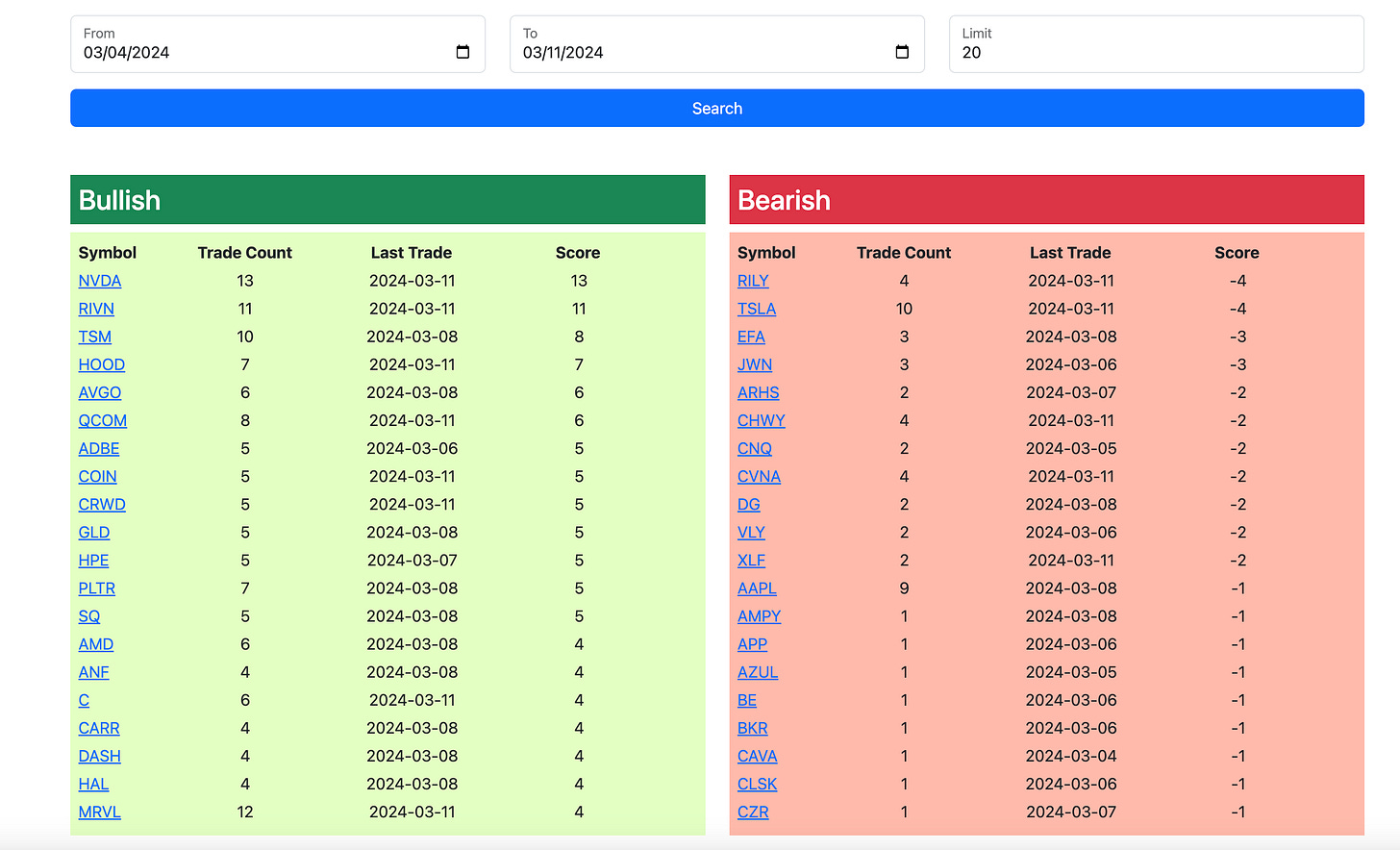

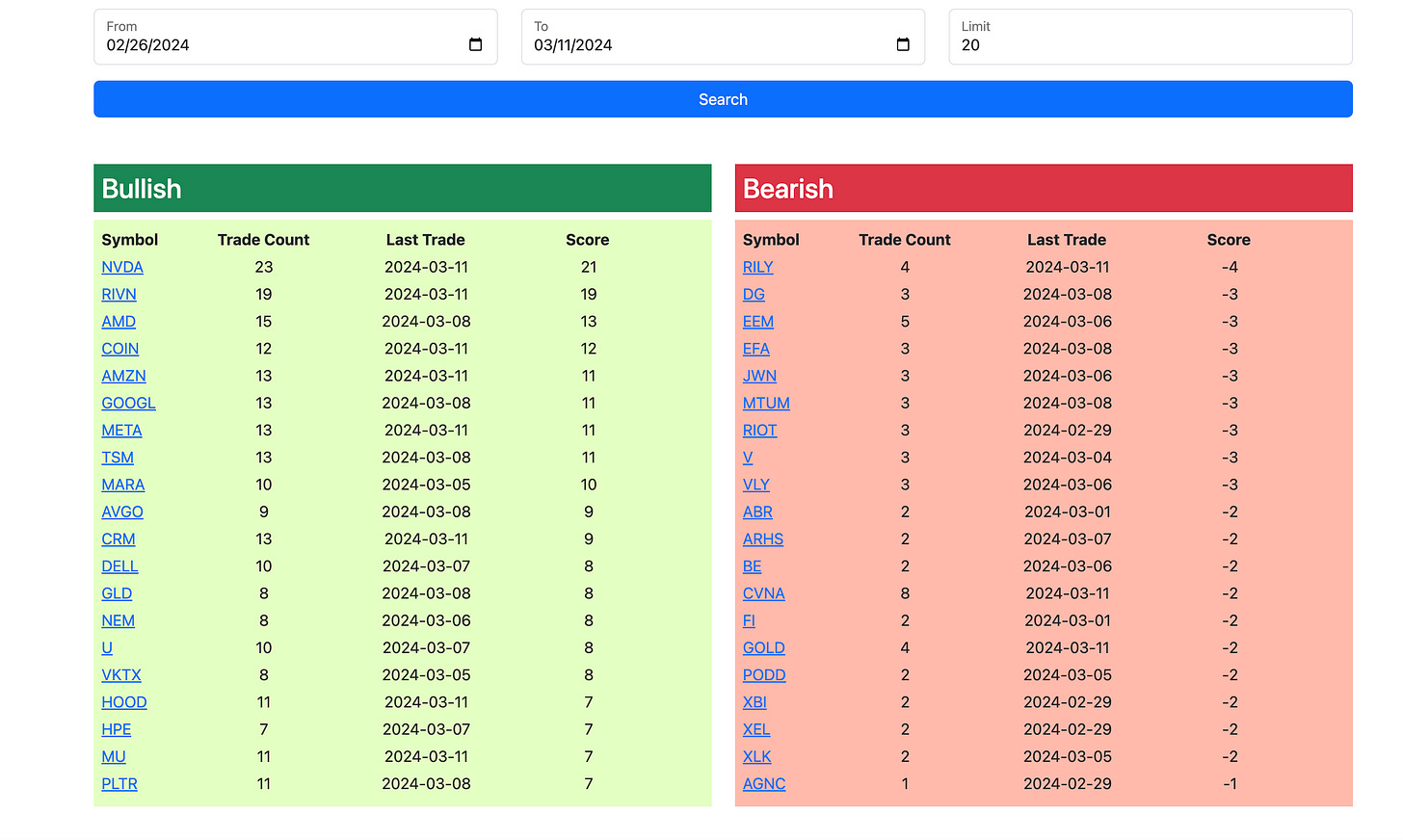

I always get asked if there is a way to make these clickable here, there just isn’t as far as I know so be sure to view this inside the app below so you can click on the tickers and see all the trades individually.

1 Week

2 Week

1 Month

Year To Date

Today’s Unusual Options Activity

Below is today’s link to the database, as always it expires at the open tomorrow morning for everyone not on the live tier. I will have the rest of today’s trades added as the afternoon goes along. So check back for the updated list and trends