3/13 Recap

We got a sharp selloff in tech stocks today. It all began with the Wells Fargo downgrade of Tesla from $200 to $125 this morning. At this moment Tesla is the worst perfomer in the S&P this year. I know alot of you are fans and have asked me why I’ve been so bearish on Tesla forever and you’re seeing it unfold in real time. ZIRP is over, and none of the things that sustained Tesla for years ever came to fruition and the company is still 10x the market cap of car makers like Ford and GM. Still a long way down in my book.

Nvidia also sold off hard today, NVDA has not broken any key levels like the 8 ema yet so I can’t get bearish on it, the run has been very hard and some are taking profits, normal stuff really. Amazon and Google were the only green names in the big 6 and their relative strength is notable. Amazon came on an upgrade from Wells Fargo to $211 combined with news their Pharmacy was tabbed to deliver weight loss drugs for Eli Lilly. When the Nasdaq is down this much, take note of who is outperforming, those are your pockets of strength to focus on short term.

Tomorrow morning we have PPI so keep that in mind if you want to de-risk anything today. Right now the IWM is outperforming everything else, with a move out of megacap tech into the IWM going on. We don’t have to agree with it, but it is what is happening momentarily as you can see below.

Oil, below, also made a big move up nearly 3% today, still though, it has not been able to close over the $80 level in a very long time. Copper is another commodity that has been on fire recently. The commodities rising is not any help to inflation and what the fed wants to see happening.

Recent Trades

SQ from this weekend’s best idea post is up almost 7% today. There was another very big risk reversal I noted below today but Square is looking very good right now.

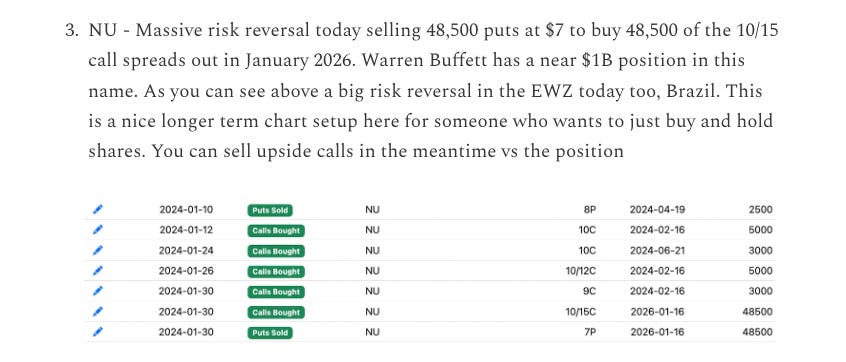

NU was the one I wanted to discuss today, back in the 1/30 recap I noted that monster risk reversal with the stock just below 9 and a player sold 48,500 puts at 7 in 2026 to buy 48,500 call spreads using a 10/15 call spread. The stock is up over 30% since to $11.62 right now.

Another fun one from recently was X, remember this name was acquired in December, and alot of put buys came in recently. Alot of you in the discord were wondering what was going on with that, well we got our answer just now with the stock down 10% with the Biden Administration concerned with Nippon Steel making the bid.

Trends

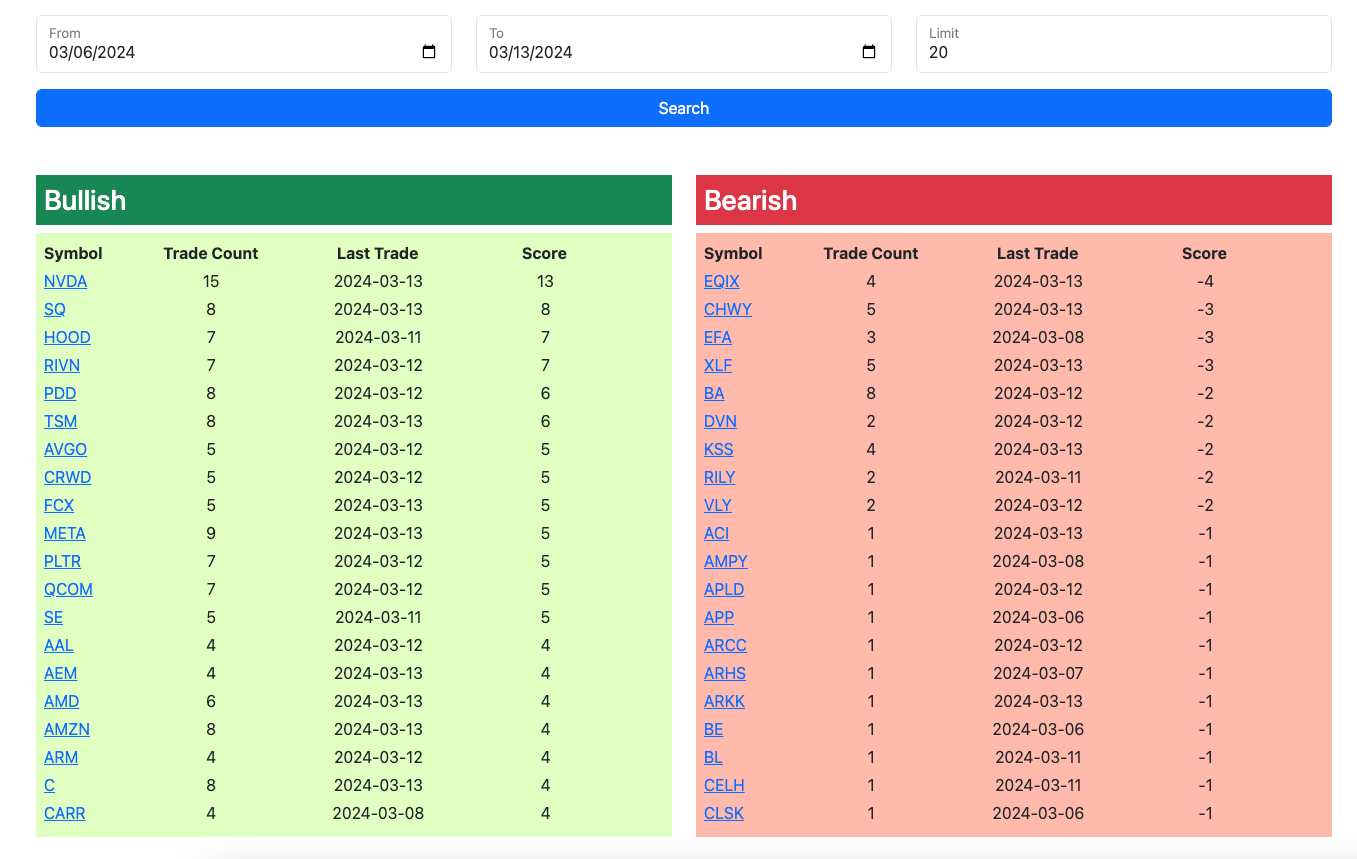

1 Week

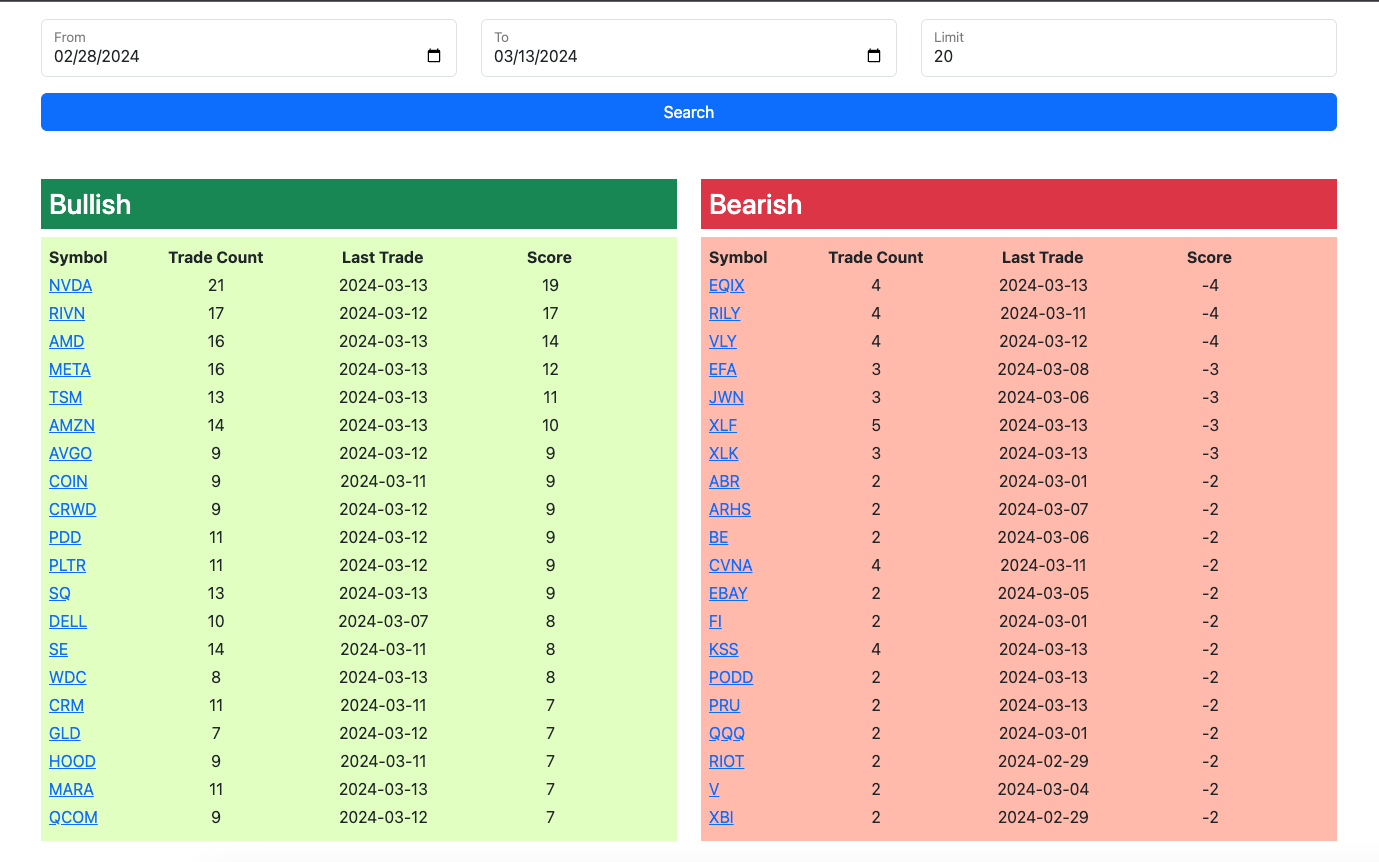

2 Week

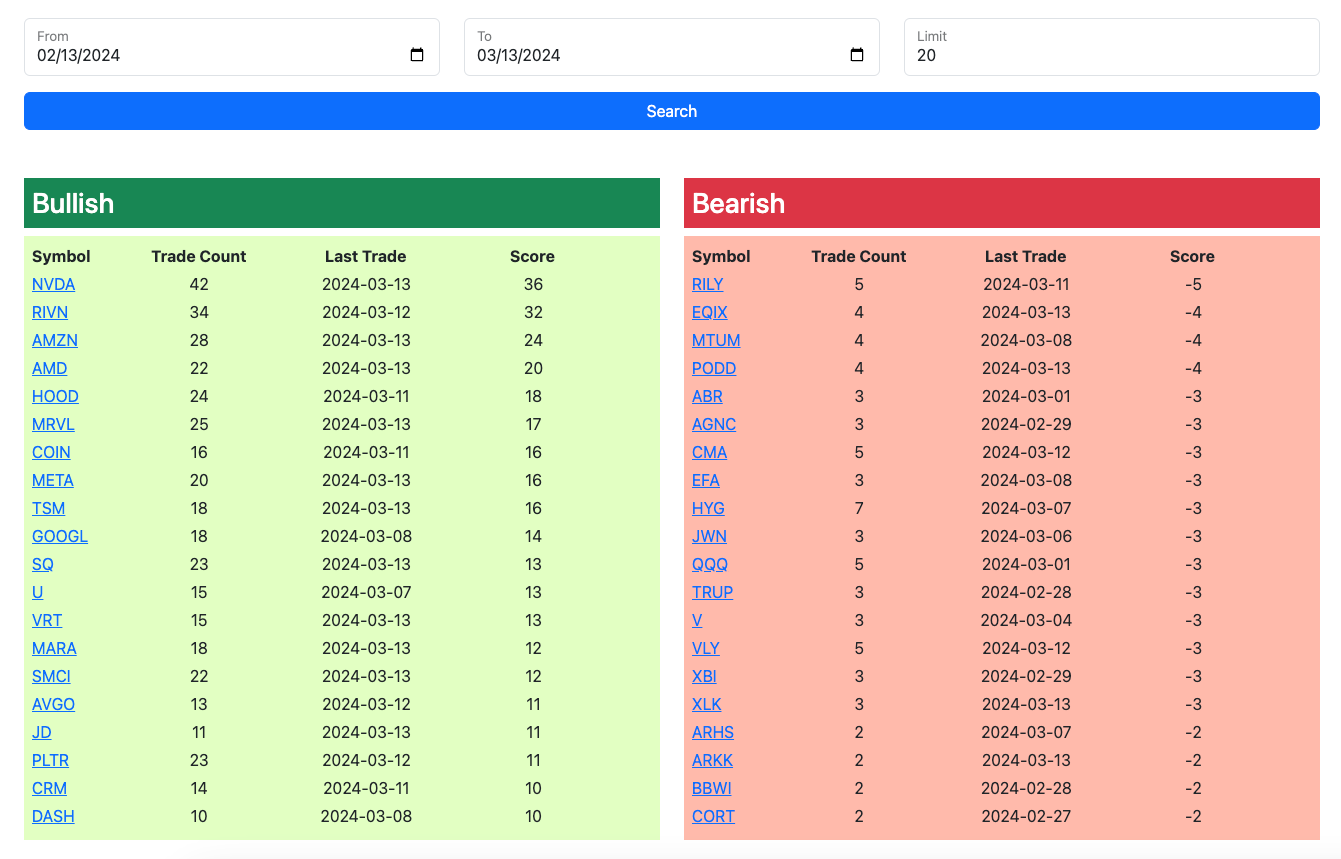

1 Month

Today’s Unusual Options Trades

Below is today’s link to the database, as always it expires in the morning at the open and the rest of today’s action will be added in by the afternoon. I fit what I could down below but there’s more trades and you can click the link below to see the rest of them