3/15 Recap

We have a problem potentially brewing here. Maybe it is just quadruple witching action and wanting to wipe out alot of option premium today, whatever it is, the SPY is now sitting on the 21 ema after opening below the 8 ema. This is not what bulls want to see and now a couple days of weakness here would lead to a bearish 8/21 cross which would be a point where we’d see some selling for a bit. NVDA does have a big conference next week and it did save the market on its earnings a few weeks back so keep that in mind, but if it doesn’t, we could be looking at a 21 ema break, I don’t have market stats infront of me but I’d be hard-pressed to say we’ve ever seen a run like this where in 5 months we’ve spent 1 maybe 2 days below the 21 ema. This may finally be it for the run we’ve had the last few months but every single time we get to this spot recently, something saves the market. We will find out if Nvidia does it again. I think a small period of weakness before earnings season begins in a couple weeks is perfectly normal and healthy at this point.

Recent Trades

PDD - on monday I highlighted PDD at 111 after 3 large bullish trades came in, what a week it has had up 11.8% since to just over 125. That player who bought the 1400 3-28 calls at 125 was dead on with that trade. Impressive one week move.

The QQQ lost the 21 ema today, the next level of support is that 50 day just below 430 but this is not looking good for tech stocks as the 8/21 ema is set to cross shortly. Again if you’re long lots of tech stocks, nothing to panic about long term, but things do not go straight up. You can raise capital and sell a few things. Sell covered calls if taxes bother you but this doesn’t look like the time to be adding to the overall market.

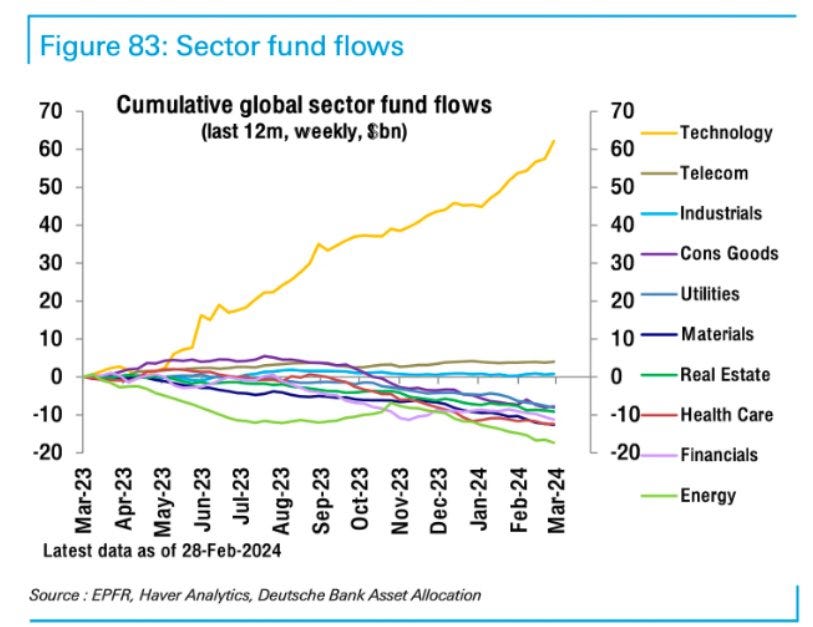

Just remember there are other stocks besides tech stocks. Things like gold are breaking out, energy has done nothing in a long time and it is setting up nicely. I know people get caught up in tech and believe me, those are some of the best companies in human history, but occasionally, for a little while, other sectors work. Look at the chart below, money has been nonstop flowing to tech, a small dip is ok.

I get so many emails and dm’s about what I’m doing with my positioning. Look, I am not changing my stance on Amazon, those June 2026 leaps I’m in have 27 months to go, some companies will struggle, others are just hitting their stride. Amazon could get hit short term, but it is up over 100% in 14 months, I’ve been in it now 10 months since last May. Stocks have been up and to the right for 200 years, people have been in constant panic all along the way.

As for Amazon, it is just getting going, no way would I cash out just because of some potential market weakness when I’m looking 6-8 quarters out and seeing the company show us what the massive capex spend leads to on the other side. I was up 41% this quarter heading into today vs 8.3% for the market. In my entire career, I’m not sure if I’ve ever been up 41% in a quarter on this much size, this has been an amazing few months and even crazier with me only in 1 trade this entire time, so if the market pulls back, I’m still outperforming it, I’m really not concerned.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Below is today’s link to the database, it will be up all weekend until monday morning at the open. I will have the rest of today’s action added in later today. Check the database later for the rest of today’s trades.