3/24/25 Recap

The SPY had a huge gap up today, it all started late friday when we heard rumblings Trump might be backing off the strictness of the tariffs and it followed through with more news today that April 2nd is likely going to be less eventful than most feared. Combine that with a huge weekend crypto pump also orchestrated by a Trump tweet and you have this huge move we had today. Crypto is basically levered Nasdaq, whatever it does on weekends usually correlates to stocks when we open for the week.

Look where we stalled out right now, right at the underside of the 200 day and the 21 ema. That is going to be a tough spot to get through but if the market can get through, we should see more upside, but if we cannot, then it probably remains in this range here with 565 as the low end. I don’t know if I trust all these rumors about April 2nd because if Trump backs off it will make him look weak and knowing him that is the last thing he wants to do. So keep an open mind between now and the weekend to see how markets react as we get closer. If he does end up pushing through those tariffs, the market will not be happy.

Recent Trades

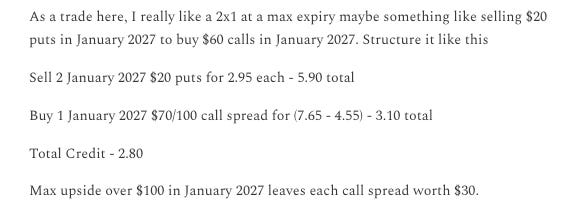

HOOD - Last weekend I wrote it up as a best idea here and it has been on a tear since opening at 39.35 last monday and rising over 20% in a week since to 48.24 as I type this. The risk reversal I suggested then is up nicely with the calls and puts both up 33% each in a week, that is a really big move on options with 2 years to go. I wouldn’t fault you if you close them, but the whole point of placing these for a credit is so you don’t care what happens. So unless you think HOOD is going below 20 I wouldn’t worry about closing up.

My Open Book

Like I said in yesterday’s note, I’m so levered up that up moves I will outperform and today is just that with me up over 5% vs the NQ up 2%. These short puts are violent movers but I think they’re the right play in this chaotic tape. I added more on AMD,AMZN, and C today. Nothing crazy just some option flow I saw and I’m mostly just sitting on this book now. I think I’m in a good spot for whatever is coming. I don’t see some massive upside in the market this year so I don’t really see the need to be in commons or calls, these short puts I have should suffice to outperform.