3/20 Recap. Is The Banking Crisis Beginning Or Ending?

Yesterday when we got news of the bailout of Credit Suisse, the way it went down had many wondering what it meant for the banking space in general. Alot of firsts happened that left a sour taste for many. We woke up to most of the banks up nicely premarket and then mid day we got the implosion of FRC and now as of 2 pm they’re mostly all red. This is going to be a choppy space for a while, there are quality names, but my recommendation is take banks off your watchlist for the most part. This isn’t going to resolve anytime soon.

The SPY remains in the same no man’s land it has been in for a week now. Well below the uptrend, but right above the downtrend. It probably just stays here into FOMC. It’s struggling with the 200 day which is right where the 8 ema is as well. On the plus side the RSI is turning up and the MACD looks like it wants to flip green. The downside is we’re potentially in the first inning of a GFC part 2 and the market hasn’t priced it in yet, joy. For the moment I can’t say much other than until we pick a direction by going over 399 or below 385, this is the back and forth you’re going to see.

Today’s Unusual Options Activity & What Stood Out

MET - this saw a large put sale ITM for June 2024 at 70. This trade was one I took myself and I will have more down below on it.

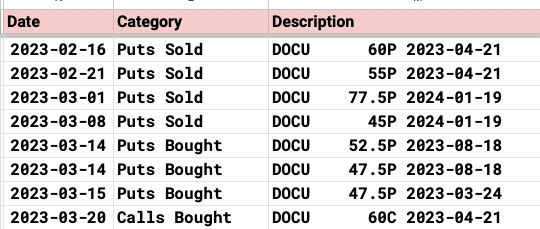

DOCU saw a large block of 5000 calls bought at 60 in April. This name has been a mixed bag over the last month but this was a notable trade

A huge risk reversal was put on for June in the IWM selling 175 puts to buy 175 calls 22,000x

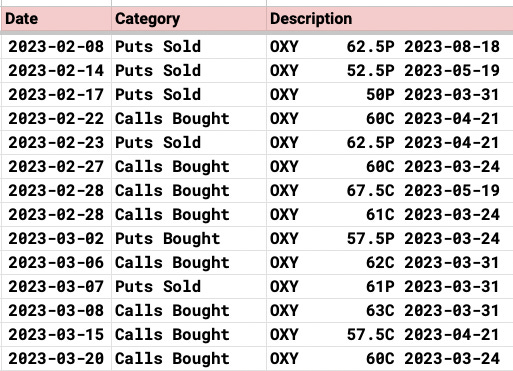

OXY had a big buy of weekly 60s today. Notable because they expire Friday, so they’re looking for a continued move this week. This name remains a favorite of the bulls likely due to the man in Omaha who keeps buying it.

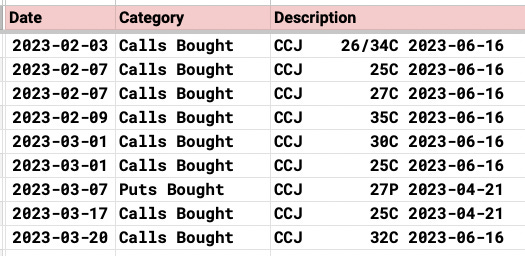

CCJ had 10,000 calls bought at 32 in June. That has been a directionally bullish name for a while now

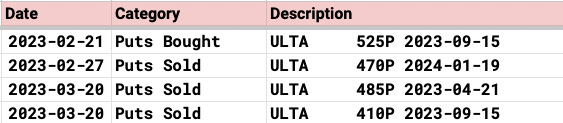

ULTA was the last one I noted 2 large put sales on. One in April at 485 and one in September at 410. This has been one of the stronger names in the market recently.

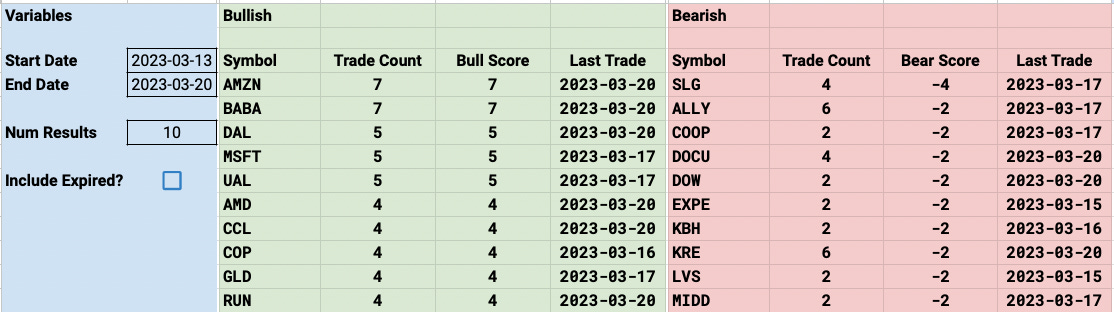

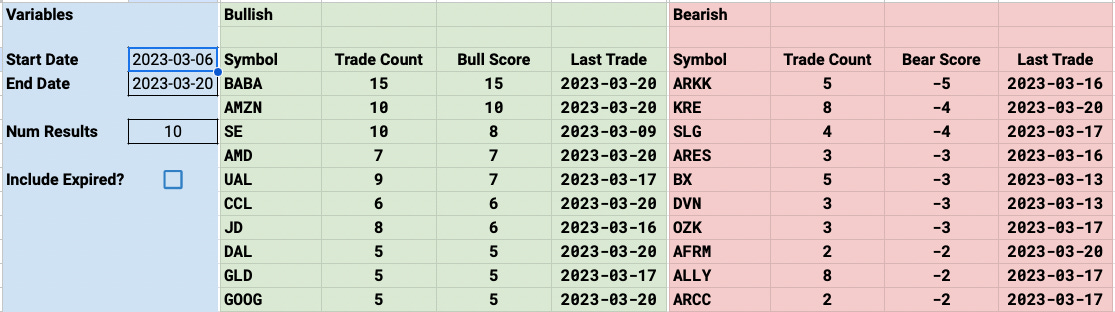

Trends

1 Week

2 Week

1 Month

Trade Of The Week Update

GOOG was soft today but saw another large call buy you can see in the table above out in September at 107.50/117.50 along with a large buy of 100 calls for next week on GOOGL. GOOG closing with another green candle today right on the 200 day. As you can see the moving averages are sloping up and it just takes time for them to catch up, this is where a name consolidates for a bit as it builds strength.

What Did I Do Today?

Pretty great day over here up 4% with the S&P up .74% and the NQ up .2%. The leverage I put back on helped out today. The big bounce in OXY also helped as did the huge recovery in SU.

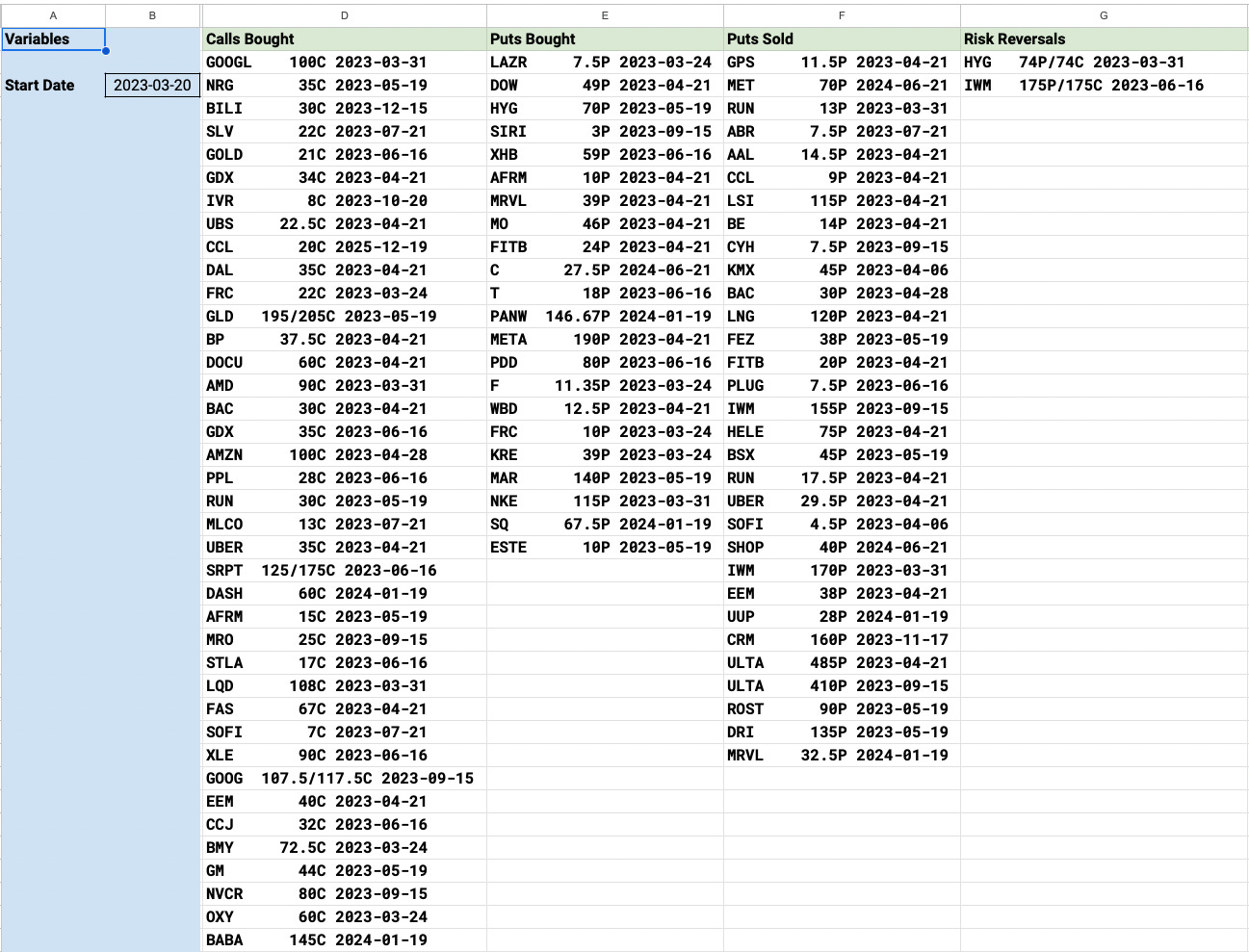

Here is my open book at the moment as I do every monday. As I said last week I’m going to not focus on explaining the how/why I put trades on simply because too many of you began to think this was high school and you could just copy off my test. As I’ve said countless times the whole purpose of this is to provide you with data, for a cheap price, and for you to use that data to guide you in your trading. I post my book simply to be honest with you about my thoughts and my returns, but I’m done answering questions about the entry/exits and why. So instead, I will post my book daily and you can take what you will from it.

Today’s Live Trading

Day 1 in the books for us on the discord in regards to the live trading. I was only able to get feedback from a few of you in there, but I would like more whether it be in the comments below or you can email me to jamesbulltard@gmail.com.

Let’s talk about the “pros”

This morning at 8:52 I mentioned that huge block of puts sold on MET that caught my eye, I followed it immediately

Almost instantly the equity took off as you can see below. That’s what tends to happen when large blocks of puts are sold. That’s why I always say you can’t get the same entry as me because I do intraday and you’re getting the recap after hours. So that was why so many were asking me if we could do this live.

So now what? Tomorrow we will be back trying to perfect the things you all wanted

There is the ability to have an API deliver options flows directly into a channel in the discord, it isn’t cheap, but it’s doable if enough are interested. The only problem is it would look something like this and while I could explain how to decipher this, you would be on your own. This is how options trades are seen, I just make it easy for you all by breaking it down into easy to decipher categories and tables.

Lastly Im trying to figure out how to share my database with you all without it slowing it down for me. You can imagine if all of you were crawling in there all day it would severely slow things down for me so that is another thing.

The reality is this, Substack was not designed for all this functionality you all seek. This is a platform for a newsletter, that’s it. I would likely need to have a dedicated platform built which is fine, but it is costly, I spoke to someone about it last summer and then maintaining is who knows what because that isn’t my area of expertise. Believe me I’m trying to find an easy solution to give you all what you want in the best manner but realistically there is almost no way to do it for as cheap as I’m doing it except to give you the recap at the end of the day and on this platform. Being there live is nice, and I’m willing to continue to do it if there is enough interest, but that tier would be significantly more just because of the amount of work and time required from. The benefit is easy to see tailing these trades intraday but for how many of you is that a worthwhile thing, I do not know. So anyways. If you are interested, like I said shoot me an email and let me start to converse with you on how to better things to tailor them to what you want + to build a running list of who is interested so we can see how far to take this idea.

How did you all like what Andrew offered today? He is the best premium buyer I know, you saw how meticulous he was backtesting things and showing you data on how to properly play the premium to the long side. You can’t just buy calls because, you have to execute it like a master which he is. He plays the opposite side of the options game from me which is why I thought he could add so much value if we decided to go through with this.

"Almost instantly the equity took off as you can see below. That’s what tends to happen when large blocks of puts are sold."

I wonder how do you consider if something is large there. Any specific metric?

In your portfolio book you post, how do we know what new names or positions you added today ?