3/16 Recap. The Liquidity Is Pouring In.

This market is the toughest you’ll encounter in your life, I’m not complaining because that’s how it is supposed to be, but the day to day narrative shifts are just so hard to keep up with. Last week the banking system was about to unravel, today I wake up to the fed may inject $2 trillion into the system.

Every little thing that may be construed as bearish is followed up with some sort of intervention to prevent the bad from happening. It almost feels like it is illegal to have a prolonged move down in equities. I can’t complain though, it sure beats the past decade we just had where equities just went up everyday and everyone was doing well in the market. This market is violently moving in both directions and chewing everyone up and spitting them out as it absorbs countless datapoints from around the world. In the end it’s hard to believe with all the big moves we’ve had, we are barely up on the year, with the S&P up around 3%.

The SPY is still in no man’s land above the downtrend and below the uptrend. I can’t say anything other than we still don’t have a direction. Closing today over all those moving averages you see below would be constructive but until we get back over that 397.50 level where the uptrend is, it’s all meaningless. Over 402.50 is where the fun begins, for the bulls. Bears wants a move under 385. The RSI is pointing up, the MACD is curling higher for now I’d give a slight edge to the bulls but the real winner is the put sellers who continue to do well in this chop.

Trends

The interesting thing with these trends as you all are slowly seeing is that while it does take a little bit of time to play out, as more and more inertia goes in 1 direction on a name, eventually the majority of names do follow all the unusual options action.

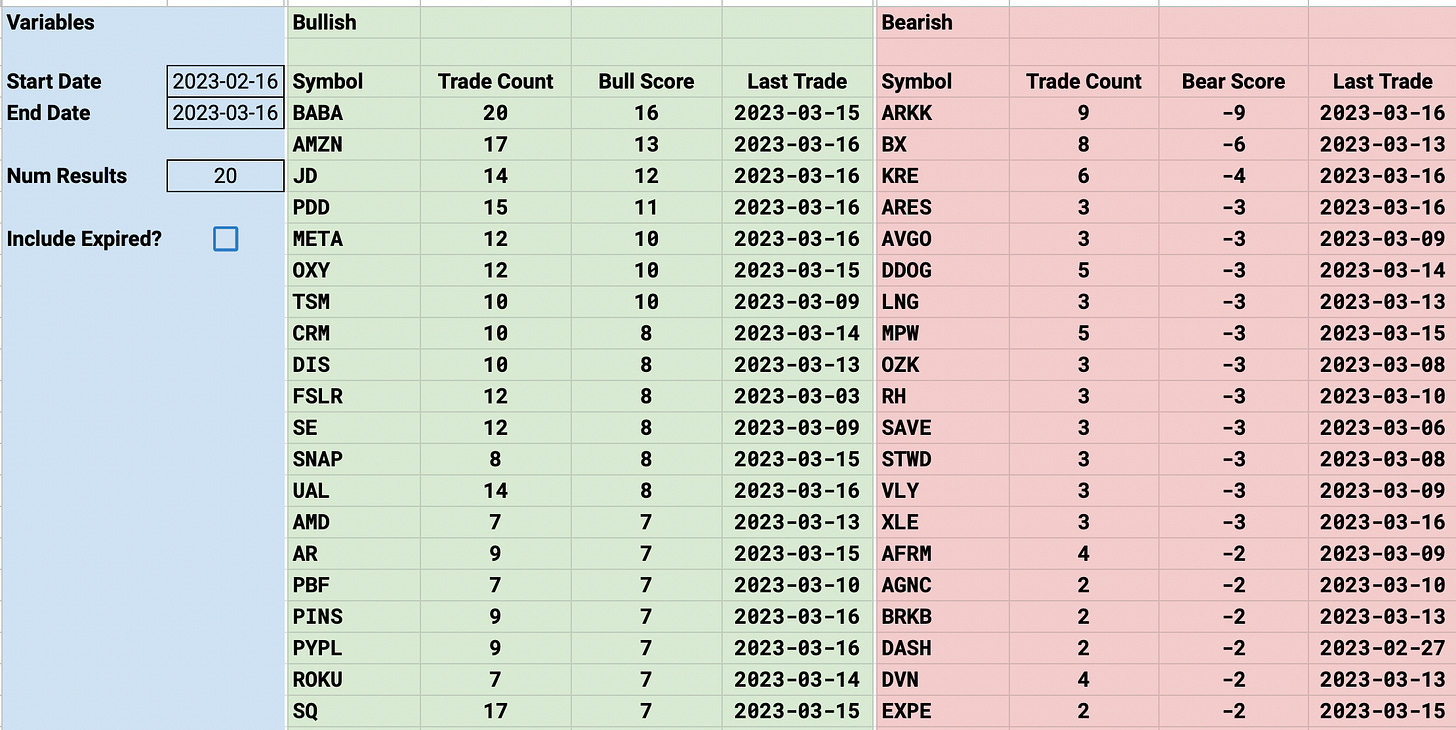

Look at the 1 month trend below and look on a name like Amazon and how long it took for it to finally take a leadership position like it did this week. Which is why I mentioned BABA the other day, I don’t even like Chinese equities but the flows are so one sided there that even I sold puts there today that you can see below. In my experience, it will have its time sooner than later with all that’s going on under the surface in terms of positioning. So definitely utilize these trends to help you stay in trending names. The various timeframes are to give you different ideas, but if you want to avoid weakness, this is one way to do it, it’s rare to see repeated bullish activity over longer periods in a name that remains weak.

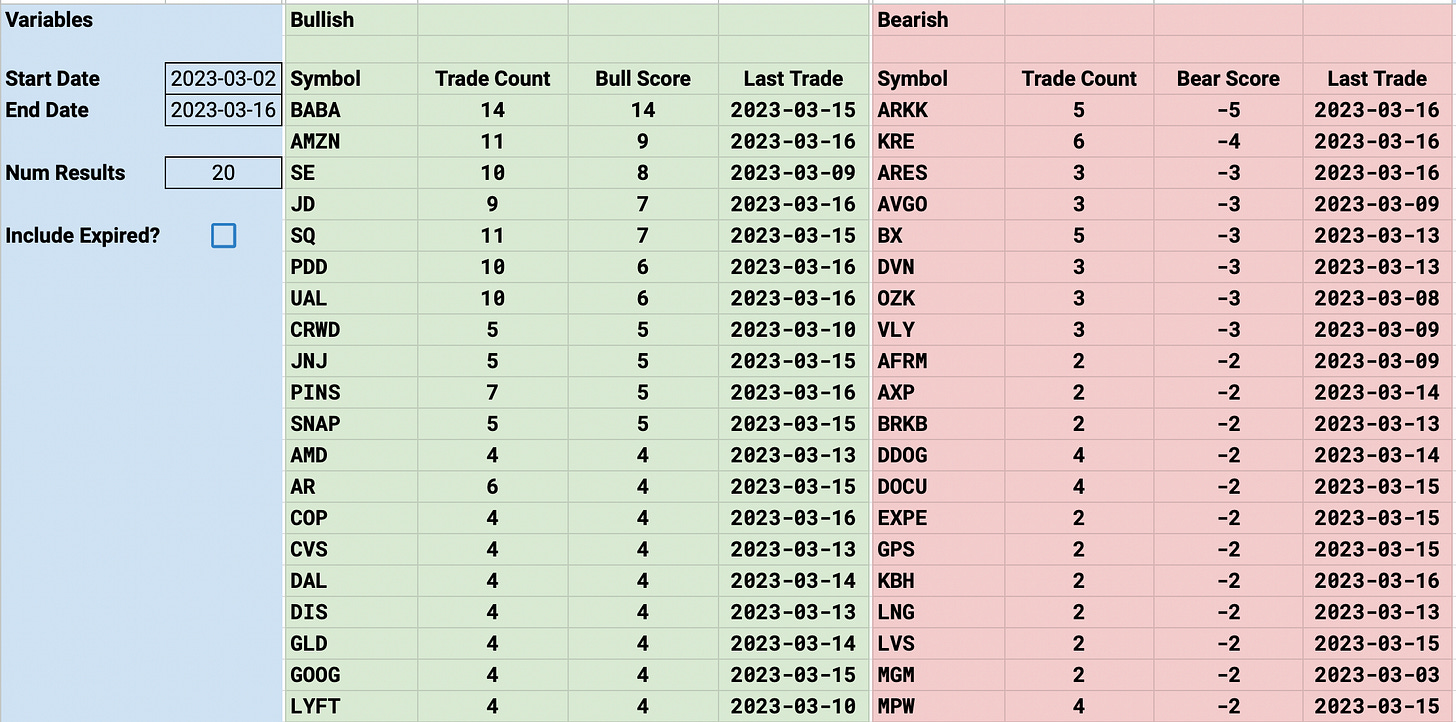

1 Week

2 Weeks

1 Month

Today’s Unusual Options Activity & What Stood Out