3/23/25 Best Idea For The Week Ahead

We wrapped up another uneventful week in the market with our 2nd straight close below the 50 week on the SPY. We have not done that since all the way back in January 2023. You can see the 8 ema crossing down through the 21 ema and you really have to start getting worried as a bull if the market doesn’t bounce soon. We’re really struggling with that previous breakout level of 565.15. The problem becomes as the moving averages begin to slope down, they become resistance on all moves up. We still have the tariffs looming in 10 days on April 2nd and who knows where that leads this market if they’re actually implemented. Clarity is all the market seeks right now.

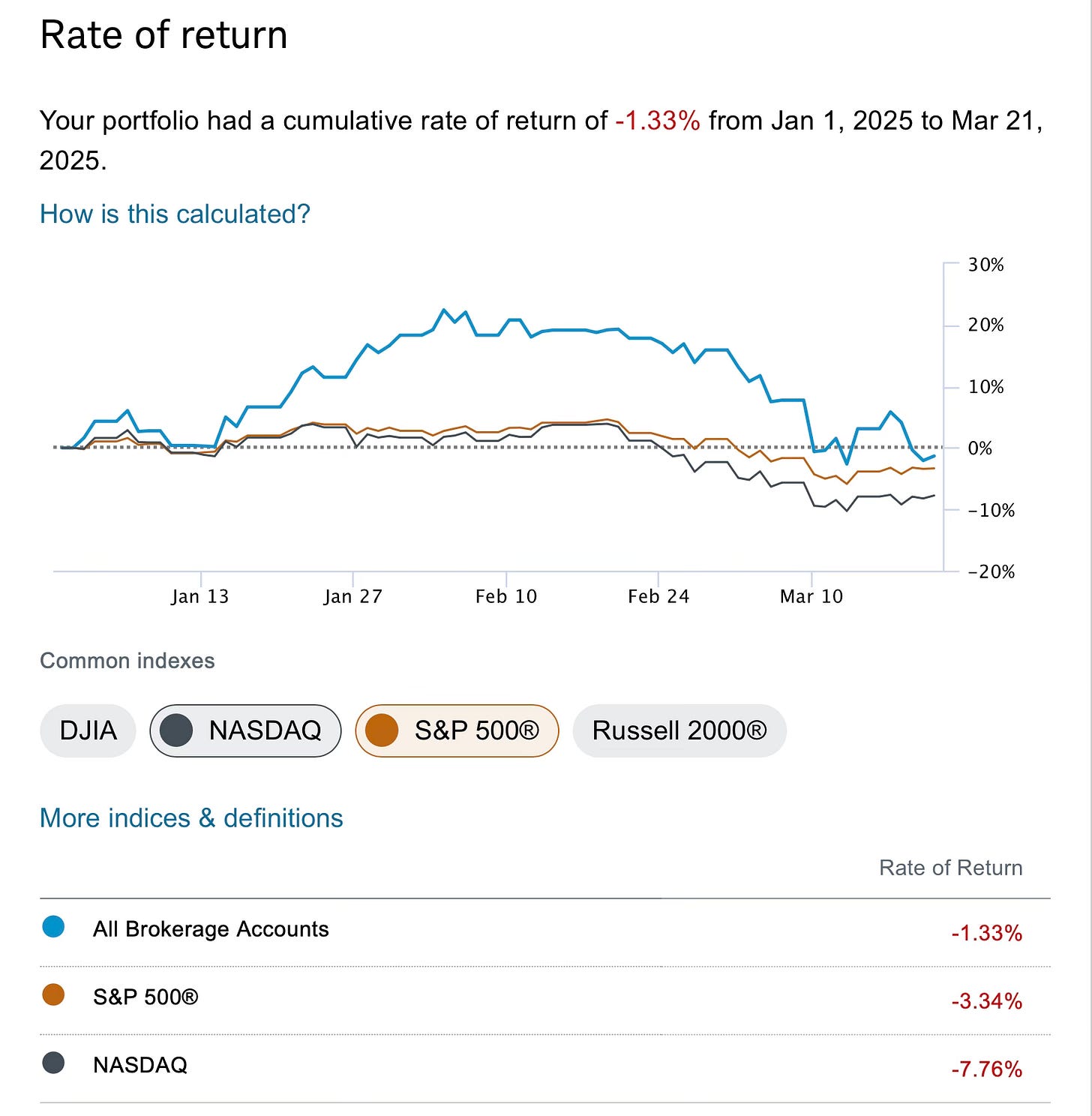

This 2025 market has been tougher to navigate, I know alot of people have messaged me about getting discouraged this year. Look, when stocks go up everyday like they did the last 2 years, life is easy. The good news is they’ve mostly gone up for the last 100 plus years with a few blips here and there, this downturn is a very minor negative moment. The reality is if you’re down this year, it is simply because you’re overweight tech which has been the trade of the last 15 years. Will that pay off in time, more than likely, yes, but for now big tech is not being bought. It has been a bumpy 3 months, but I don’t believe the best days of American big tech are behind us. I get the frustration, I was up 20% in YTD in late January and even I’ve flipped slightly negative YTD for the time being down 1.3% YTD now.

Does it bother me? No, not really, I’m managing my own money and I don’t exactly answer to anyone. I know that my short puts are going to pay off later into the year as the theta decay hopefully kicks in. I still think this year is flat at best, maybe up a little in a goldilocks scenario and if either one of those scenarios happens I will be up alot in the back half of 2025. I very well could end the year outperforming the market by 20-30-40% as markets possibly end negative. So it’s all about knowing the environment you’re in and positioning accordingly. I like to think I always position myself properly for the environment at hand whether it be hiding in the Twitter buyout in late 2022 to avoid the market pain or leveraging up into Amazon in summer 2023 till early this year before adding the META risk reversal in early 2025 before flipping into TLT. Right now is just not the time to put long term bullish trades on if short timeframes matter to you. When it’s time, you will see charts settle down and reclaim moving averages, that is when you will see long term call buys coming in. Just trust, there is a method to my madness I promise and it just simply is me trying to best position myself for a flat to down market where I will still do well if stocks don’t go up. If I’m wrong and stocks do go up, I’m so levered up I will still outperform. It’s a heads you win, tails you win situation and the only way I really end up losing badly is if the market crumbles, but I don’t see that level of pain.

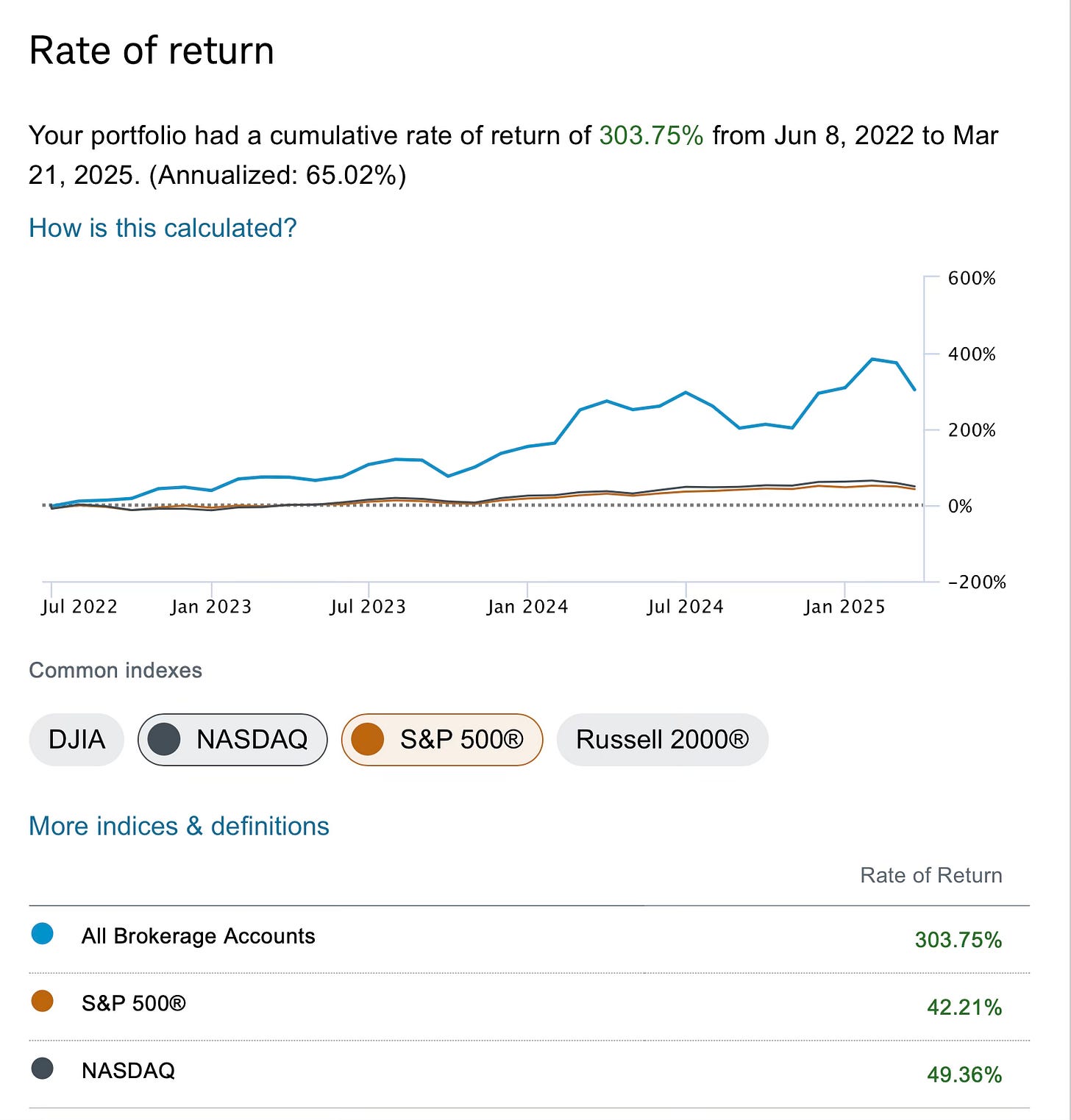

I’m very lucky to be down 1% overall to be honest, I use a ton of leverage and I thought I mostly timed my 2025 trades very well but leverage can sting you. I timed my Amazon exit right at 229, I timed my META risk reversal entry at 650 and exit at 717 right, and I timed my move to TLT right to avoid the initial carnage of the selloff right when the 21 ema broke. Those were my 3 big moves this quarter and all were pretty good looking back, but the leverage I’m utilizing still bit me in the ass in the short term. As I’ve said before, I did feel we were in trouble when I sent out that emergency email in late February, but I don’t short stocks, so I didn’t catch that move lower. I don’t sit at my screens from open to close so I try to position myself into what I think will work with as little effort required as possible. I barely look at my book most afternoons, If I wanted to be an active trader and have multiple positions on I would do that, but my book has grown so much the last 3 years that I honestly just don’t have the desire to be active in that manner anymore. You have to remember when I started all this back in 2022 I had barely over $1m to trade with and even now after this brutal month I’m still near a $6m trading book. As your book grows, your trading style is going to change with it. I don’t expect someone with a book my size to be swinging short term calls unless they were a real action junkie. From time to time fat pitches will emerge like when I saw those max strike META calls and I will pounce, but at the current juncture there is nothing like that on my radar.

So all I’m saying is if you’re frustrated this year, step back, take a deep breath, and realize it has been a rough 3 months after 24 months straight up if you’re heavy on tech. Also remember, you’re not competing with anyone, it is you against the market, not you against random people posting screenshots on Twitter. Also, the Nasdaq is down 8% this quarter so most of the darlings are hit hard. Sometimes markets aren’t easy, but as long as you don’t blow up during these downturns you will survive until the good times return. So stop beating yourself up looking at your 1 month or 3 month performance and look at your performance over a longer timeframe, you’re probably doing just fine. You can’t get upset during every rough patch because you’re probably going to outperform in good times and it will offset your underperformance in times like this. Below is my total return since I began sharing my book and documenting what I was doing in June 2022. Even with this “bad” quarter I’m still beating the market by almost 7x since this all began, so no, I’m not going to cry about a 3 month rough patch where I’m down 1% when the S&P is down 3.3%, you shouldn’t either.

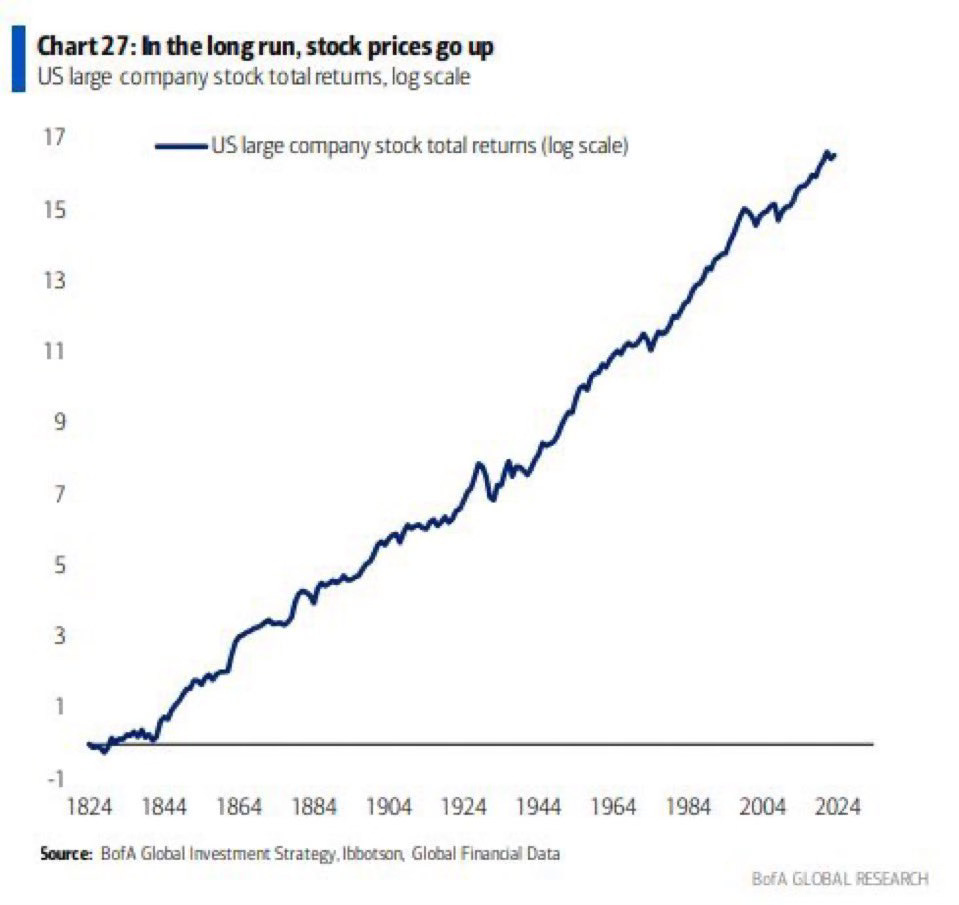

Just keep things in perspective, we’re in a fairly normal 10% pullback as we implement some radical policy changes and the market does what it always does, where it throws a tantrum until it gets some clarity on what is happening. Markets hate uncertainty and the Trump era has been full of it with the constant flip flopping on tariffs and their start dates. Once we get more information on the tariffs and their implementation along with all this tax policy change talk, I’m sure stocks will resume the same trajectory they’ve been on since the beginning of time. Just keep this chart I shared last year in mind before you panic. We’ve been through alot of rough patches and markets have always resolved higher in time.

This week’s best idea is a former growth darling that has been hit hard recently. A couple big put sellers stepped in recently and are trying to put a floor in the stock, I think following these put sellers is a prudent move, let’s take a look at what levels they’re looking to go long at……