3/21 Recap. We All Await FOMC.

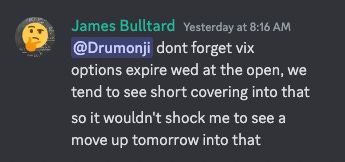

In what seems like a never-ending carousel of binary events, tomorrow we get the big decision. Will Powell hike 25 bps, will he not hike, will he cut rates? I don’t know, but I do know that playing anything tomorrow is just gambling. I’ve seen so many FOMC days where we’re green by eod and significantly lower 3 days later. I’ve seen days where we go red and break out within a few days. It’s complete chaos and just not worth it for me to waste time with. I try to wait for trends to develop and just play along. With that said, I closed most positions today and left just a handful of things that expire next week. That’s it. As for today’s move, it really wasn’t that shocking to me, I mentioned this yesterday in the live channel on the chat

Pretty normal vix expiry action we saw today. As for the markets they remain in no man’s land, we still have 2 hours left today but I wanted to get this out early to give you time to decide on your next move. Look where the SPY rejected today, right below the previous uptrend, so it isn’t exactly confirming time to buy. The MACD did flip green, and the RSI is sloping up albeit still weak.

Tomorrow will give more clarity but for now, considering I’m up 28% in less than 3 months. It’s time to move aside and wait a few days. The biggest mistake most investors make is just continuing to press their luck. As someone who utilizes a ton of leverage, I’m very keen on when to dial it up and when to scale it back.

The move this morning felt like a blowoff top in $TICK which hit nearly 1600 and went to -600 within 45 minutes. That was when I decided to move aside.

Tech stocks though look alot better with the QQQ breaking out with clear skies above.

The story in markets now is how billions fled bank stocks and the same amount of money basically moved into tech stocks, literally, it’s a zero sum game, money has to go somewhere, it left financials for megacap tech…..

Today’s Unusual Options Flow & What Stood Out