3/17/25 Recap

The SPY is trying to reclaim the 8 ema today after touching it for the first time in 11 sessions. This is a good first step in trying to settle down but we’re still below the breakout of 565.15 from last year and that is going to be our first resistance to battle. After that we have the 200 day over 570 to contend with. Stocks don’t go straight down, there are going to be bounces along the way, the last 2 days are that, you can see megacap tech is very weak today still. How we react to the moving averages we encounter on these bounces will tell more about where we go. Right now I’d say everything this week is meaningless until FOMC wednesday and Powell speaking after. I would lighten up wherever you want short term before that if you’re using a lot of leverage. Those are binary events and if you’re on the wrong side of things, you can get wiped out, so be careful with the leverage.

Recent Trades

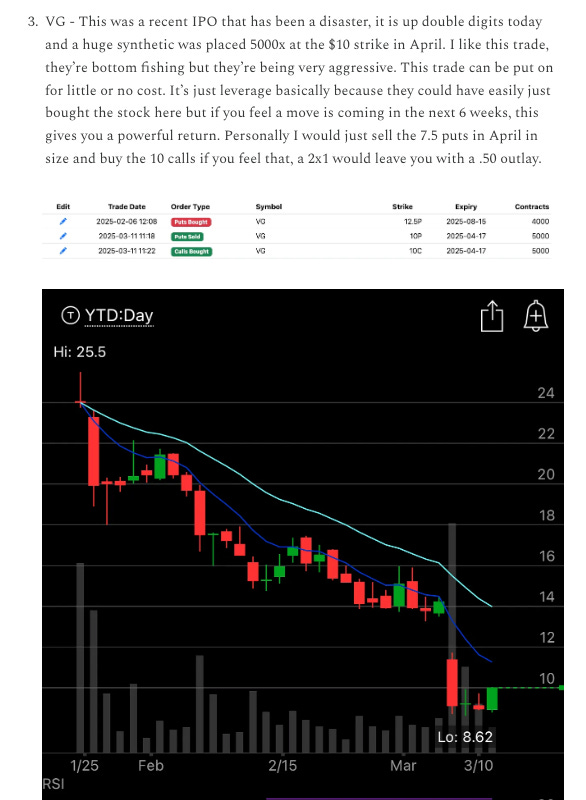

VG - last week on 3/11 I flagged this massive synthetic here when VG was right at $10, it ended up rising another 7% the rest of the week and closing at 10.7. Up another 3.5% today to $11+. This has been a really sharp move relatively speaking, you can take some off here if you’re happy with the 4 day move, but these trades are still in the open interest. Amazing how the minute this synthetic was placed the player nailed the bottom ;)

My Open Book