3/14 Recap

PPI came in hotter than the fed would like to see. This sparked a run on the megacaps ex Nvidia. The reality is that we have been in this back and forth for nearly 2 years now on what the fed will do. Coming into the year they had the fed pegged for 7 rate cuts and with these recent prints they really shouldn’t even be contemplating one cut. Inflation is no joking no matter, it is a hidden tax on all of us and they have to sustain these rates which means companies that actually make money like the Apple,Microsoft,Google,Amazon, Meta and Nvidia of the world will be the big winners of a higher rate world. The small caps will not thrive there which is why you see so many of those selling off.

Do I think this is the end of the back and forth? NO, small cap stocks are always going to find a reason to be bought but for now, the megacaps really do seem like the names you want to be in. It’s fairly simple to see where all these megacaps stash this cash and you can see how much is being put into high yield instruments, they really benefit more than you can imagine with these rates.

On another note NVDA is breaking the 8 ema right now, it is early and can reverse but our market leader has not closed below the 8 ema since before earnings, this would be a short term trend shift if it does. So keep on eye on the close today.

The SPY remains on the edge of a cliff just riding this 8 ema higher but the more times you test that the higher the likelihood is we break it and we’ve been on this for over a month now. It’s getting scary because the 21 ema is just below 510 and we’re sitting at 513.xx, if we break that, there isn’t anything to slow us down between there and the 50 day at 495 right now.

Oil continues to move up, this is the highest close oil is going to have seen in months over 81 today. This is a nice breakout in oil and it might be time to start moving money into oil names finally, they are very cheap right now if this breakout has legs.

Recent Trades

I highlighted EVER on friday in the 3/8 Recap it was $16 then, it is up 15% since in 4 sessions to $18.53 today. It’s always notable when these tickers you don’t know start seeing calls bought. This is a very small company, nothing I’d ever pay attention to otherwise.

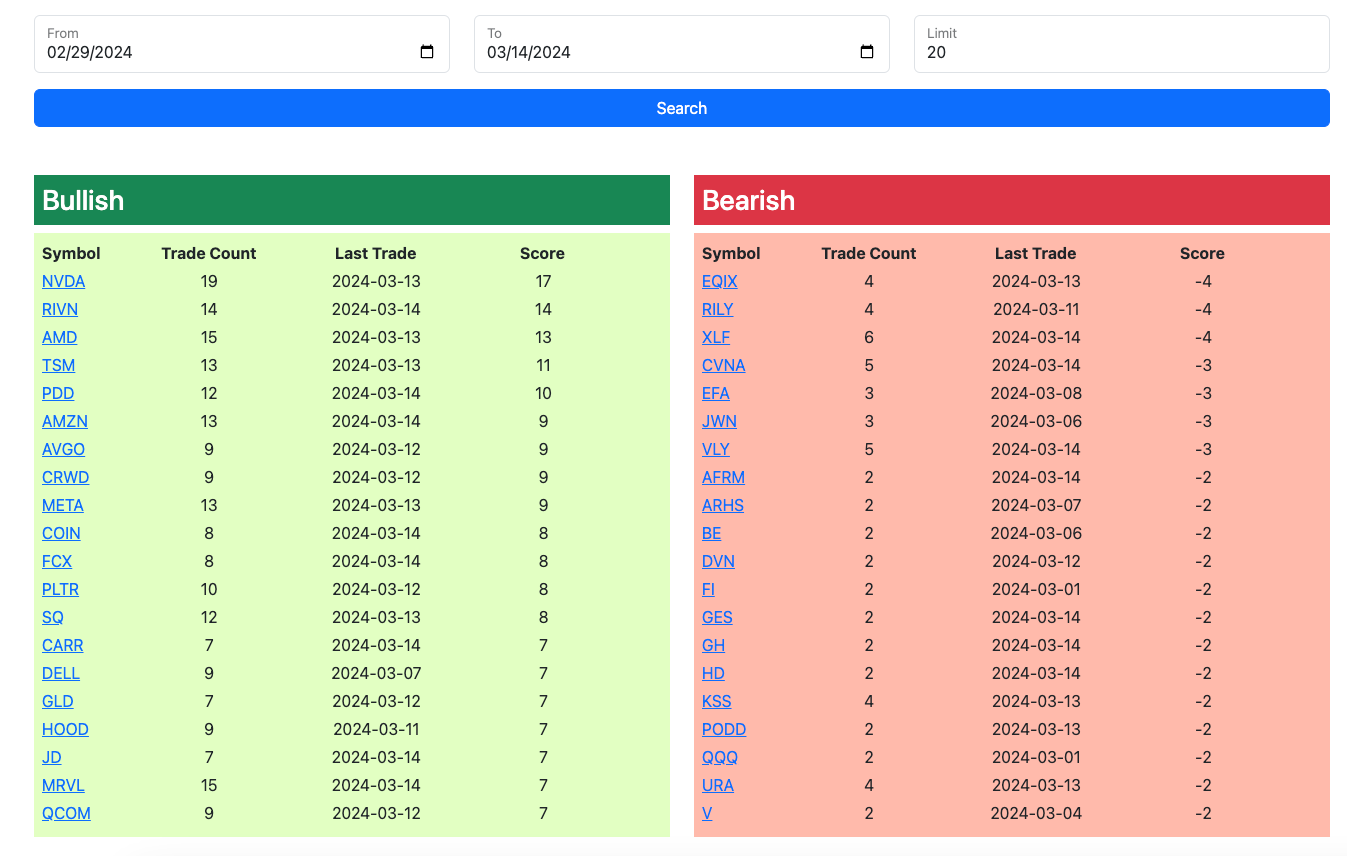

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires in the morning at the open and I will have the rest of today’s action updated throughout the afternoon. The database is the best way to get all of the table below because I can’t fit it all in one screen grab on here.