3/19 Recap

We got a big move down in the Nasdaq at the open going down over 150 points early on and we’ve now flipped green. Investors are making their final moves before Powell speaks tomorrow. I can’t see him being dovish tomorrow and many were getting out of the way before that. From a technical standpoint, the SPY continues to hold up but there is a very clear bearish divergence below. Will it play out? I don’t know but tech stocks have been very weak as a whole recently with the QQQ opening below the 21 ema for the 2nd time in 3 days as investors de-risk before the event. It could very well be a headfake. Overall I still stand by my stance that the Nasdaq will be much higher 2 years from now, but short term a little weakness is normal after 5 straight months up. The amount of growth and profit the leading Nasdaq companies have is astounding and I don’t see any reason to be long term bearish.

Oil continues the breakout nearing $84 right now, the rotation to oil names has been going on for a while now and it appears to have legs going forward.

Why Do I Suggest Put Sales?

I get a lot of comments about why I suggest put sales on the trades I highlight below. That is my style, you all can do whatever you want with all this data, I’m just trying to point out how I would play these trades in my own manner based on the directional data I see in the options bets. I think most investors biggest mistake is thinking they have to be in trades, for me, I know better than that and I sell puts and wait. If I’m right and the stock goes up, I make a profit. If I’m wrong and the stock falls to levels of support I’ve seen in a chart, I get to buy a good name at the level I want. That’s why I focus on put sales. If you want to buy calls, by all means don’t let me stop you. Investors all have different objectives, I’m not in the attempt to get rich making 300% on 1% of my book phase. You may be, it is just different strokes for different folks. I like to utilize risk reversals as ideas because to me they’re the best trade in the market and nobody uses them properly. You get all the upside while minimizing the downside. It’s alot better than having calls go down 80% with nothing in return.

Recent Trades

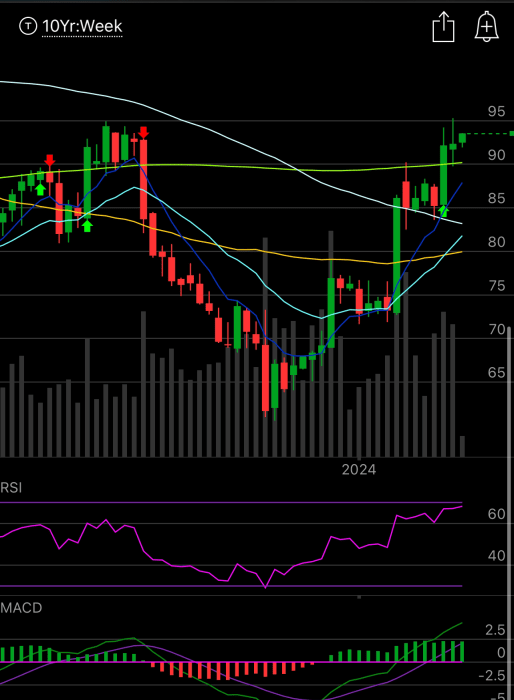

EW - This thing has been unreal. A leader in heart valves that had sold off hard. Look at this move up and look at the setup right now. It has come a very long way from when I wrote it up as a best idea on the weekend in late November 2023 here. It had another big trade today in the database looking for more but those call buyers back in November at the lows nailed this trade beautifully.

Today’s Link To The Database

Like yesterday I won’t be posting the trends or options table on the substack today. It’s just too difficult on a latop, so it can all be found in the link below. This is today’s link to the database, as always it expires at the open tomorrow and I will the rest of today’s action added in by tonight, so check back there for updated trends and names.